Shinhan and KB Kookmin Card Actively

Existing Overseas Subsidiaries Also Turned Profitable

[Asia Economy Reporter Ki Ha-young] Major domestic card companies are intensifying their efforts to target new southern markets such as Cambodia, Vietnam, and Indonesia. Overseas subsidiaries that had previously entered these markets are also turning profitable, raising expectations for improved profitability.

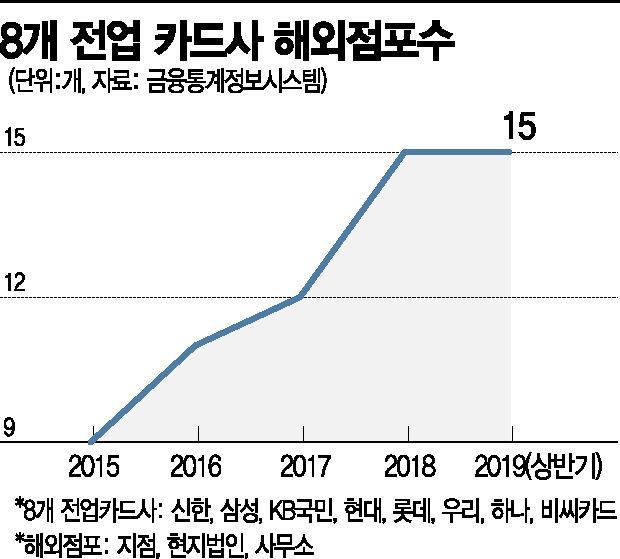

According to the Financial Supervisory Service's Financial Statistics Information System on the 18th, the number of overseas branches of eight specialized card companies (Shinhan, Samsung, KB Kookmin, Hyundai, Lotte, Woori, Hana, and BC Card) stood at 15 as of the first half of last year. Overseas branches include branches, local subsidiaries, and offices. The number of overseas branches, which was only nine in 2015, increased by about 67% in four years. This year, KB Kookmin Card and Hyundai Card are also preparing to launch overseas branches in Indonesia and Vietnam.

The most active companies are Shinhan Card and KB Kookmin Card. Shinhan Card posted profits in all four overseas subsidiaries in Vietnam, Myanmar, Indonesia, and Kazakhstan through the third quarter of last year. Shinhan Vietnam Finance (SVFC), launched by Shinhan Card last year, recorded a cumulative net profit of 12.338 billion KRW by the third quarter of last year. Shinhan Finance LLC in Kazakhstan and Shinhan Microfinance, which handles microloans (microfinance, MFI) in Myanmar, also achieved profitability. Shinhan India Finance, which was in deficit in 2018, also turned profitable last year.

KB Kookmin Card plans to launch 'PT Finansia Multi Finance,' an Indonesian credit finance company it acquired last year, as an overseas subsidiary this year. On the 10th, it also opened its first overseas branch, 'KB Daehan Special Bank (KDSB) Sen Sok Branch,' in Phnom Penh, Cambodia. As a result, it now has a total of four overseas business infrastructures in three countries?Cambodia, Laos, and Myanmar?including two local subsidiaries, one branch, and one representative office. KB Daehan Special Bank, a local subsidiary established in Cambodia in 2018, succeeded in turning profitable within 10 months of operation and posted a net income of $290,000 (about 344 million KRW) as of the third quarter of last year.

Woori Card's Myanmar local subsidiary, Tutu Finance, also maintained a profit trend from last year, recording a cumulative net profit of 1.707 billion KRW as of the third quarter of last year.

Lotte Card launched its local subsidiary Lotte Finance in Vietnam in December 2018, becoming the first domestic card company to enter the Vietnamese market. Hyundai Card signed a contract in October last year to acquire a 50% stake in Vietnamese consumer finance company 'FCCOM' for 49 billion KRW. After completing the stock acquisition and approval procedures from Korean and Vietnamese financial authorities this year, it plans to fully launch operations in the second half of the year.

BC Card, which has been collaborating with Indonesia's state-owned bank Mandiri Bank since 2014, officially started services in Indonesia last year. Recently, it has also been pursuing collaboration with Lien Viet Post Bank, which exclusively operates the Vietnam Post network.

An industry insider said, "Card companies are diversifying their revenue streams amid merchant fee reductions by expanding overseas. Since the economies of new southern countries are expected to continue growing, the entry of card companies is expected to accelerate."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)