Accused of Fraud

Anxiety Ahead of Institutional Entry Opportunity

[Asia Economy Reporter Kim Min-young] Peer-to-peer (P2P) financial companies are on edge amid a series of adverse developments. Recently, delinquency rates have been rising sharply, accompanied by news of large firms selling off non-performing loans. One company was reported to the Financial Supervisory Service on fraud charges. The industry, which had envisioned ‘entering the regulated sector’ with the enforcement of related laws this August, is now concerned that investor sentiment may be weakening.

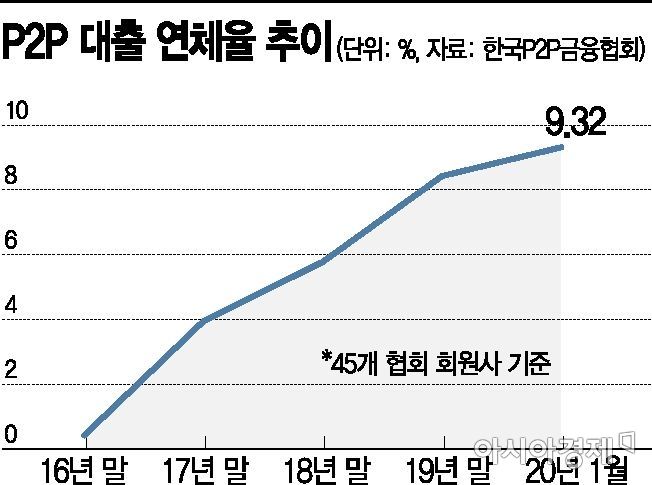

According to the Korea P2P Finance Association on the 20th, the average delinquency rate of its 45 member companies stood at 9.32% as of the end of last month. This marks an increase of nearly 1 percentage point from 8.43% in December last year. Compared to the delinquency rate of 0.42% at the end of 2016, when P2P finance first emerged in South Korea, it has risen more than 22 times.

In particular, red flags have been raised regarding the soundness of major companies. Terra Funding, the industry leader with cumulative loans of 1.0403 trillion KRW, saw its delinquency rate soar by 4.51 percentage points to 17.48% at the end of last month. During the same period, Honest Fund (with cumulative loans of 770.9 billion KRW) also experienced an increase from 5.83% to 6.23%. As of the end of last month, the cumulative loan amount of member companies was 6.1243 trillion KRW, with these two firms (1.8112 trillion KRW) accounting for about 30% of the total.

These companies have mainly handled real estate project financing (PF) loans or mortgage loans, and the rise in delinquency rates is attributed to the downturn in the real estate market. A P2P industry insider explained, “Due to the slowdown in real estate development and tightened loan regulations, the collateral value has declined or disputes have arisen in some projects, leading to increased delinquency rates.”

News of large firms selling off non-performing loans is also cooling investor sentiment. Recently, Terra Funding recorded losses on three projects: a multi-family new construction product in Taean, Chungnam; a row house new construction product in Paju, Gyeonggi Province; and a multi-family new construction product in Goyang, Gyeonggi Province. The net loss, considering the principal of 10.2 billion KRW and previously paid returns to investors, was reported at 2.39 billion KRW (loss rate of 23.4%). This is the first time Terra Funding has sold off bonds.

Eight Percent, which mainly handles personal credit P2P loans, reportedly recorded an average principal loss of 28% on the musical production crowdfunding product ‘The Musical 1~12.’

The news of a prosecution referral also sent shockwaves through the industry. The Financial Supervisory Service reportedly detected fraud allegations during an investigation of Pop Funding in December last year and requested a criminal investigation. The company’s cumulative loan amount is 498.4 billion KRW, with a delinquency rate reaching 64.80%.

The industry is gripped by anxiety over whether the market will shrink ahead of the enforcement of the P2P Finance Act (Online Investment-Linked Finance Act) this August. An industry insider expressed concern, saying, “We worry that the market might be seen as a hotbed of bad loans even before it properly starts.” Another insider predicted, “This opportunity will lead to a clear sorting out of bad companies.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)