Korea Economic Research Institute: "Korea's Economic Growth Rate Declines Along with Private Sector Growth Contribution... Serious Economic Vitality Contraction"

Calls for Benchmarking the US and France, Which Boost Economic Vitality with Pro-Business Policies

[Asia Economy Reporter Changhwan Lee] An analysis has emerged showing that South Korea's key economic indicators such as economic growth rate, investment, and employment have lagged behind those of the United States and France for several years. It is argued that the South Korean government should benchmark the U.S. and France, which have boosted economic vitality through pro-business policies.

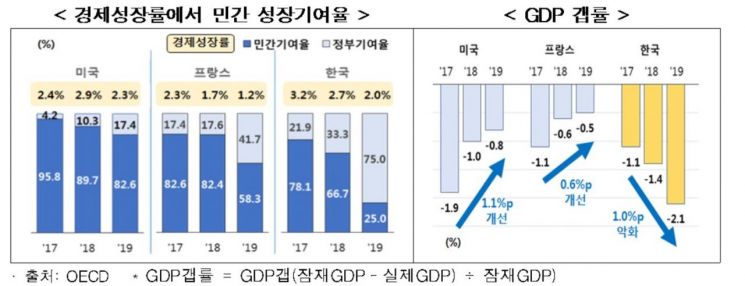

On the 25th, the Korea Economic Research Institute (KERI) released a report titled "Comparison of Economic Policies and Performance of Korea, the U.S., and France from 2017 to 2019," revealing that South Korea's economic growth rate declined by 1.2 percentage points (p) from 2017 to last year. During the same period, the U.S. and France saw decreases of 0.1%p and 1.1%p respectively, indicating that South Korea's growth rate decline was more severe.

Looking into the details of the economic growth rate, the private sector's contribution to growth, excluding the government, fell the most in South Korea. From 2017 to 2019, the private sector growth contribution rate in the U.S. dropped from 95.8% to 82.6%, and in France from 82.6% to 58.3%.

In contrast, South Korea's rate plummeted in a stepwise manner from 78.1% to 25.0%. KERI emphasized that this indicates a rapid contraction in private economic vitality such as household consumption and corporate investment in South Korea.

As the economic growth rate failed to keep pace with the potential growth rate, the GDP gap rate?which is the ratio of the difference between potential GDP and actual GDP to potential GDP?worsened only in South Korea.

South Korea's GDP gap rate expanded twofold from 1.1% in 2017 to 2.1% last year, contrasting with the U.S. and France, which halved their negative gaps during the same period. A low GDP gap rate means that the real growth rate is below the potential growth rate, increasing the likelihood of an economic recession.

Private investment performance also diverged. Thanks to strong pro-business policies, the U.S. and France recorded positive private investment growth for three consecutive years despite the global economic slowdown, whereas South Korea sharply declined from an 11.1% increase in 2017 to a 6.0% decrease in 2019.

Foreign direct investment (FDI) inflows, which indicate attractiveness as an investment destination, increased in France from $29.8 billion in 2017 to $39.3 billion in the first three quarters of 2019, while South Korea's FDI sharply decreased from $12.7 billion to $5.8 billion during the same period.

The decline in private vitality was directly reflected in stock indices. The Korean stock market experienced repeated phases of falling more sharply during downturns and rising less during recoveries, resulting in a cumulative return of 13.2% from early 2017 to recently, far behind the U.S. at 49.3% and France at 23.6%.

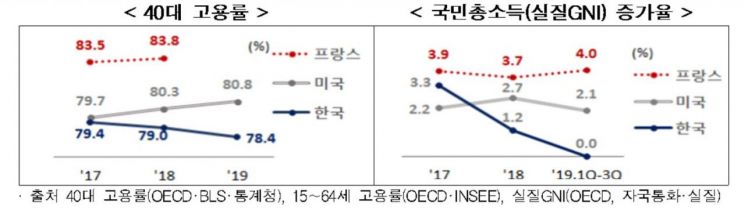

Employment rate improvement was also weakest in South Korea. Compared to the first quarter of 2017, the seasonally adjusted employment rate (ages 15-64) in the fourth quarter of 2019 increased by 1.9%p in the U.S. and 1.6%p in France, but only by 0.6%p in South Korea. Notably, the employment rate for people in their 40s, considered the backbone of the economy, declined only in South Korea. From 2017 to 2019, the 40s employment rate dropped by 1.0%p in South Korea, while it rose by 1.1%p in the U.S.

Employment sector achievements translated into income growth. Gross National Income (GNI) per capita increased annually by 2-3% in the U.S., where per capita GNI is $60,000, and by 3-4% in France, where it is $40,000. South Korea, which entered the $30,000 per capita GNI bracket in 2018, saw a sharp slowdown in GNI growth, dropping to 0.0% in the first three quarters of last year, widening the income gap with advanced countries.

KERI analyzed that the background to the U.S. and France's enhanced economic vitality was bold economic policies that promoted corporate activities. After the Trump administration took office in January 2017, the U.S. implemented groundbreaking tax cuts, including lowering the corporate tax rate from 35% to 21% and reducing the tax rate on repatriated overseas corporate earnings from 35% to 15.5%.

The U.S. also introduced a bold deregulation system such as the "2 for 1 rule," which mandates the elimination of at least two existing regulations for every new regulation introduced, removing obstacles to corporate investment. France also took the lead in creating a business-friendly environment. After President Macron took office in May 2017, he significantly lowered corporate and wealth taxes and increased labor market flexibility through major labor reforms, including easing dismissal regulations.

However, South Korea's new government, which took office around the same time as the U.S. and France, pursued different policy directions. It raised corporate and income taxes and implemented pro-labor policies such as minimum wage increases and a 52-hour workweek, along with public sector job creation policies.

Choo Kwang-ho, head of KERI's Job Strategy Office, emphasized, "The U.S. and France, which focused on creating a business-friendly environment through tax cuts, deregulation, and labor reforms, achieved excellent economic results despite the global growth slowdown. South Korea must also shift its economic policies toward promoting corporate activities to revive private vitality."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)