Life Insurance Industry Implements Support Measures to Overcome COVID-19 Crisis

On the 26th, when the number of confirmed COVID-19 cases exceeded 1,000, access to visitors was restricted at Eunpyeong St. Mary's Hospital of Catholic University in Eunpyeong-gu, Seoul. The Seoul Metropolitan Government sent an urgent text message to Seoul citizens, stating that one more confirmed case related to Eunpyeong St. Mary's Hospital was reported the previous day, and at the hospital's request, visitors who have been to the hospital since February 1 are advised to contact their nearest public health center for medical guidance. Photo by Kang Jin-hyung aymsdream@

On the 26th, when the number of confirmed COVID-19 cases exceeded 1,000, access to visitors was restricted at Eunpyeong St. Mary's Hospital of Catholic University in Eunpyeong-gu, Seoul. The Seoul Metropolitan Government sent an urgent text message to Seoul citizens, stating that one more confirmed case related to Eunpyeong St. Mary's Hospital was reported the previous day, and at the hospital's request, visitors who have been to the hospital since February 1 are advised to contact their nearest public health center for medical guidance. Photo by Kang Jin-hyung aymsdream@

[Asia Economy Reporter Ki Ha-young] The life insurance industry has decided to grant payment deferrals for insurance premiums and policy loan interest to support those affected by the novel coronavirus disease (COVID-19).

On the 27th, the Life Insurance Association and the life insurance industry announced that they have prepared a joint support plan focusing on deferring payments of insurance premiums and policy loan interest, providing relief supplies and supporting local economic revitalization, and establishing a sound insurance solicitation culture to overcome the crisis, and will actively promote these measures.

The life insurance industry plans to provide timely support to citizens and small business owners affected by COVID-19 through deferrals of insurance premium and policy loan interest payments, as well as prompt payment of insurance claims.

The Life Insurance Association has temporarily suspended nationwide life insurance-related qualification exams (for agents and variable insurance) conducted monthly to prevent the spread of COVID-19.

To prevent cases of insurance fear marketing, such as encouraging unnecessary insurance subscriptions by exploiting COVID-19 infection anxieties, the insurance industry will strengthen self-regulation efforts. To this end, they plan to actively work to prevent exaggerated advertisements using provocative phrases and incomplete sales.

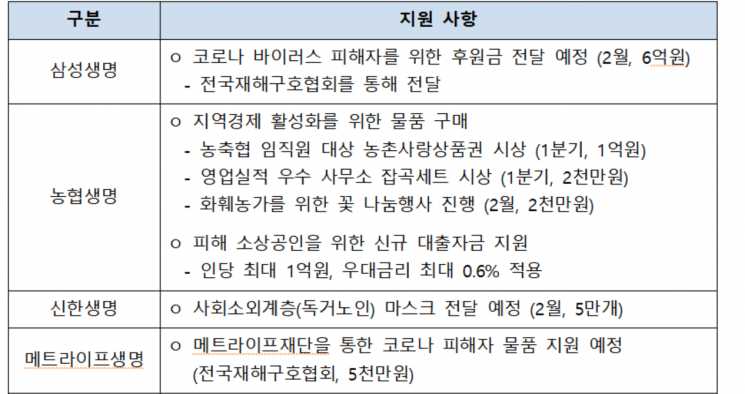

Support will also be provided for relief supplies and local economic revitalization. Each life insurer will provide emergency relief supplies such as masks and hand sanitizers to COVID-19 affected areas and vulnerable groups including children and elderly living alone, according to their capabilities and characteristics. They will also actively promote early procurement of necessary goods to contribute to domestic demand revitalization.

To practically support small business owners through stimulating consumption in traditional markets, the use of Onnuri gift certificates will be actively encouraged at insurance companies’ own award events and other occasions.

Meanwhile, the Life Insurance Association has donated 10 million won collected from executives and employees to the National Disaster Relief Association to support affected citizens, and the life insurance industry plans to continue various efforts to prevent the spread of COVID-19 and minimize economic damage in the future.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.