[Asia Economy Reporter Kim Hyewon] #. A petrochemical company located in Ulsan is obligated to measure air pollutants emitted once every two weeks. Most workplaces comply with this obligation by outsourcing to measurement agencies due to manpower and equipment issues. However, after the outbreak of the novel coronavirus infection (COVID-19), quarantine measures have been strengthened, telecommuting has increased, and external access has been restricted, making normal work impossible.

#. A semiconductor equipment company located in Gyeonggi Province requires on-site business trips to understand equipment design and specifications due to the nature of made-to-order production. They must stay in China for more than 300 days a year, but business trips have been blocked. Sales decreased by 15% in just one month, and due to cash flow problems, 30 to 40 domestic partner companies also faced a crisis together.

These are difficulties reported by domestic companies to the 'COVID-19 Task Force' operated by the Korea Chamber of Commerce and Industry (KCCI) since last month. As of the 6th, KCCI received a total of 357 cases of corporate difficulties and plays a role in delivering them daily to related ministries such as the Ministry of Economy and Finance and the Ministry of Trade, Industry and Energy.

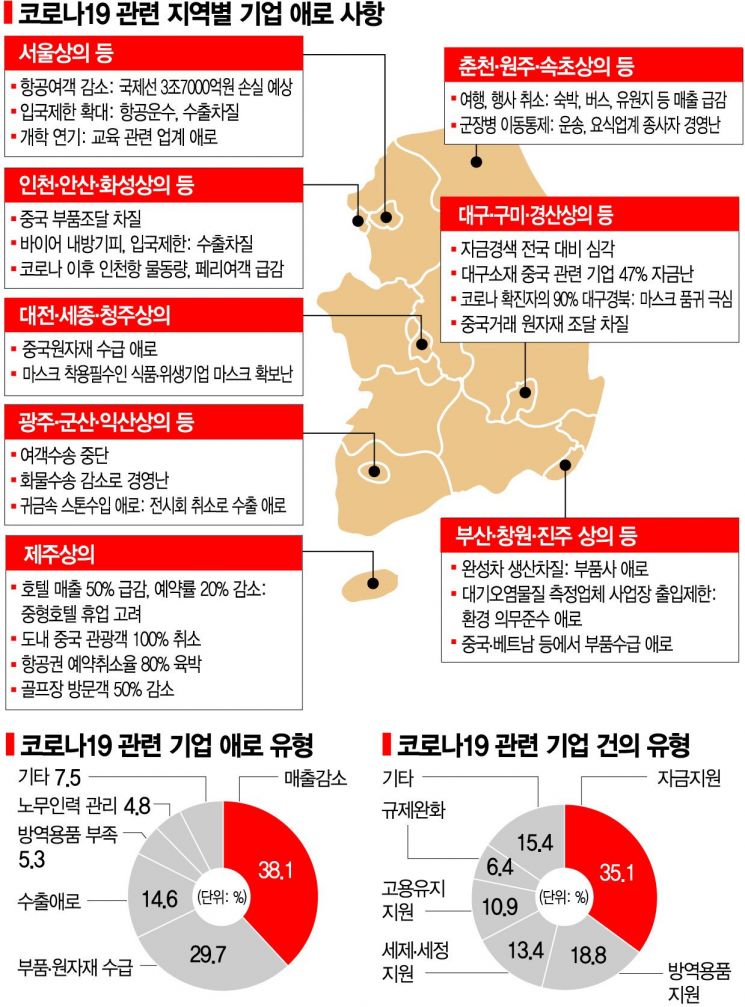

On the 9th, the KCCI task force analyzed the cases of difficulties and found that the most common challenge companies face is a decrease in sales (38.1%). This was followed by difficulties in procuring parts and raw materials (29.7%), export difficulties (14.6%), shortages of quarantine supplies (5.3%), and labor and personnel management (4.8%).

By industry, manufacturing companies, which have many transactions with China and are concentrated in industrial complexes and manufacturing-heavy regions such as Gyeonggi, Gyeongnam, and Gyeongbuk, reported many cases of sales decline and raw material procurement difficulties. The exhibition industry and air transportation sector suffered significant damage due to mass cancellations of exhibitions and a nearly 90% drop in air passengers. Retail distribution and sectors such as academies were also heavily impacted due to reduced external activities and school opening delays.

In the Daegu and Gyeongbuk regions, where COVID-19 outbreaks were concentrated, urgent financial support for survival, mask supply for quarantine activities, and related cost provisions were requested. The Daegu Chamber of Commerce stated, "Among companies in Daegu that trade with China, 47% are requesting 'emergency management funds,'" adding, "Although government support has increased, new loans or maturity extensions are practically difficult due to loan limit excesses, restrictions on eligible industries, and corporate credit issues."

Among government requests, financial support (35.1%) accounted for one-third of the total. Support for quarantine supplies such as masks and sanitizers (18.8%), tax reductions and postponement of tax audits (13.4%), employment retention support (10.9%), and deregulation in labor and environment (6.4%) followed. Notably, companies requesting financial support including funds, tax, and employment retention exceeded 60%, indicating that the COVID-19 crisis seriously threatens not only export issues but also the very foundation of small business owners and companies.

Although the government has introduced measures such as financial support, voices are emerging that the effectiveness is reduced due to stringent damage verification criteria and policies that do not consider industry-specific characteristics. For example, rental car businesses that purchase vehicles through capital companies and repay monthly loans by operating the vehicles find it difficult to use primary financial institutions, but financial support policies are limited to these institutions, excluding them from support. A food service company in Busan that supplies school food materials has no sales in March due to school opening delays. When inquiring about emergency management fund support from the government, they were told that if there are no sales, it is considered that there is no business activity, and they were only asked to provide damage verification documents.

Professor Shin Gwanho of Korea University (KCCI advisory committee member) pointed out, "Companies are in a comprehensive crisis and urgently need help, but if support procedures are complicated and evaluation criteria remain the same as before, the perceived effect will inevitably be limited," adding, "In addition to regional and industry-specific measures, burden reduction measures common to all companies, such as financial support, tax reductions, and deferrals of various investigations and fee payments, need to be bundled and implemented at once."

Woo Taehee, Executive Vice President of KCCI, said, "We plan to prepare a comprehensive proposal containing responses to COVID-19 and economic recovery soon and submit it separately to the government."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.