50 New Companies in KOSDAQ Market in One Year

Stricter Monitoring Has Impact but Main Cause Is Business Deterioration

[Asia Economy Reporter Oh Ju-yeon] Ninety-three listed companies with December fiscal year-ends were designated as companies under management last year. This figure is more than double compared to the previous year. While the strengthened accounting audits due to the revised External Audit Act last year had an impact, more than half of the companies were designated as companies under management solely based on their performance results such as operating losses and capital erosion, indicating that business deterioration is the main cause. Additionally, companies that received adverse audit opinions and were designated as companies under management typically suffered from poor performance, suggesting that the fundamental strength of listed companies has declined accordingly.

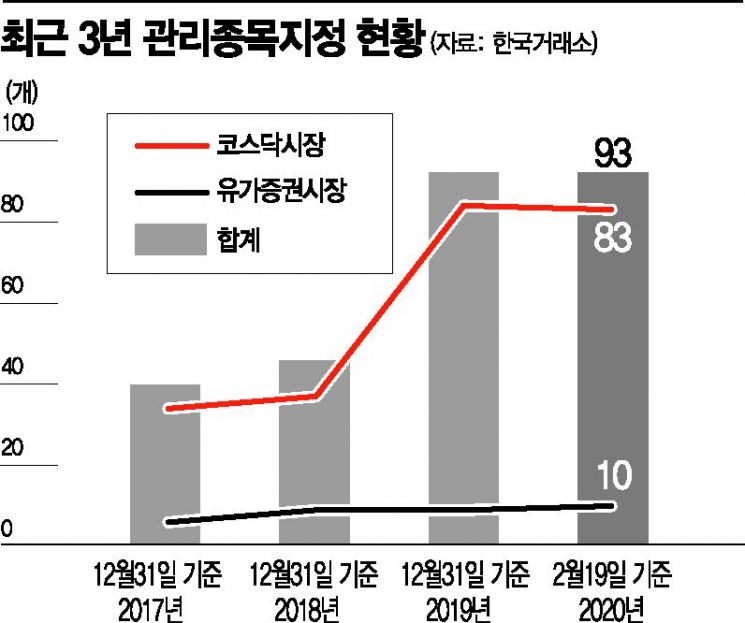

According to the Korea Exchange on the 20th, the number of domestic listed companies designated as companies under management increased by 53 (132.5%) from 40 to 93 over the past three years from December 31, 2017, to December 31 last year. In particular, the number of companies under management in the KOSDAQ market surged significantly, rising by 50 (147.06%) from 34 to 84 during the same period.

This increasing trend was especially prominent in the KOSDAQ market last year. At the end of 2018, the number of companies under management was 46 in total, with 9 in KOSPI and 37 in KOSDAQ. By the end of last year, the number remained the same at 9 in KOSPI, but the KOSDAQ market saw a massive increase to 84 companies under management. This trend continued this year, with the number of companies under management as of February 19 standing at 10 in KOSPI and 83 in KOSDAQ, totaling 93.

A Korea Exchange official explained, "There has been an increase in marginal companies, and along with this, the revised listing management system implemented last year also had an effect." Last year, the Financial Services Commission reformed the existing system where listed companies receiving adverse audit opinions such as qualified, adverse, or disclaimer of opinion would be immediately delisted to reduce the external audit burden on companies. Under the new system, companies receiving adverse audit opinions are designated as companies under management instead of immediate delisting, and if they submit an objection, a one-year grace period is granted.

The exchange official added, "Since last year's fiscal year, companies with disclaimer of opinion audit opinions have also had their delisting deferred, so some companies that would have been delisted remain as companies under management, which has contributed to the increase in numbers."

In fact, the number of delisted companies decreased significantly last year. Only one KOSDAQ-listed company was delisted related to last year's fiscal year-end, down sharply from 13 in 2018. However, this was because delisting was deferred even after receiving adverse audit opinions such as disclaimer of opinion. In 2015, 12 companies were delisted related to fiscal year-end, 9 in 2016, and 8 in 2017.

Even if delisting was deferred last year, companies receiving adverse opinions this year will be delisted without further grace periods. Thirty-seven companies in the KOSDAQ market were designated as companies under management last year due to adverse, disclaimer, or scope-limited qualified audit opinions. Among them, 24 companies will face delisting procedures if they receive adverse audit opinions again this year.

Along with this, many companies are at risk of delisting depending on the 2019 fiscal year performance results to be announced this year. Eighteen KOSDAQ companies, including Kooksoondang, Korea Precision Machinery, and Natural Endotech, have been designated as companies under management due to consecutive operating losses over the past four business years.

If a company records operating losses for five consecutive business years, it becomes subject to a substantive review of listing eligibility, and companies under review may be expelled from the market depending on the results. Currently, 31 companies, including Kolon TissueGene KDR and WFM, have been designated as subjects of the substantive review of listing eligibility.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)