Russia Targets US Shale Industry

Saudi Arabia Seems to Seek Quick Russian Surrender

Contrary to Both Sides' Expectations, Unexpected Prolonged Conflict May Unfold

[Asia Economy Reporter Naju-seok] As the novel coronavirus infection (COVID-19) has brought suffering worldwide, Russia and Saudi Arabia have entered an 'oil war.' Despite declining demand, they intend to increase crude oil production. Why have Russia and Saudi Arabia engaged in this self-destructive competition?

The Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC oil-producing countries including Russia held an OPEC+ (a consultative body of 10 major oil-producing countries) meeting in Vienna, Austria, on the 5th and 6th to discuss production cuts. The meeting aimed to reduce crude oil production due to the global economic slowdown caused by COVID-19. However, Russia refused to cut production, stating that it needed to observe the situation further. Subsequently, Saudi Arabia abruptly announced an increase in crude oil production, declaring the start of the 'oil war.'

This decision has broken the consultation channels among oil-producing countries that had managed international oil prices for the past three years.

Why did Russia refuse to cut production despite the obvious decline in oil prices?

Primarily, experts believe Russia aimed to induce a drop in oil prices to damage the U.S. shale industry, its competitor. The U.S. has become the world's largest oil producer thanks to shale oil development. However, unlike oil from Saudi Arabia or Russia, shale oil has higher extraction costs. While it can be profitable above a certain price threshold, profitability becomes difficult if prices fall below that level. For Russia, this strategy could not only strike the U.S., which has imposed various sanctions and economic burdens, but also undermine current and future potential competitors.

Moreover, Russia currently has sufficient financial reserves accumulated through oil exports. Even if oil prices fall, it can withstand the situation with funds accumulated in sovereign wealth funds amounting to $150 billion (183 trillion won).

Of course, Russia is not invincible. Although the immediate financial impact may not be significant, the burden Russia must bear is substantial. Russian President Vladimir Putin is currently pushing to extend his term until 2036 through constitutional amendments. For Putin's long-term rule to continue, Russia's economic growth must be maintained, but the current finances may be insufficient. A decline in oil prices leading to reduced fiscal revenue will inevitably impact business expenditures.

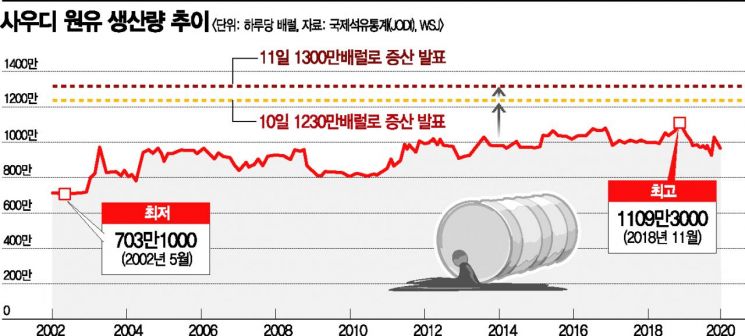

Saudi Arabia faces even greater risks. Unlike Russia, Saudi Arabia has not prepared for low oil prices, and its financial needs are large due to modernization plans. Analysts predict that Saudi Arabia could face a fiscal deficit of $120 billion if oil prices fall. Although an oil-rich country, such a large deficit is not easy for Saudi Arabia to manage.

Therefore, the analysis suggests that Saudi Arabia's announcement to increase production and drive down oil prices was actually an attempt to force Russia's surrender within a short period. However, it is doubtful that Russia, with relatively better financial conditions, will be the first to give in.

Jean-Fran?ois Seznec, a Middle East expert at the Atlantic Council, a U.S. international affairs think tank, said, "The current situation reminds me of World War I," adding, "France and Germany thought the war would end before Christmas, but in fact, they fought in trenches for four years." This implies that the 'oil war' could lead to a catastrophe beyond what Russia and Saudi Arabia anticipated.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.