Bank of Korea 'Financial Market Trends in February 2020'

[Asia Economy Reporter Kim Eunbyeol] Despite the government's real estate loan regulations, household loans from banks surged by more than 9 trillion won last month. This is the largest increase on record.

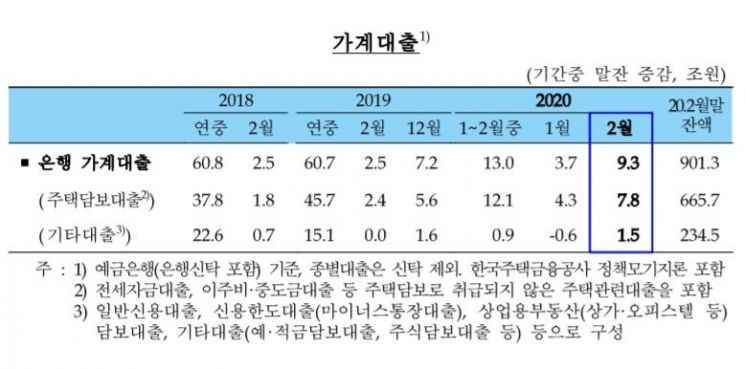

According to the Bank of Korea's 'Financial Market Trends in February 2020' released on the 11th, the balance of household loans (including policy mortgage loans) at the end of February was 901.2823 trillion won, an increase of 9.3 trillion won compared to the previous month. This increase is about 2.5 times the growth in January (+3.7 trillion won).

This is also the largest increase since the Bank of Korea began compiling related statistics in 2004. The previous record was in October 2015 (+9 trillion won).

The surge in household loans was driven by mortgage loans, which make up the majority of household loans. At the end of February, the balance of mortgage loans was 665.7031 trillion won, up 7.8 trillion won from the previous month. The increase was significantly larger than the previous month (+4.3 trillion won), influenced by demand for funds related to housing jeonse (key money deposit), sales, move-in, and refinancing of non-bank loans. This is the largest increase since April 2015 (+8 trillion won).

Yoon Okja, head of the Financial Market Department's Market General Team, stated, "Housing transactions lead to household loan demand with a lag of about 2 to 3 months," adding, "It is estimated that most of the fund demand from housing transactions before the December 16 measures was reflected in bank household loans in February."

Regarding whether the December 16 measures are working properly, she said, "It would be better to judge after observing the loan flow from March onward," and predicted, "Household loans from banks are expected to slow down after March, but the extent will be influenced by the housing market situation."

The Bank of Korea's analysis suggests that there is inevitably a time lag before the effects of the government's 'December 16 Housing Market Stabilization Measures,' which include strong loan regulations, are reflected in household loans. In January, the number of apartment sales transactions in Seoul was 6,000 units, down from 10,000 units the previous month.

Other loans such as overdraft accounts and credit loans increased by 1.5 trillion won last month. This turned to an increase again due to demand for payment funds related to the Lunar New Year and housing transactions.

Corporate loans saw a reduced increase of 5.1 trillion won compared to 8.6 trillion won the previous month. The increase in loans to small and medium-sized enterprises (+5.3 trillion won) continued. Corporate bonds saw a significant increase in net issuance from 100 billion won in January to 3.3 trillion won in February, influenced by steady investment demand and large-scale issuance by some major corporations.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)