Restaurant Industry Continues at Lowest Level... Future Outlook Pessimistic "The Bottom Remains"

9 out of 10 Restaurants See Sharp Customer Decline... Closures This Month Up by 132 Compared to Last Year

Mass Closures Expected... Cash Support Needed Under 'Minimum Operating Cost' Title

[Asia Economy Reporter Lee Seon-ae] "Now, the key question is how much longer we can hold on. Many places are already going bankrupt, but soon, collective closures will inevitably become a reality." - Mr. Choi, owner of an izakaya in Cheonho-dong.

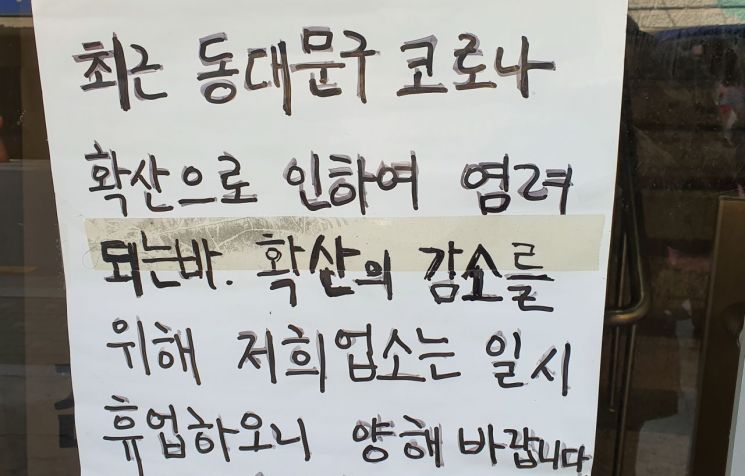

Concerns are rising over a 'collective closure' in which self-employed restaurant operators across the country simultaneously go bankrupt within months due to the spread of the novel coronavirus infection (COVID-19). The restaurant industry’s business conditions have already plunged to the worst level ever, as clearly reflected in the indicators.

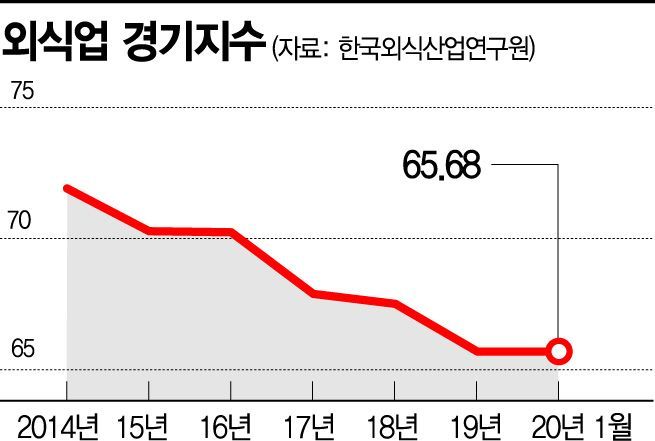

◆ Restaurant Industry Business Index Hits Record Low = According to the March restaurant industry statistics released on the 28th by the Korea Foodservice Industry Research Institute, the restaurant industry business index for January was 65.68, marking the lowest level ever recorded in comparable public statistical indicators. Looking at the figures over the past six years, the index was 71.91 in 2014, 70.28 in 2015, 70.24 in 2016, 67.89 in 2017, and 67.51 in 2018. Last year, it fluctuated between 65.97, 65.08, and 66.01, before dropping to 65.68 from October onward, maintaining the lowest point through this year. The restaurant industry business index is based on a scale from 50 to 150, where values above 100 indicate growth and below 100 indicate contraction.

The market condition trends for small business owners operating restaurants and self-employed operators running food establishments in traditional markets were recorded at 60.9 and 62.4 respectively in January. Values above 100 indicate improvement, while below 100 indicate deterioration. The situation is particularly severe for self-employed operators running food businesses in traditional markets. Compared to 68.3 in 2014 and 67.3 in December last year, this represents a sharp decline.

The outlook is even more pessimistic. Sales have already hit rock bottom due to the spread of COVID-19. With forecasts predicting the COVID-19 shock will last at least six months, it is assessed that the restaurant industry indicators have not yet bottomed out. The business outlook index for small and medium enterprises in lodging and food services plunged from 92.2 in December last year to 72.8 in January. An index below 100 means many companies expect further deterioration in the future.

The same phenomenon was starkly revealed in five surveys conducted by the Korea Foodservice Industry Research Institute. Since the first confirmed case on January 20, customer numbers at foodservice businesses have steadily declined. In a survey conducted over four days from March 3 to 6 targeting 600 member establishments of the Korea Foodservice Industry Association, 95.2% of foodservice businesses reported a decrease in customers following the domestic outbreak of COVID-19. The cumulative customer decrease rate across all businesses was confirmed to be 65.8%. The Foodservice Industry Research Institute stated, "The average customer decrease rates after confirmed cases were 29.1% in the first phase, 26.1% in the second, 32.7% in the third, 59.2% in the fourth, and 65.8% in the fifth," adding, "If self-employed operators facing limits are driven to close their businesses, it is highly likely that closures will occur not sequentially but in the form of 'simultaneous collective closures,'" expressing concern.

◆ Concerns Over Simultaneous Collective Closures = Signs of collective closures have appeared this month. Analysis of Seoul’s food hygiene business data from the Seoul Open Data Plaza shows that 1,600 establishments closed between the 1st and 20th of this month. This is 132 more closures compared to the same period last year. The burden of costs such as labor and rent, combined with the unforeseen variable of COVID-19, has increased the number of restaurant closures.

In particular, the closure of 114 restaurants that had been operating in the same location since before 2008 has caused shock. 'Apgujeong Chuncheon Makguksu,' which started business in May 1987 in Sinsa-dong, Gangnam-gu, and had been operating for 34 years, filed for closure on the 6th. 'Wonju Grandma’s Beef Tripe Grill' (formerly Wonju House), which opened in Wangsimni in 1992, also closed on the 20th. 'Pungnak Banjeom' in Mapo-gu, opened in 1999, 'Wangja Tteokbokki' in Seodaemun-gu, opened in 2001, and 'Sogeumijip,' which started in Jongno in 2005, also voluntarily filed for closure within days.

Closures among self-employed businesses are flooding not only in the foodservice sector but across the entire industry. From February to March 13, the number of claims paid under the Yellow Umbrella Mutual Aid, a closure insurance system for small businesses and small merchants, reached 11,792 cases. This is a 40.8% (8,377 cases) increase compared to the same period last year. The Yellow Umbrella Mutual Aid is considered a representative 'small business closure index.'

Experts are raising their voices, urging that government policy funds must actually reach these businesses. The Foodservice Industry Research Institute emphasized, "To prevent self-employed operators from collectively becoming credit delinquents, cash support under the name of 'minimum operating expenses' rather than loans should be considered."

Meanwhile, the closure rate in the foodservice industry is expected to soar this year. Currently, the closure rate in the foodservice industry is higher than the average closure rate across all industries. As of 2017, it reached 23.1%, nearly twice the average closure rate of 12.6% across all industries. According to the 'Franchise Industry Status as of the End of 2019' released by the Fair Trade Commission last month, the average lifespan of franchise brands was shortest in the foodservice industry at 6 years and 5 months, and the closure rate was also highest in the foodservice industry at 10.8%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.