[Asia Economy Reporter Kim Hyo-jin] Illegal loan advertisements targeting low-income individuals in urgent need of funds have recently surged.

According to the Financial Supervisory Service (FSS) on the 28th, from January 1 to March 24 this year, consultations related to illegal private loans received by the FSS Illegal Private Finance Reporting Center totaled 29,227 cases, a 43.6% increase compared to the same period last year. Accordingly, the FSS issued a consumer alert at the 'caution' level.

The FSS explained that many cases involve attempts at illegal loans through text messages and flyers disguised as COVID-19 damage support loans, exploiting anxiety caused by the spread of the novel coronavirus infection (COVID-19).

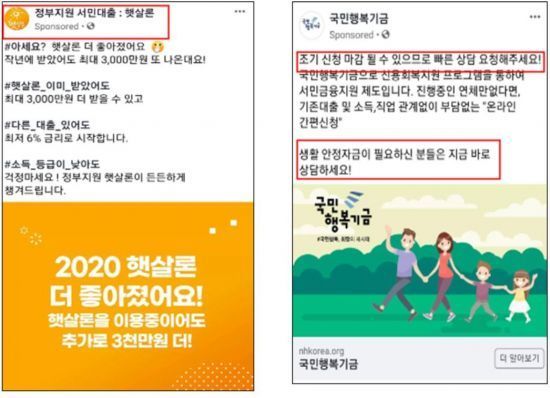

Illegal loan operators use names and logos similar to those of the Sunshine Loan from the Integrated Support Center for Low-Income Finance and the National Happiness Fund on social media, display the Taegeukgi (Korean national flag), or cleverly alter government agency logos to create the impression that these are legitimate government loans, thereby deceiving consumers.

Illegal loan advertisements also flourish by mixing names of government agencies such as the Workers' Integrated Support Center (Workers' Welfare Fund + Integrated Support Center for Low-Income Finance) to impersonate government-supported loans targeting office workers.

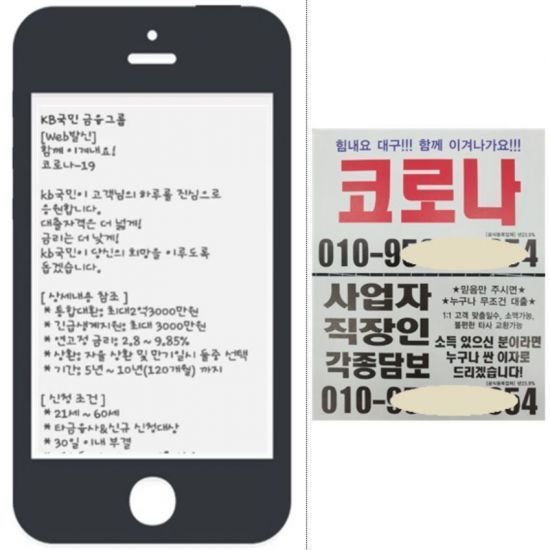

Illegal loan companies also send advertisements disguised as COVID-19 related loans from regulated financial institutions using phrases like 'KB National Support Center.'

Based on this, they attempt illegal loans by using phrases such as "Let's overcome together! COVID-19," "COVID-19 Integrated Debt Consolidation Loan," and "Up to 230 million KRW fixed interest rate 2.8%."

In some cases, consumers who reply to such text messages are asked for personal information and then induced into illegal loans.

Public institutions do not offer financial product loans or advertisements through smartphone applications or text messages, so caution is advised.

The FSS urged that text messages claiming to be "COVID-19 loans" sent from senders with names similar to regulated banks, requesting personal information and prompting app installation, are loan scams and should not be responded to.

Below are the prevention tips against illegal financial advertisement damages presented by the FSS.

▲ Carefully verify company information listed in online advertisements

▲ Use regulated financial institutions for loans

▲ Be cautious of impersonation of reputable regulated financial institutions

▲ Advertisements claiming "loans available to anyone regardless of credit" are false and exaggerated

▲ If personal credit information is requested by phone, suspect personal credit information trading

▲ If you suspect your personal credit information has been exposed, register with the 'Personal Information Exposure Accident Prevention System'

▲ Be cautious of loan solicitations claiming to convert to low-interest loans such as Sunshine Loan

▲ Advertisements stating "We will prepare the documents needed for the loan" suggest loan fraud

▲ Advertisements for daily loans, urgent loans, or same-day approval loans should be suspected as illegal lending companies

▲ Actively respond to high-interest rate damages and unregistered loan damages

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.