WTI ETN Products Hit Record Lows... Nearly 90% Drop Since Early Year

Excess Premium Disclosures Surge... 4 to 6 Times Increase Compared to January

[Asia Economy Reporters Minwoo Lee and Eunmo Koo] As international oil prices plummet, the prices of derivative products such as exchange-traded notes (ETNs) based on crude oil are also sharply falling. Moreover, these products are criticized for failing to reflect the actual asset value in a timely manner due to time differences or supply and demand disparities, highlighting the need for improvement measures.

◆Derivative products hit record lows amid oil price plunge=According to the Korea Exchange on the 19th, as of 10 a.m., the Shinhan Leverage WTI Crude Oil Futures ETN(H) dropped 20.08% from the previous day to 1,930 won. This is the lowest price ever recorded, a decline of 87.6% from the annual high of 15,510 won recorded on January 8. At the same time, the Samsung Leverage WTI Crude Oil Futures ETN also traded at 1,910 won, down 31.31% from the previous day. This is also an all-time low, about one-tenth of the annual high (19,025 won) on January 8. The QV Leverage WTI Crude Oil Futures ETN(H) also fell 18.79% from the previous day, showing 1,750 won, down 88.3% from its annual high. These products have taken a direct hit from the plunge in international oil prices.

The previous day, international oil prices crashed to levels seen 18 years ago amid concerns that the spread of the novel coronavirus (COVID-19) would sharply reduce oil demand. According to the New York Mercantile Exchange (NYMEX), West Texas Intermediate (WTI) crude oil for delivery in India plummeted 24.4% in one day, closing at $20.37 per barrel. This is a 68% drop from $63.27 on January 6, marking the lowest level since February 2002. At one point during the session, prices fell to $20.06, raising fears of a collapse below the $20 mark.

Researcher Soobin Shim of Kiwoom Securities said, "Demand slowdown due to COVID-19 continues, and with Russia and Saudi Arabia failing to agree on oil production cuts, concerns over oversupply are unlikely to be resolved in the short term." He added, "Even if COVID-19 eases, it will be difficult to overcome oversupply concerns, making it hard for prices to exceed $40 per barrel."

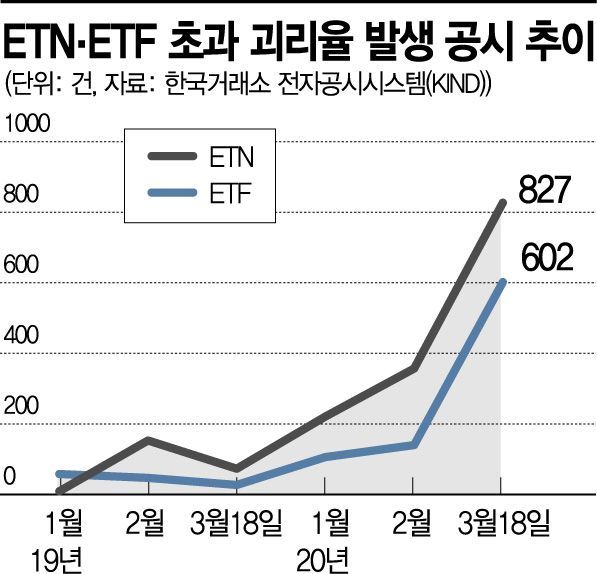

◆Surge in excess premium/discount disclosures... "Failing to reflect actual value"=As market volatility rises higher than ever, there are increasing cases where market prices fail to properly reflect actual values. According to the Korea Exchange, disclosures of 'ETN premium/discount excess occurrence' have totaled 827 cases so far this month, a sharp increase compared to 221 cases in January and 357 cases in February this year. The increase is even more pronounced compared to the same period last year. Related disclosures were 9 cases in January, 153 in February, and 73 in March last year. The same trend applies to exchange-traded funds (ETFs). Disclosures of 'ETF premium/discount excess occurrence' this month have reached 602 cases, a significant rise compared to 106 cases in January and 140 cases in February.

The premium/discount rate of ETNs and ETFs is an investment risk indicator that expresses the ratio of the difference between the market price and the intrinsic value of the underlying assets. Currently, the Korea Exchange requires disclosures when the premium/discount rate exceeds 1% for domestic asset-based products and 2% for foreign asset-based products.

The surge in excess premium/discount disclosures means that actual values are not being adequately reflected in prices. When ETNs and ETFs are traded in the market, price fluctuations occur due to supply and demand, causing a gap between intrinsic value and market price. If trading occurs while this gap exists, investors may buy at prices higher or sell at prices lower than the actual value, resulting in losses.

The recent widening of the premium/discount gap is due to the sharply increased market volatility. Due to the impact of COVID-19, stock markets worldwide have been highly volatile, causing market prices to fail to properly reflect actual values. This is especially frequent in foreign asset-based products with different trading hours. A time lag between the closing price of ETNs/ETFs and their reference price can cause the premium/discount rate to widen depending on movements in overseas markets during that period.

To reduce losses caused by premium/discount occurrences, it is advised to trade during hours when liquidity providers (LPs) can perform real-time hedging. Sungin Jung, head of the ETF Strategy Team at Korea Investment Trust Management, said, "We recommend trading during overlapping trading hours so that LPs can reduce bid-ask spreads through real-time hedging."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.