[Asia Economy Reporter Oh Hyung-gil] Office worker Choi Sooyoung (36, pseudonym) had a frustrating experience at a university hospital. Despite taking cold medicine for over a month, her cough did not subside, so she decided to visit a large hospital, only to end up paying much more for medical fees than expected. While a local clinic charged only 5,000 won for the consultation, the university hospital required a hefty 30,000 won. She also had to bear half of the medication and injection costs. Choi said, "I heard that patients have to pay more at university hospitals, but I didn’t expect such a big difference," and decided to claim the out-of-pocket expenses through her indemnity health insurance.

From now on, patients visiting large hospitals for outpatient treatment of mild illnesses such as colds will have to pay significantly higher out-of-pocket medical expenses than before. As the increased costs are passed on to indemnity insurance, insurance companies are expected to see a rise in loss ratios.

According to related government departments and the insurance industry on the 23rd, the Ministry of Health and Welfare has announced a legislative proposal to amend the Enforcement Decree and Enforcement Rules of the National Health Insurance Act. The amendment focuses on increasing the patient’s share of medical expenses when receiving outpatient treatment at large hospitals for mild illnesses like colds. The proposal will collect public opinions until the 21st of next month and is scheduled to be implemented in the second half of this year.

Currently, outpatients with mild illnesses such as colds and body aches pay 60% of the total medical expenses when using tertiary general hospitals. This rate is higher than that of local clinics (30%), hospitals (40%), and general hospitals (50%), but the government plans to raise it even further. The goal is to reduce patient congestion at large hospitals by increasing the personal burden rate of medical fees.

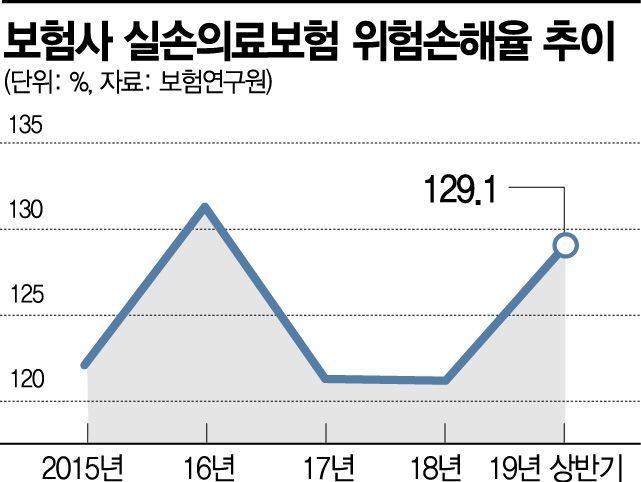

However, if the out-of-pocket expenses increase, the additional costs may be transferred to indemnity insurance, potentially leading to a rise in the loss ratio of indemnity insurance, which has been surging recently.

The insurance industry estimates that indemnity insurance subscribers, who do not worry about out-of-pocket expenses, tend to visit large hospitals more easily. Currently, indemnity insurance is divided into three types: the "old indemnity insurance" sold before October 2009, the "standardized indemnity insurance" sold from October 2009 to April 2017, and the "new indemnity insurance" sold since April 2017.

The old indemnity insurance covers inpatient medical expenses up to a maximum limit of 100 million won with no deductible. Due to its comprehensive coverage, the policy retention rate is high, and some products have loss ratios approaching 150%.

The standardized indemnity insurance has unified policy terms with identical coverage and a 10% deductible. The new indemnity insurance restructured three non-reimbursable items with frequent over-treatment (manual therapy, non-reimbursable injections, non-reimbursable MRI) into separate riders. For these riders, the deductible rate was raised to 30%. However, the loss ratio is relatively low at 70-80%, making the premiums comparatively affordable.

The government plans to adjust the coverage scope of indemnity insurance to prevent the concentration of patients at large hospitals, but critics argue that unless the terms of the old indemnity insurance are revised, only the loss ratio will increase.

An insurance industry official said, "If the deductible for large hospital medical fees increases, subscribers will inevitably rely more on old indemnity insurance," adding, "While this is a measure to prevent patient concentration at large hospitals, a comprehensive approach is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)