Impact of 2·20 Real Estate Measures... Sharp Drop in Purchase Inquiries

Investment Expected to Decline as Pre-sale Transfer Restrictions Tighten

However, Voices Say 'Another Balloon Effect Unavoidable'

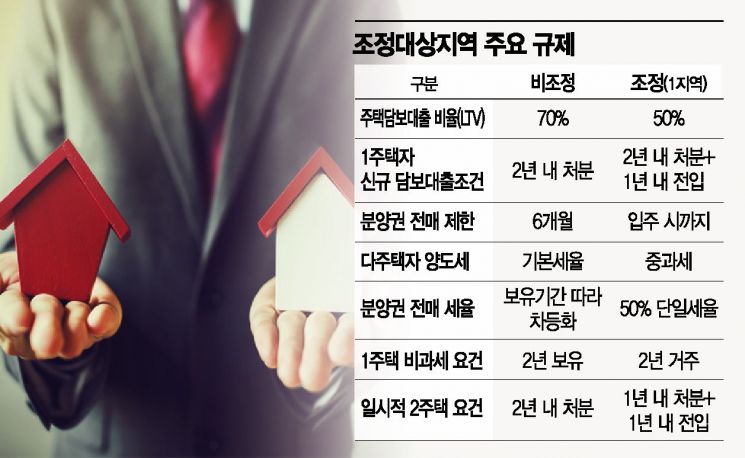

[Asia Economy Reporter Moon Jiwon] Investment demand that had concentrated in some areas of Gyeonggi Province due to the government's 'February 20 Real Estate Measures' is showing signs of slowing down. In particular, with the restrictions on resale of pre-sale rights and the tightening of interim payment loan regulations under this measure, it is expected that the enthusiasm in the subscription market, which has driven house price increases, will somewhat subside. However, since this measure is a 'pinpoint regulation,' there are considerable concerns about another balloon effect.

According to the real estate industry on the 24th, in the housing markets of five southwestern Gyeonggi areas newly designated as regulated areas on the 21st?Suwon Yeongtong, Gwonseon, and Jangan districts, Anyang Manan district, and Uiwang City?purchase inquiries significantly decreased starting from last weekend. Multi-homeowners in these areas are also withdrawing their listings due to concerns over increased capital gains tax, leading to a phenomenon of supply shortage.

It is reported that Uiwang and Anyang were more shocked because the inclusion in the regulated areas was not highly anticipated. The head of A real estate agency in Naeson-dong, Anyang, said, "The loan restrictions are greater than expected, and the resale restrictions have also been strengthened, so the impact is bound to be significant," adding, "Purchase inquiries are less than half of the usual level."

The industry also suggests that the subscription market may shrink for the time being. This is because the government designated all areas within the regulated zones as 'Category 1 areas,' which have the strictest resale restrictions, through this real estate measure. Previously, to reduce market shock, the government classified regulated areas into Categories 1 to 3. The resale restriction period for pre-sale rights is until the ownership transfer registration date (move-in) for Category 1, 1 year and 6 months for Category 2, and 6 months (private land) to 1 year (public land) for Category 3.

Areas such as Seongnam, previously Category 2, and Suwon Paldal, Yongin Giheung, Namyangju, Hanam, Goyang (all private land), previously Category 3, will now have resale restrictions strengthened to last until ownership transfer registration for complexes issuing move-in announcements. Since new constructions and pre-sale rights have driven house price increases in Gyeonggi areas with significant price rises, the impact on the market is expected to be substantial.

In Suwon, where house prices have recently surged sharply, the subscription market has also shown signs of overheating. The subscription competition rates for Suwon Station Haneulchae The First Phase 1 and Hillstate Prugio Suwon, which were sold in the second half of last year, reached averages of 88.16 to 1 and 78.36 to 1, respectively. The 84㎡ unit of Indukwon Prugio El Centro, considered a prime apartment in Uiwang Daejang, was traded at 1.19 billion KRW earlier this month, rising nearly 200 million KRW in two months.

Although limited to some expensive metropolitan areas, apartments priced over 900 million KRW within regulated areas are also facing negative market factors due to the ban on group interim payment loans. According to frontline real estate agencies, some asking prices for sales and pre-sale rights in newly regulated areas, including Hillstate Prugio Suwon in Maegyo-dong, Suwon, and Hoban Verdiem The First in Homaesil-dong, Gwonseon-gu, have dropped by about 30 to 40 million KRW within a few days. As a result, the subscription market in the metropolitan regulated areas is also expected to be reorganized around actual demand for the time being.

There are also considerable concerns that liquidity may flow into existing pre-sale rights or pre-sale rights and newly built apartments in non-regulated areas since the regulations are limited to new pre-sales within regulated areas. The industry voices that even if house prices in Seoul, Suwon, and other areas slow down due to the December 16 and February 20 measures, another balloon effect is inevitable unless groundbreaking supply measures or financial policies that fundamentally block speculative demand are introduced.

Kiwoom Securities researcher Seo Youngsoo stated in a report related to the February 20 measures, "(The government) again suppressed demand from actual buyers in specific areas through Loan-to-Value (LTV) ratio regulations, thereby inducing demand to non-regulated areas," and analyzed that "the government's measures will have a limited impact on the housing market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.