Three Daejeon Districts Rank in Top 10 for Apartment Official Price Increase Rates

Last Year’s Cumulative House Price Rise 8.07%, Highest Nationwide... Already Up 4.72% This Year

But Government Takes No Action Amid Speculative Overheating Zone Designation

Ministry of Land, Infrastructure and Transport: "Monitoring Closely but Too Early to Designate Regulation Zones"

Experts Say "Policy Timing Already Missed"

Criticism That Real Estate Measures Are Concentrated in Seoul and Capital Area

[Asia Economy Reporter Lee Chun-hee] Questions are being raised as Daejeon remains a regulatory safe zone despite steep housing price increases. On the 19th, the Ministry of Land, Infrastructure and Transport announced the 'Officially Scheduled Prices for Apartment Complexes,' where three districts in Daejeon ranked among the top 10 nationwide in terms of price increase rates, yet none have been designated as speculative overheated zones or subscription adjustment areas. This has led to criticism that the government's housing price stabilization measures are overly concentrated on Seoul and the metropolitan area.

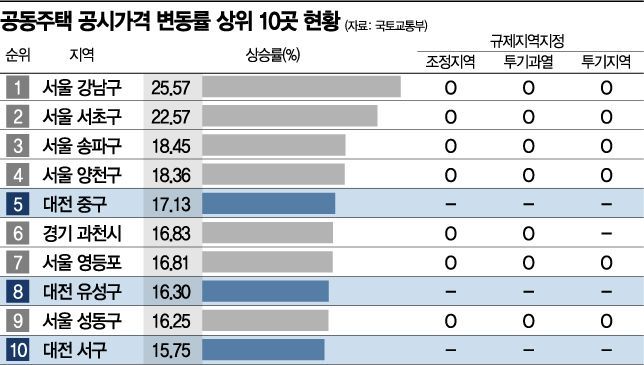

Looking at the year-on-year increase rates by city, county, and district for this year's officially scheduled apartment prices, four districts in Seoul?Gangnam-gu (25.57%), Seocho-gu (22.57%), Songpa-gu (18.45%), and Yangcheon-gu (18.36%)?ranked first through fourth, with Daejeon Jung-gu ranking fifth at 17.13%. While the four Seoul districts are subject to overlapping regulations as adjustment areas, speculative overheated zones, and housing speculation zones, Jung-gu in Daejeon faces no such regulations.

The difference becomes even clearer when expanding to the top 10 cities, counties, and districts by official price increase rates. In addition to Jung-gu, Daejeon includes Yuseong-gu (8th place, 16.3%) and Seo-gu (10th place, 15.75%). Other than these three districts in Daejeon, Gwacheon-si in Gyeonggi Province (6th place, 16.83%), Yeongdeungpo-gu in Seoul (7th place, 16.81%), and Seongdong-gu (9th place, 16.25%) are under strong regulatory measures. Gwacheon-si, the only Gyeonggi area in the top 10, is also a speculative overheated zone.

As reflected in the official price increases, last year’s housing price surge in Daejeon was the most prominent among large provincial cities. According to the Korea Real Estate Board’s monthly apartment sales price index, as of December last year, Daejeon’s year-on-year housing price increase rate was 8.07%, the highest nationwide. This contrasts with the nationwide average housing price decline of 1.42% and a modest 1.11% increase in Seoul.

Despite the housing market contraction caused by the COVID-19 pandemic this year, Daejeon’s housing price rise continues. According to the Korea Real Estate Board’s weekly apartment sales price index, Daejeon’s cumulative increase this year is 4.72%, second only to Sejong (8.49%). Even after the February 20 real estate measures, prices have steadily risen by 0.75%, 0.41%, 0.40%, and 0.46% over four weeks.

A similar trend is seen in the sales market. The 'Doma e-Pyeonhansesang Forena,' launched in October last year, attracted 65,845 applicants for 837 units in the first priority subscription, recording an average competition rate of 78.7 to 1. The minimum winning score also reached 50 points.

▲ Visitors are viewing the model house of 'Doma e-Pyeonhan Sesang Forena' in Daejeon, which opened last October. According to Daelim Industrial, more than 35,000 people visited over three days at that time. (Photo by Daelim Industrial)

▲ Visitors are viewing the model house of 'Doma e-Pyeonhan Sesang Forena' in Daejeon, which opened last October. According to Daelim Industrial, more than 35,000 people visited over three days at that time. (Photo by Daelim Industrial)

The Ministry of Land, Infrastructure and Transport is closely monitoring the Daejeon real estate market but considers it premature to designate it as a regulated area. Lee Myung-seop, head of the Housing Policy Division at the Ministry, explained, "The perception of the market differs between Daejeon and the metropolitan area," adding, "We have designated Daejeon as a high-priced pre-sale management area under the Housing and Urban Guarantee Corporation (HUG) to control pre-sale prices."

Experts analyze that the policy timing has already been missed. Professor Kwon Dae-jung of Myongji University’s Department of Real Estate said, "The rise in Daejeon’s official prices is due to large-scale redevelopment creating new housing complexes," and added, "The government should have implemented policies in a timely manner last year."

Some argue that the government’s focus on stabilizing housing prices in Seoul and the metropolitan area has led to contradictions in regulation. A similar situation occurred last year when the officially scheduled apartment prices were announced. Nam-gu in Gwangju had a 17.77% increase, ranking fifth nationwide, yet it has never been designated as a regulated area.

An industry insider pointed out, "Although objective criteria for designating regulated areas exist, excluding rapidly rising provincial large cities from regulation could spark fairness controversies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)