March Consumer Sentiment Freezes More Than During 2008 Financial Crisis

"Supporting Specific Companies Preferred Over Cash Handouts," Experts Say

[Asia Economy Reporter Kim Eun-byeol] Can the government's 'Emergency Disaster Relief Fund' thaw the frozen consumer sentiment caused by the novel coronavirus infection (COVID-19)? With the April 15 general election approaching, the ruling party is pushing for a plan to provide emergency disaster relief funds related to COVID-19 to 25 million people, about half of the population, which is expected to spark controversy. The shock to consumer sentiment has already surpassed the level during the 2008 financial crisis, recording the largest drop since the Bank of Korea began compiling monthly statistics. Due to concerns about COVID-19, people are refraining from consumption and focusing on securing cash, raising questions about how much distributing cash can actually help stimulate consumption.

On the 27th, Lee Hae-chan, leader of the Democratic Party, stated at a joint meeting of the COVID-19 National Crisis Overcoming Committee and the Election Countermeasures Committee held at the National Assembly, "There are many opinions surrounding the payment of emergency disaster relief funds, but to avoid confusion among the public, the party and government will make a swift and bold decision before next week's 3rd Emergency Economic Meeting." It is expected that the party and government will finalize the plan by this weekend and announce measures at next week's emergency economic meeting. The emergency disaster relief fund includes support for residents' livelihoods and cash support to overcome the consumption cliff. Local governments have already been rushing to promise 'disaster basic income,' so attention is focused on what decision the central government will make.

However, there remains doubt as to whether the government's plan to give cash to citizens, like in the United States, can truly stimulate consumption.

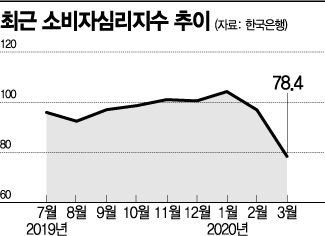

According to the Bank of Korea's 'March Consumer Sentiment Survey Results,' the Consumer Confidence Index (CCSI) for this month was 78.4, down 18.5 points from the previous month. This is the lowest level since March 2009 (72.8), during the height of the global financial crisis. The month-over-month decline is the largest since statistics began in July 2008. The CCSI is based on 100; a value above 100 indicates consumer sentiment is more optimistic than the long-term average (2003?2019), while below 100 indicates pessimism.

Previously, the largest drop was 12.7 points in October 2008, immediately after the Lehman Brothers bankruptcy in September 2008. This means the impact of the COVID-19 crisis on consumer sentiment was greater than that of the global financial crisis. The monthly decline was also larger than in March 2011 (-11.1 points), when the Great East Japan Earthquake and Fukushima nuclear accident occurred, June 2015 during MERS, and February this year (-7.3 points) when the COVID-19 outbreak began.

In particular, looking at the detailed components of the index, expectations for employment opportunities, wages, inflation rate, and interest rate levels have all worsened across the board, making it difficult to guarantee that simply distributing cash will improve consumer sentiment.

Photo by Asia Economy DB

Photo by Asia Economy DB

Experts point out that basic income handouts are unlikely to improve consumer sentiment. Shin Sung-hwan, president of the Korean Finance Association, said, "The reason people are not consuming is not because they lack money," adding, "Basic income is not the remedy needed at this stage."

There are also voices suggesting that instead of distributing cash to the entire population to mitigate the damage caused by COVID-19, it would be better to rescue specific companies clearly affected by the virus. Lee In-ho, professor of economics at Seoul National University, said, "Now is the time to prevent small businesses from going bankrupt rather than increasing demand," adding, "You can block a falling rock, but if a sand pile collapses, it's hard to stop."

Moreover, doubts about whether cash support can lead to actual consumption recovery are confirmed by research results.

According to a report titled 'Analysis of Age, Generation, and Year Effects on Household Consumption Changes' released by the National Assembly Budget Office on the 22nd, the share of private consumption in South Korea's nominal gross domestic product (GDP) fell from 54.5% in 2000 to 48.0% in 2018. The real private consumption growth rate, which had previously outpaced real GDP growth, sharply declined in 2003 and, except for one or two years, has lagged behind GDP growth annually.

Using the Household Finance and Welfare Survey from Statistics Korea, the Budget Office found that the average propensity to consume of households dropped from 0.64 in 2011 to 0.58 in 2015. The average propensity to consume refers to the proportion of consumption expenditure out of disposable income after deducting non-consumption expenditures such as taxes and pensions. Even excluding the special factor of the COVID-19 crisis, the consumption propensity was already declining, raising doubts about whether distributing cash amid the added variable of an infectious disease can lead to domestic demand recovery. The Budget Office suggested, "To resolve consumption contraction, tailored policies by age and generation are necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.