[Asia Economy Reporter Yuri Kim] Seoul apartment prices have turned downward for the first time in over 10 months. The three Gangnam districts (Gangnam, Seocho, and Songpa), which have shown weakness for three consecutive weeks, led the decline in housing prices. Due to government regulations, holding tax burdens, and concerns over an economic downturn, buying sentiment for high-priced apartments has weakened, resulting in downward adjustments in prices of investment-attractive reconstruction apartments such as Eonma in Daechi-dong, Gangnam-gu, Gaepo Jugong, and Jamsil Jugong Complex 5 in Songpa-gu. Areas with many mid- to low-priced apartments, such as Nowon, Guro, and Gwanak, continued to see price increases. In the metropolitan area apartment market, Incheon's progress stood out, while the rise in prices in Gwacheon and the Su-yong-seong area (Suwon, Yongin, Seongnam) slowed compared to the previous week.

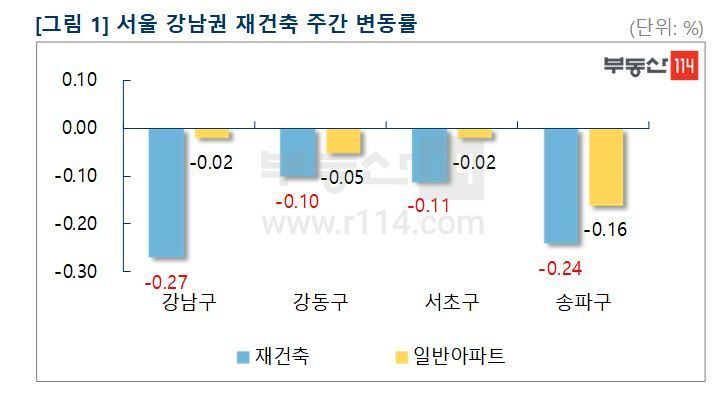

According to Real Estate 114 on the 27th, the weekly change rate of Seoul apartment sale prices recorded -0.01%. This is the first decline since the first week of June 2019 (June 7, -0.01%). Reconstruction apartments fell by 0.19%, while general apartments rose by 0.01%. New towns and Gyeonggi/Incheon rose by 0.01% and 0.11%, respectively.

In Seoul, loan regulations and the impact of COVID-19 reduced transaction inquiries. By region, high-priced apartment areas such as Songpa (-0.17%), Gangnam (-0.12%), Gangdong (-0.06%), Seocho (-0.04%), and Yongsan (-0.01%) experienced declines. In Songpa, Jamsil-dong Jugong Complex 5, Lake Palace, and Jamsil Parkrio in Sincheon-dong fell by 5 to 25 million KRW. In Gangnam, reconstruction and new apartments such as Raemian Blestige and Jugong Complexes 5 and 6 in Gaepo-dong, Eonma in Daechi-dong, and Hanbo Mido Mansion dropped by 5 to 90 million KRW. In Gangdong, Godeok Gracium and Godeok Raemian Hillstate in Godeok-dong, and Samik Green 2nd Complex in Myeongil-dong fell by 5 to 25 million KRW. Seocho saw declines of 10 to 25 million KRW mainly in medium to large-sized units in Banpo-dong Jugong Complex 1, Jinhung in Seocho-dong, and Sinbanpo 2nd Complex in Jamwon-dong. In Yongsan, large units in Raemian Ichon Chellitus in Ichon-dong dropped by 50 million KRW. Meanwhile, demand for mid- to low-priced apartments continued sporadically, with increases in Nowon (0.21%), Guro (0.18%), Gwanak (0.14%), Geumcheon (0.11%), and Dobong (0.09%).

New towns rose in the order of Sanbon (0.05%), Jungdong (0.03%), Bundang (0.02%), Paju Unjeong (0.02%), and Ilsan (0.01%). In Sanbon, large apartment complexes with over 1,000 households such as Halla Jugong Complex 4 and Jugong Complex 11 increased by 2.5 to 7.5 million KRW. In Jungdong, Yeonhwa Ssangyong and Yeonhwa Daewon rose by 5 million KRW. Bundang saw increases of 5 to 10 million KRW in Yatap-dong Jangmi Dongbu, Seohyeon-dong Hyoja Samhwan, and Gumi-dong Mujigae Cheonggu. In Paju Unjeong, Hadang-dong Hanbit Village Complex 3 Jayuro IPARK rose by 2.5 million KRW, and in Ilsan, Juyop-dong Munchon Complex 16 New Samik, Munchon Complex 2 Life, and Gangseon Complex 2 Gyeongnam increased by 2.5 to 5 million KRW.

