Total Liquidity Supplied During the Financial Crisis Matched

Additional Issuance Power Can Be Mobilized Depending on the Situation

Bank of Korea Finds It Difficult to Directly Take Risky Loans

Public Consensus Needed on Government Guarantees and Central Bank Issuance Power for Corporate Bonds

As criticism mounts that the Bank of Korea (BOK) should take a more proactive stance to mitigate the shock caused by the novel coronavirus disease (COVID-19), the BOK is expressing reluctance. This is because the amount of money already planned to be injected matches the liquidity supply during the 2008 financial crisis, and if the central bank directly undertakes loans that could result in losses, it could spark controversy over the abuse of its note-issuing power. Similar to the United States, unprecedented quantitative easing requires not only government support but also public consensus on unlimited quantitative easing.

According to the government and the BOK on the 25th, the financial sector is discussing detailed support plans for the Bond Stabilization Fund and the Securities Stabilization Fund, with plans to finalize the details within this week. The Bond Stabilization Fund and Securities Stabilization Fund are composed of 20 trillion won and 10.7 trillion won respectively, with the BOK expected to supply liquidity amounting to half (about 15 trillion won). Additionally, the BOK will bear about half of the liquidity for the other measures announced by the government. Eun Sung-soo, Chairman of the Financial Services Commission, said, "The BOK will support liquidity for about half, and the government will actively backstop any losses that occur later."

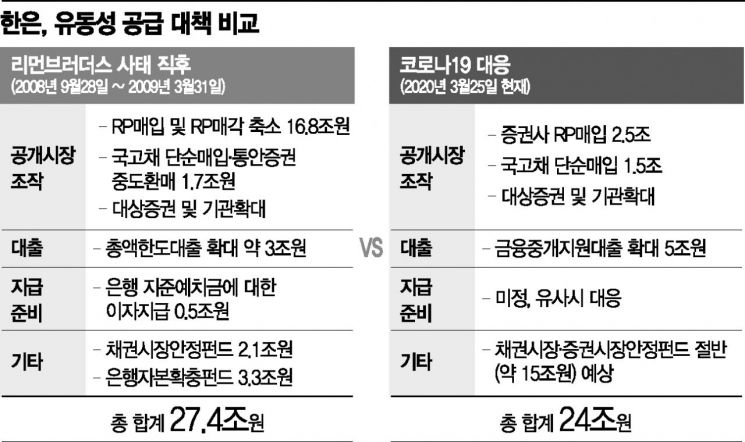

The most likely method for the Bond Stabilization Fund and Securities Stabilization Fund is liquidity supply through loans from the BOK to financial institutions participating in the funds. It is expected that the BOK will purchase Korea Development Bank bonds or buy repurchase agreements (RPs) issued as collateral. Besides this, the BOK has announced measures including ▲purchase of securities firms' RPs (2.5 trillion won) ▲simple purchase of government bonds (1.5 trillion won) ▲expansion of financial intermediation support loans (5 trillion won). The simple sum amounts to about 24 trillion won, comparable to the total supply by the BOK (about 27 trillion won) after the Lehman Brothers crisis.

Nevertheless, financial institutions criticize the BOK for not taking a more active role. The issue lies in risk burden. Although the BOK lends money to financial institutions, all these loans must be collateralized. While the scope of bonds acceptable as collateral has been expanded, the principle of "only collateralized loans" remains unchanged.

According to the industry, the five major domestic financial holding companies?Shinhan, KB, Hana, Woori, and NH Nonghyup Financial?plan to invest around 2 trillion won in the Bond and Securities Stabilization Funds. In a situation where loan defaults and increased loan loss provisions are feared due to COVID-19, additional capital injection is inevitably burdensome for commercial banks. Especially, domestic banks are experiencing a decline in interest income due to narrowing net interest margins (NIM) from interest rate cuts, and their profitability is increasingly constrained amid expected deterioration in asset quality due to economic uncertainty. The worsening of capital adequacy and increased concerns over non-performing assets due to rising risky assets are predictable. In particular, a decline in the Bank for International Settlements (BIS) capital adequacy ratio could lead to credit downgrades and higher funding costs, making additional capital expansion to improve financial soundness inevitable. Although regulatory authorities are expected to ease banks' soundness standards, the deterioration of banks' soundness remains an unchanging fact.

The BOK understands the burden on commercial banks but maintains the position that the central bank cannot bear losses. A BOK official said, "There is no case anywhere in the world where a central bank makes loans that could result in principal losses." This is why the BOK recently explained the Federal Reserve's quantitative easing measures in detail through its New York office. Although it may appear that the Fed directly purchases corporate bonds, it establishes a special purpose vehicle (SPV) in the middle, into which the government injects guarantees. If the SPV incurs losses from purchasing risky corporate bonds, the losses are deducted from the government guarantee amount.

A BOK official said, "Just as the government must obtain parliamentary approval to spend additional supplementary budgets, the money issued by the central bank is ultimately taxpayers' money, so it must not cause losses to taxpayers," explaining why the central bank must avoid losses.

The fact that the Korean won is not a global reserve currency is also a burden for the BOK. In the case of the Bank of Japan (BOJ), large amounts of funds have already flowed overseas in the form of foreign investment and speculative capital, allowing it to conduct quantitative easing freely. Even with quantitative easing, Japan can avoid causing inflation problems domestically. Although Korea has recently experienced low inflation trends, raising the argument that inflation concerns may be unnecessary, an increase in money supply could lead to a depreciation of the currency value, eventually causing a sharp rise in the exchange rate.

Ultimately, for "unprecedented measures" to be introduced, the government must clarify how much loss it is willing to bear. A financial institution official pointed out, "Economic actors such as the government, banks, and the BOK must be prepared to share risks and losses." A BOK official said, "We hope the National Assembly will also examine what kind of system is necessary for the BOK to provide unprecedented support."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.