Luxury Storefronts Crowded with Masked Customers 'Bustling Scene'

Ranked 8th Worldwide for 2 Consecutive Years... Last Year 14.8 Trillion KRW, 4.6% Growth

Louis Vuitton Store Expansion... Department Stores 'Booming Alone' Strengthen Luxury Brands

[Asia Economy Reporter Lee Seon-ae] The common sight in front of luxury brand stores at department stores such as the Chanel store at Lotte Department Store Main Branch, the Louis Vuitton store at Shinsegae Department Store Yeongdeungpo Branch, and the Gucci store at Hyundai Department Store Trade Center Branch is the noticeable lines every time you visit. This is despite the spread of the novel coronavirus disease (COVID-19). While many multi-use facilities appear empty as confirmed COVID-19 cases surpass 8,000, luxury brand stores boast bustling crowds.

On the afternoon of the 13th, Mr. Lee, whom we met at a luxury store in Lotte Department Store Main Branch, said, "I was bored staying at home, so I came out, and because luxury stores have entry restrictions, I can view products comfortably, which makes me feel more at ease during times like these." Mr. Park, whom we met at a luxury store in Shinsegae Department Store Main Branch, also said, "I heard that the product I originally wanted to buy has arrived, so I came to the store," emphasizing, "If I don't buy it now, the stock will run out immediately."

A luxury store official explained, "Entry is restricted if customers are not wearing masks, and we assist entry while conducting hand sanitization for visitors, so customer service time has become slightly longer than before the COVID-19 outbreak," adding, "There has been no change in sales due to COVID-19; in fact, sales increased last month compared to the same period last year."

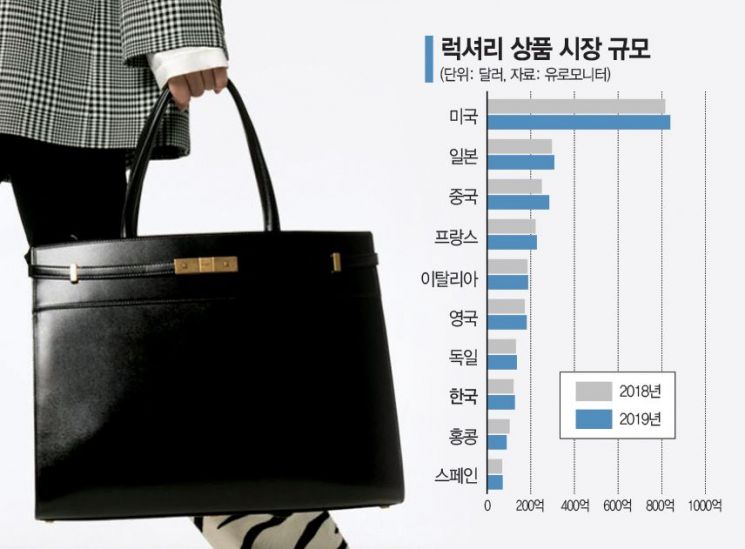

According to Euromonitor, the size of the luxury goods market in Korea last year was $12.7267 billion (14.8291 trillion KRW, based on the fixed 2019 exchange rate of 1,165.200 KRW), an increase of 650 billion KRW from the previous year's $12.1685 billion (14.1787 trillion KRW). Korea ranks 8th globally after the United States, Japan, China, France, Italy, the United Kingdom, and Germany. Since 2013, the Korean luxury market has shown an average annual growth rate of 6.5%, with 4.6% growth last year. This figure excludes duty-free, secondhand markets, and black markets based on domestic sales, so the actual market size and growth rate are estimated to be much larger and steeper.

Hong Hee-jung, Senior Researcher of Beauty & Fashion at Euromonitor International Korea, analyzed, "Korea's luxury goods market shows steady growth across all categories including luxury clothing, bags, and watches, driven by the broad luxury consumption of Korean consumers. While demand was previously focused on traditional luxury brands like Louis Vuitton, Prada, and Chanel, recently, there has been an increase in demand for affordable or inclusive luxury among younger consumers and the middle class."

Based on this high growth rate, frequent price increases by luxury brands continue. Louis Vuitton raised prices of major products by about 2-4% on the 4th of this month. This was the fourth price increase within a year and a half, following a price hike last November. Since Chanel adjusted handbag prices by about 3-13% last October, the industry widely expects Chanel to soon raise prices as well. Earlier this year, Prada and Dior also adjusted their prices ahead of others.

Focusing on the rosy growth of the Korean luxury market, luxury brands are actively expanding their stores. They are broadening their main product lines from bags to shoes and clothing. Louis Vuitton is expanding its store located in the luxury hall of Shinsegae Yeongdeungpo Branch. This is to strengthen men's products and to sell a variety of items including clothing, shoes, and accessories, not just bags. As the MZ generation (Millennials and Generation Z), a major consumer group of luxury goods, shows more interest beyond bags to shoes and clothing, and as men's purchasing power increases to rival that of women, operational strategies are being adjusted accordingly.

Gucci is also taking active steps. Focusing on men's purchasing power, it has separated men's and women's clothing at its boutiques in Cheongdam, Galleria Luxury Hall, Lotte Main Branch, Jamsil, Busan, and Shinsegae Gangnam and Centum City branches. At Lotte Main Branch, men's and women's stores were expanded and reopened separately, and in Jamsil, a women's fashion accessories store and a clothing store were additionally opened, operating three stores including the men's store. Recently, the women's and men's stores were renewed and reopened at Lotte Busan Main Branch as well.

The department store industry is also putting effort into securing luxury brands. Hyundai Department Store plans to open the largest department store in Seoul in Yeouido and is working hard to attract the three major luxury brands there. Lotte Department Store remodeled its Main Branch first floor last year by replacing cosmetics with luxury stores to create a premium store and plans to apply premium stores to major branches such as Jamsil and Busan Main Branches. Shinsegae Department Store has introduced Herm?s in all 14 branches and plans to focus on expanding Chanel and Louis Vuitton stores this year.

Louis Vuitton store appearance.

Louis Vuitton store appearance.

Although department stores nationwide have been closing due to confirmed cases visiting and customers reducing visits due to infection concerns, resulting in an average 15% decrease in sales across all brands, luxury brands are showing clear growth. Lotte Department Store's sales last month decreased by 22% year-on-year, but luxury sales increased by 6%. Galleria Department Store's sales in February fell by 4%, but luxury sales jumped by 17%. Shinsegae Department Store and Hyundai Department Store also saw sales decrease by 15.8% and 12.1% respectively from the 1st to the 25th of last month, but luxury sales increased by 2.4% and 9.3% respectively.

Researcher Hong said, "The outlook for the Korean luxury market is expected to continue steady growth led by luxury purchases from various consumer groups, similar to previous years," adding, "While offline stores like department stores have been the main consumer access points for luxury brands, in the future, promotion and sales of luxury products through TV home shopping, social media, and online channels will also stand out more."

In fact, online luxury sales have also been strong recently due to the spread of COVID-19. According to Moltail, Korea's No.1 overseas direct purchase delivery agency, the scale of direct purchases of luxury bags (over $500 each) last month increased by 76% compared to the same period last year. The transaction amount of Ballan, Korea's largest luxury specialty shopping mall, also increased 15 times year-on-year in February.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.