[Asia Economy Reporter Changhwan Lee] Last year, as the semiconductor market deteriorated significantly, Samsung Electronics' corporate tax expenses also drastically decreased. Despite the government raising the corporate tax rate, the corporate tax paid by Samsung Electronics declined, resulting in South Korea's overall corporate tax revenue falling short of government expectations by more than 7 trillion won last year.

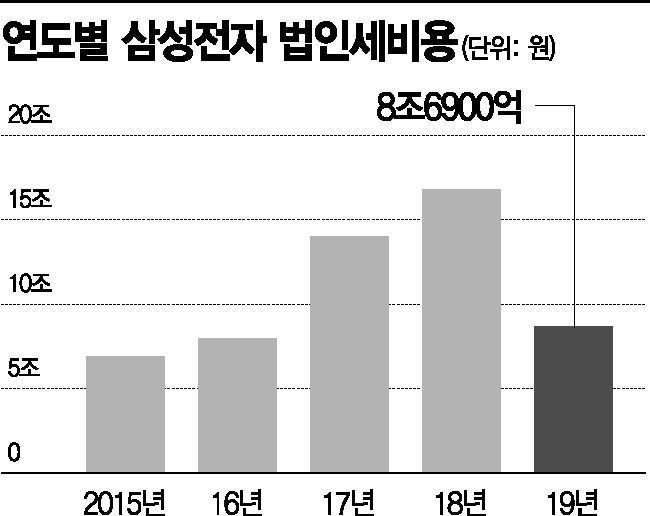

According to Samsung Electronics' consolidated audit report disclosed on the 25th, the corporate tax expense reflected in the company's consolidated financial statements last year totaled 8.69 trillion won. This represents a sharp drop of 48.3% compared to 16.82 trillion won the previous year. It is also the lowest level in three years since recording 7.99 trillion won in 2016.

Corporate tax expense is the amount calculated from the cost perspective of taxes imposed on a company's income. Due to various tax credits and other factors, there may be some differences from the actual corporate tax paid by the company.

The significant reduction in Samsung Electronics' corporate tax expense last year was due to decreased operating profit caused by the downturn in the semiconductor market. Last year, Samsung Electronics' sales were approximately 230 trillion won, and operating profit was about 27.8 trillion won, down 5.5% and 52.8% respectively from the previous year. The decrease in profit is interpreted as the main reason for the substantial reduction in corporate tax.

Although corporate tax decreased, the corporate tax burden ratio (corporate tax expense / profit before corporate tax expense), which indicates the tax burden on companies, actually increased. Samsung Electronics' corporate tax burden ratio last year was 28.6%, marking the highest ever, up from 27.5% the previous year.

The increase in the corporate tax burden ratio is mainly attributed to the government's tax law revision, which raised the top tax rate to 25% (previously 22%) for taxable income brackets exceeding 300 billion won starting in 2018.

Despite the government raising the corporate tax rate, the overall corporate tax revenue in South Korea fell short of expectations due to declining corporate performance. According to the Ministry of Economy and Finance's recent fiscal trend report for February, last year's corporate tax revenue was 72.2 trillion won, falling short of the initial revenue budget of 79.1 trillion won by 7.1 trillion won.

Due to the significant shortfall in corporate tax revenue, last year's national tax revenue also decreased by 100 billion won to 293.5 trillion won from 293.6 trillion won recorded the previous year. Compared to the initial plan of 294.8 trillion won, it was short by 1.3 trillion won, marking the first tax revenue deficit in five years since 2014. The government views the main cause of the tax revenue shortfall as the reduction in interim tax payments due to worsened corporate performance amid the semiconductor market downturn last year.

The tax revenue situation is expected to worsen this year. Last year's operating profit influences this year's corporate tax revenue, and corporate operating profits worsened further last year. According to the corporate evaluation site CEO Score, the operating profit and net profit of the top 100 companies by market capitalization last year plummeted by 36% and 45% respectively compared to the previous year. The semiconductor industry slump had a significant impact, with Samsung Electronics and SK Hynix's operating profits sharply declining.

A business community official said, "Not only Samsung Electronics but companies overall had poor performance last year," adding, "The government should actively implement policies to improve the business environment, such as corporate tax cuts and deregulation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.