Supplementary Budget Size Expected Around 7 Trillion Won

Some Criticize Political Line-Drawing Over 'Good Landlords'

"Minimal Effect of Passenger Car Acquisition Tax Cut, Should Focus on Regular Consumer Goods"

[Sejong=Asia Economy reporters Kim Hyunjung, Joo Sangdon, Jang Sehee] On the 28th, the government emphasized that the total support scale for overcoming the damage caused by the novel coronavirus infection (COVID-19) and boosting the economy amounts to 20 trillion won plus alpha (α). It also announced plans to prepare an additional supplementary budget (supplementary budget) at the level of or exceeding that of the 2015 Middle East Respiratory Syndrome (MERS) outbreak. Experts forecast that the effect may be minimal compared to the fiscal scale and pointed out that political demarcation or welfare-type cash support should be avoided.

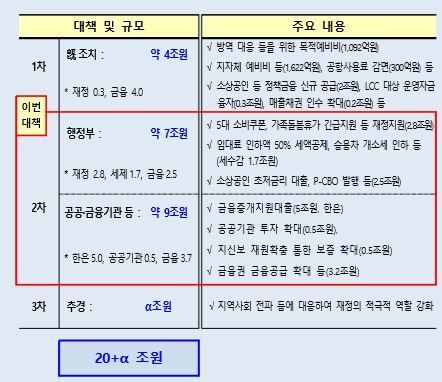

◆An additional 16 trillion won to overcome damage and boost economic vitality= On the 28th, the government held the 9th COVID-19 Response Economic Ministers' Meeting and the 6th Economic Vitality Measures Meeting at the Government Seoul Office, chaired by Deputy Prime Minister and Minister of Economy and Finance Hong Namki, and announced the "Comprehensive Measures for Minimizing the Impact of COVID-19 and Early Recovery of Livelihoods and Economy." Previously, including the contingency funds for quarantine response (109.2 billion won), local government contingency funds (162.2 billion won), and new policy finance supply for small business owners (2 trillion won), a support plan worth 4 trillion won had already been announced. On this day, the executive branch (about 7 trillion won) and public and financial institutions (about 9 trillion won) presented additional support measures totaling about 16 trillion won. The confirmed fiscal scale so far reaches 20 trillion won.

In particular, the government focuses on recovery for small business owners and small and medium-sized enterprises (SMEs). Following the 'Good Landlord' support announced by Deputy Prime Minister Hong Namki the day before, the ultra-low interest loans for small business owners will be expanded from the existing 1.2 trillion won scale to about 3.2 trillion won, and the guarantee fee will be reduced from 0.8% to 0.5% for one year. The special guarantee by the Regional Credit Guarantee Foundation will also be expanded more than tenfold to 1 trillion won, and the guarantee rate will be lowered from 1.0% to 0.8%. To support SMEs that find it difficult to issue corporate bonds alone, the issuance scale of bond collateralized securities (P-CBO) will be increased and the repayment burden reduced. Management stabilization fund loans for affected SMEs will increase twentyfold to 630 billion won, and the loan interest rate will be lowered by 0.5 percentage points to 2.15%.

By industry, a new unsecured credit guarantee special loan of 50 billion won will be established for the tourism sector, and an additional 80 billion won in general loans will be supported. Emergency loans of up to 300 billion won will be provided to low-cost carriers (LCCs), and a public guarantee program for airline operating leases will also be introduced. In addition, tax burdens will be eased for small individual businesses with annual sales under 600 billion won, and support will be provided for tax and customs clearance for small business owners and SMEs, early and advance payment of insurance premiums for industries severely affected by COVID-19, various fee payment deferrals and reductions, and reemployment programs for retired personnel.

◆Experts say "Effectiveness uncertain compared to fiscal scale"= The government also announced plans for a third supplementary budget. The draft is expected to be submitted to the National Assembly as early as next month, with a projected scale of about 7 trillion won excluding revenue adjustments. However, voices mainly from the ruling party call for a supplementary budget exceeding 10 trillion won, and final adjustments on the scale and content are reportedly underway.

Regarding this support plan, experts diagnosed that there was a lack of detailed consideration in terms of effectiveness. Professor Kim Sangbong of Hansung University’s Department of Economics said, "Regarding rent, lowering it only causes political demarcation that fosters conflict between 'good people' who reduce rent and 'bad people' who do not," adding, "Voluntary reductions would be more effective." He also pointed out, "Considering that automobiles are not frequently purchased items, the reduction of individual consumption tax (ICT) on cars is less effective since those who wanted to buy have already done so," and added, "Reducing ICT on frequently purchased goods would be much more effective."

He also evaluated the form of providing incentives limited to 'senior jobs' separately from consumption coupons as 'cash welfare.' Professor Kim said, "Cash has already been sufficiently distributed through job projects, and it is difficult to understand why fiscal spending is limited to seniors in a disaster situation," adding, "Not all people in their 60s are vulnerable groups, and rather, budget should be concentrated on health and medical quarantine sectors." Professor Cho Jangok of Sogang University explained, "Crisis situations do not improve significantly through fiscal policy," and said, "Assuming 10 trillion won is spent, the scale directly linked to production effects would be only 3 to 4 trillion won."

Professor Kang Sungjin of Korea University’s Department of Economics criticized, "'Good Landlord' is a movement that started in the private sector, so it is questionable what kind of imagination the government has applied this time," and pointed out, "The estimated amount such as the decrease in tax revenue predicted based on past consumption patterns is no longer meaningful now."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["I'd Rather Live as a Glamorous Fake Than as a Poor Real Me"...A Grotesque Success Story Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)