Tomorrow, Jujeongsim to Designate Suwon and Others as Regulated Areas

Regulation Levels Adjusted Considering Upcoming Election Voter Sentiment

Intended to Prevent Balloon Effect but Raises Concerns of Another Balloon Effect

Pinpoint Regulations Continue Without Mid- to Long-Term Plans, Showing Clear Limitations

[Asia Economy Reporter Moon Jiwon] As the government plans to introduce additional measures just over two months after the December 16 real estate policy, criticism is spreading that the simplistic real estate policies focused solely on 'curbing house prices' are causing only side effects. The 'war on Gangnam house prices,' which began in 2017, has produced 19 rounds of measures in just two and a half years, fueling market distortions and confusion. Without presenting a mid- to long-term policy direction and chasing only micro-level house prices, even the government's proclaimed 'preemptive response' is being evaluated as a practical failure.

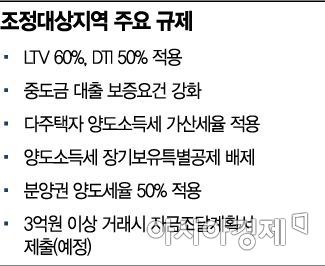

◆Indiscriminate balloon effect caused by measures chasing only house prices= According to the Ministry of Economy and Finance and the Ministry of Land, Infrastructure and Transport on the 19th, the government plans to hold the Residential Policy Deliberation Committee on the morning of the 20th to finalize the 19th real estate measures and announce them on the same day. Since Yongin and Seongnam have already been mostly designated as regulated areas, five southwestern Gyeonggi areas?Suwon’s Gwonseon, Yeongtong, and Jangan districts, Anyang’s Manan district, and Uiwang city?are expected to be subject to regulations.

The market's response to the measures is lukewarm. It has been repeatedly learned through multiple regulations that 'whack-a-mole' style regulations targeting specific areas whenever localized price surges occur cannot stabilize the real estate market. In fact, while the Gangnam 3 districts (Gangnam, Seocho, Songpa) calmed somewhat during the two months after the December 16 measures, localized price surges have continued around new apartment complexes in areas that escaped regulation such as Nowon, Dobong, Gangbuk districts (known as No, Do, Gang), Geumcheon, Gwanak, Guro districts (known as Geum, Gwan, Gu), Suwon, Yongin, Seongnam, as well as Hwaseong, Ilsan, Guri, and Gwangmyeong in the metropolitan area. When prices rise in one place, house prices in other areas competitively rise, creating a height-matching effect.

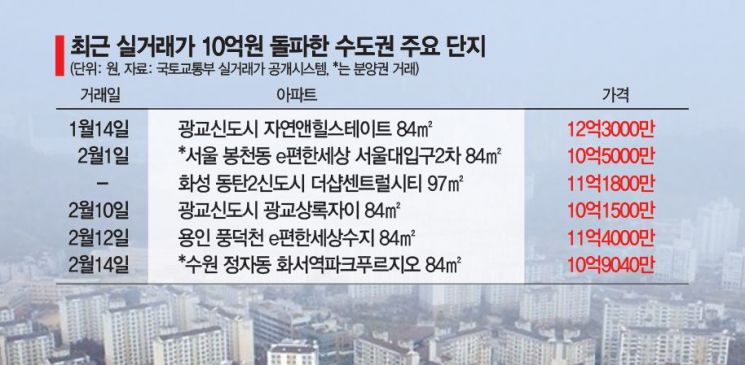

For example, the 94㎡ (exclusive area) unit at The Sharp Central City in Cheonggye-dong, Hwaseong, Gyeonggi Province, which mostly traded below 1 billion KRW before December last year, surpassed 1.1 billion KRW after the December 16 measures announcement, and current asking prices have risen to around 1.3 billion KRW. Prices in non-Gangnam areas of Seoul such as Bongcheon-dong, Gwanak-gu’s ePyeonhansesang Seoul National University Entrance 2nd Complex, Gwanggyo New Town’s Gwanggyo Sangnok Xi, and Suwon’s Jangan-gu Jeongja-dong Hwaseo Station Park Prugio 84㎡ units have also soared well above 1 billion KRW, with transaction prices in peripheral metropolitan area complexes rising competitively.

This trend sharply contrasts with the past price increase pattern that moved from Gangnam → surrounding areas → Gangbuk → new towns and adjacent metropolitan areas. The government's measures seem to have stimulated buyers' psychology, causing price increases to appear across various metropolitan areas within a short period without a fixed pattern.

Kwon Il, head of the Real Estate Info Research Team, said, "If the government continues to impose regulations only on specific areas without comprehensive regulatory measures, the balloon effect will inevitably occur again. When regulations come out, people stop transactions temporarily, so the rate of increase may slow down, but market liquidity remains, causing regulations to bounce to unexpected areas."

◆Money has already moved elsewhere, but the government’s measures are too late= There is also significant criticism that the government's 'pinpoint regulations' coming after prices have already surged have clear limitations. In particular, for designation as a regulated area, quantitative conditions such as the housing price increase rate exceeding 1.3 times the consumer price inflation rate over three months must be met, making it structurally inevitable that the measures come too late.

Even if regulations are imposed belatedly after meeting designation requirements, liquidity moves to other areas, leading to a secondary balloon effect. In fact, the Suwon, Yongin, and Seongnam areas targeted by the government's follow-up measures have already stopped their excessive price increases and are showing signs of stabilization.

Concerns are also raised that regulations such as designation as regulated areas or speculative overheating districts are causing harm to innocent actual buyers. This is because situations vary greatly depending on the construction period and complex size even within the same area. For example, in Suwon’s Gwonseon-gu, apartments in newly developed housing districts have seen price increases of over 100 million KRW in recent months, but older apartments built in the 1990s nearby have seen almost no price changes during the same period. If the entire Gwonseon-gu is designated as a regulated area, local real estate agencies worry that tightened loan regulations will suppress demand even for low-priced housing by actual buyers.

Some criticize that with no clear real estate policy control tower, the government focuses solely on 'house prices' and the ruling party on 'votes,' resulting in the complete disappearance of mid- to long-term housing policies looking 10 to 20 years ahead.

Kwon Daejung, professor of real estate at Myongji University, said, "With the general election approaching, I think the government will announce an extensively expanded regulated area as a 'showcase' regulation. Since no new supply measures are coming out, there is a high possibility that another balloon effect will appear."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.