KCS Announces Export-Import Status from 1st to 20th of This Month

Exports to China Down 3.7%...Daily Average Exports Down 9.3%

Cumulative Export Value Also Negative...Adverse Impact on Growth Rate

Amid a sharp decline in cargo imports from China due to the recent novel coronavirus impact, on the 6th, the designated warehouse at Incheon Airport Customs in Yeongjongdo, Jung-gu, Incheon, showed a noticeably empty appearance compared to its usual state filled with cargo./Yeongjongdo=Photo by Kim Hyun-min kimhyun81@

Amid a sharp decline in cargo imports from China due to the recent novel coronavirus impact, on the 6th, the designated warehouse at Incheon Airport Customs in Yeongjongdo, Jung-gu, Incheon, showed a noticeably empty appearance compared to its usual state filled with cargo./Yeongjongdo=Photo by Kim Hyun-min kimhyun81@

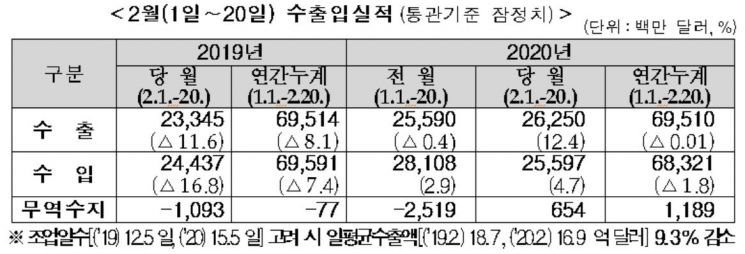

[Asia Economy reporters Kim Bo-kyung, Kim Eun-byeol, Moon Chae-seok] Concerns have become reality. As the impact of the novel coronavirus infection (COVID-19) prolongs, a red light has turned on for our exports. The average daily export value decreased by 9.3%, and the cumulative export value and trade with China have also turned downward this year. If there is no rebound by the end of this month, it will mark 15 consecutive months of negative export growth.

According to the Korea Customs Service on the 21st, the export value from February 1 to 20 (provisional customs clearance basis) was $26.25 billion, an increase of 12.4% ($2.91 billion) compared to the same period last year. This was largely due to three additional working days compared to last year because of the Lunar New Year holiday movement.

Average Daily Exports and Trade with China Both 'Negative'... Will It Be 15 Consecutive Months of Decline?

The problem is that as the COVID-19 situation prolongs, the average daily export value adjusted for working days has significantly decreased. During this period, the average daily export value was $1.69 billion, down 9.3% from $1.87 billion last year.

Exports to China, which account for a quarter of South Korea's total exports, decreased by 3.7%. Earlier, exports to China from February 1 to 10 had increased by 36.0% compared to the same period last year. However, as the impact of COVID-19 expanded, exports to China turned to a decline within just 10 days.

By product category, exports of petroleum products (-4.1%), passenger cars (-0.1%), and ships (-29.0%) decreased. In particular, due to the closure of factories in China, the supply of automobile parts was hit, causing Hyundai Motor, Kia Motors, and others to face situations where they could not assemble finished vehicles.

The cumulative export value from January 1 to February 20 this year also turned negative. During this period, exports amounted to $669.51 billion, a decrease of $4 million (-0.01%) compared to the same period last year. Previously, the cumulative value 10 days earlier had increased by $1.471 billion (2.8%) year-on-year. In other words, from mid-February, the damage caused by COVID-19 began to seriously affect exports. If export performance does not improve by the end of this month, it will continue a 15-month streak of negative growth.

Professor Sung Tae-yoon of Yonsei University said, "It is difficult to immediately create alternative demand to China, so support for export companies' funding and reducing labor burdens should be implemented together. Since companies were already at a critical point even before the COVID-19 situation, efforts to diversify exports and prevent companies from falling into additional difficulties are necessary; otherwise, it may be hard to recover from this shock."

Government Optimistic About Positive Exports in Q1... "Economic Growth Rate Hit Unavoidable"

Earlier, Sung Yun-mo, Minister of Trade, Industry and Energy, predicted at a press briefing at the end of December last year that exports would turn positive in the first quarter (January to March) and grow by 3% annually. This was based on expectations that exports of key items such as semiconductors and shipbuilding would improve as the global economy recovered. However, with the emergency signal on Korean exports due to the COVID-19 impact, gloomy forecasts that this year’s economic growth rate may fall again are emerging.

The timing when global credit rating agencies and investment banks (IBs) consecutively lowered growth forecasts for China and South Korea to the 1% range coincided with the visible impact on manufacturing and exports.

As growth forecasts plummeted one after another, both the government and the Bank of Korea are facing increasing concerns. Given the domestic economic structure where exports account for 80%, a significant hit to exports will inevitably lead the Bank of Korea to revise down its growth forecast for this year. The government is also considering supplementary budgets as regional consumption sharply contracts and the impact spreads across all industries. Even the Bank of Korea, which previously judged that lowering interest rates was not the answer, is now facing greater dilemmas.

Jang Min, senior research fellow at the Korea Institute of Finance, said, "How much the Bank of Korea lowers the growth rate will be key. Even if interest rates are not cut this month, if the economic growth impact is judged to be severe, there is a high possibility of additional rate cuts within this year."

Professor Kim So-young of Seoul National University said, "It is questionable whether China’s COVID-19 situation will recover by summer, and even if quarantine ends, the real economy recovery will take longer. Since the government had already decided to accelerate fiscal spending to stimulate the economy before the COVID-19 outbreak, comprehensive government support should be as swift as possible."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.