[Asia Economy Reporter Seulgina Jo] South Korea's three major mobile carriers are on the verge of achieving the '0% churn rate era,' a dream milestone. This is the result of each company focusing on a 'home rabbit (existing customer) defense strategy' amid rapid market changes over the five years since the implementation of the Device Distribution Structure Improvement Act. SK Telecom, the number one operator, recorded a churn rate in the 0% range for the first time on a quarterly basis last year with the commercialization of 5G, signaling an annual entry into the 0% range as well.

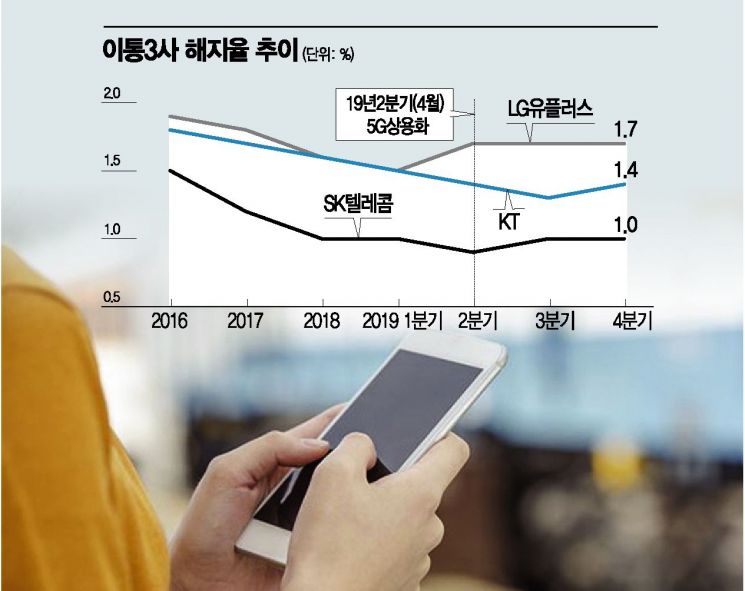

◆Declining trend since the enactment of the Device Distribution Structure Improvement Act= According to the industry on the 24th, a review of the wireless service churn rates of the three carriers through last year's fourth-quarter earnings reports shows a continuous decline in churn rates since the Act was implemented in September 2014.

Among the companies, SK Telecom's churn rate decline is the most pronounced. As of the end of last year, it recorded an all-time low of 1.0%. This marks a 0.5 percentage point drop in just three years. Compared to the second quarter of 2014, just before the Act's enforcement (1.9%), the decrease is 0.9 percentage points. This period reflects a significant increase in customer loyalty to the carriers.

Most notably, SK Telecom recorded a churn rate of 0.9% in the second quarter of last year, marking the first time ever that the quarterly churn rate fell into the 0% range. Considering the 5G price wars and the subscriber scale of each company, this 0% churn rate is highly significant.

KT and LG Uplus, whose churn rates exceeded 2% just before the Act's enforcement, also dropped to 1.4% and 1.7%, respectively, by the end of last year. Although still higher compared to SK Telecom, the downward trend continues. Compared to three years ago, their churn rates have decreased by 0.4 and 0.2 percentage points, respectively. An industry insider said, "With subsidy competition restricted by the Act, all three carriers have shifted their strategies to attract long-term subscribers, leading to a decline in churn rates," adding, "Changes in market characteristics, such as family-specialized plans, have also been reflected."

Last year, the number of mobile number portability cases was 5,768,357, the lowest since 2005 (5,572,690). This is about half the volume compared to 11,165,786 cases in 2013.

◆It will be more difficult to reduce churn rates this year= However, with the full-scale popularization of 5G starting this year, competition among the three carriers to lower churn rates is expected to become more complex. Since the market is already saturated, the three carriers inevitably need to spend large-scale marketing expenses to retain their customers and poach competitors' customers. The three carriers poured about 8 trillion won into marketing expenses last year alone due to the 5G price wars, which inevitably causes a financial burden.

Additionally, KT and LG Uplus face the challenge of attracting 5G customers while narrowing the churn rate gap with SK Telecom, the number one operator. In the second quarter of last year, when SK Telecom recorded a churn rate in the 0% range, KT and LG Uplus had churn rates of 1.4% and 1.7%, respectively, with gaps of 0.5 and 0.8 percentage points compared to SK Telecom. For LG Uplus, this represents a fourfold increase from 0.2 percentage points just before the Act's enforcement.

An industry insider said, "The higher the churn rate, the higher the proportion of consumers switching carriers, which inevitably becomes a burden for the carriers." Among the three, LG Uplus, which has the highest churn rate, will have to spend more on marketing than its competitors to maintain or expand its subscriber base, which will directly impact its performance.

There is also speculation that the budget phone industry, which had recently slowed in growth, might absorb 5G carrier customers. In the first year of commercialization last year, budget phones saw a net increase of about 280,000 customers moving from the three major carriers, which was a positive effect for the carriers. However, the industry expects a new structure to form this year with the release of mid-to-low-priced 5G devices.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)