In Gyeonggi and Incheon, Osan (0.37%), Gunpo (0.31%), Guri (0.29%), Uiwang (0.19%), Ansan (0.18%), and Hanam (0.18%) rose. In Osan, large apartment complexes such as Naesammi-dong Osan Segyo Xi, Geumam-dong Geumam Village Complex 6 Humancia Desiang, and Yangsan-dong Osan Sema e-Pyeonhan Sesang increased by 2.5 to 10 million KRW. Gunpo saw rises of 5 to 10 million KRW in Sanbon-dong Raemian Hires and Sanbon 2nd e-Pyeonhan Sesang. Guri's Daemyeong and Jugong Complex 6 in Inchang-dong, which have good subway transportation conditions, rose by 10 million KRW. Uiwang's Naeson-dong Poil Xi and Daewon Cantavil Complex 1 increased by 10 million KRW. Meanwhile, the Su-yong-seong area, which had driven Gyeonggi housing price increases, saw a slowdown in the rise since mid-March, increasing by 0.15% each.

The jeonse (long-term deposit lease) market continues to experience localized shortages of listings, but demand has decreased due to the impact of COVID-19. Seoul jeonse prices rose by 0.03%, a smaller increase compared to the previous week. New towns and Gyeonggi/Incheon rose by 0.01% and 0.03%, respectively.

In Seoul's jeonse market, Geumcheon (0.13%), Dongjak (0.10%), Gwanak (0.09%), Dongdaemun (0.09%), Gangdong (0.08%), and Jungnang (0.08%) rose. In Geumcheon, Buksan Town Complex 1 in Siheung-dong and Gyeryong in Doksan-dong increased by 5 million KRW. In Dongjak, Daerim, Raemian Roi Park, and Daebang e-Pyeonhan Sesang Complex 2 in Sadang rose by 10 to 20 million KRW mainly in medium to large-sized units. In Gwanak, demand flowed into large apartment complexes near subway stations, with Doosan in Bongcheon-dong rising by 15 million KRW. Dongdaemun saw increases of 5 to 10 million KRW in Hills State Cheonggye in Dapsimni-dong, Anamgol Buksan in Jegi-dong, and Donga in Jeonnong-dong. Conversely, Yangcheon (-0.03%), Mapo (-0.03%), and Seocho (-0.01%) declined. Yangcheon saw downward adjustments of 5 to 25 million KRW in older apartments such as Mokdong New Town Complexes 3 and 4 and Mokdong Woosung Complex 3 in Sinjeong-dong due to the move-in of Mokdong Central I-Park Weave (3,045 households). In Mapo, Seogang Hanjin Haemoro in Changjeon-dong and Bamseom Hyundai Hillstate in Hyeonseok-dong fell by 10 to 30 million KRW.

New towns rose in Gwanggyo (0.03%), Bundang (0.02%), Ilsan (0.02%), and Pyeongchon (0.02%), while others remained flat (0.00%). Gyeonggi/Incheon rose in Incheon (0.07%), Uiwang (0.05%), Gwangmyeong (0.04%), Guri (0.04%), Siheung (0.04%), Namyangju (0.03%), and Hwaseong (0.03%).

The apartment prices in the three Gangnam districts, the barometer of the domestic housing market, have fallen simultaneously for the third week, breaking the upward trend in Seoul housing prices. Since the December 16 measures last year, buyer hesitation centered on high-priced apartments has expanded due to concerns over an economic downturn triggered by COVID-19. Ye Kyung-hee, senior researcher at Real Estate 114, said, "Although the Bank of Korea lowered the base interest rate to overcome the macroeconomic crisis and announced unlimited liquidity supply to financial companies for three months, abundant market funds exist, but anxiety is growing, so demand inflow into the housing market will be limited." She predicted that if the decline in housing prices in the Gangnam area, which leads the market due to transaction contraction, prolongs, it will also curb the rise in housing prices in non-Gangnam areas of Seoul and the metropolitan area.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.