CEO Final Candidate Confirmed as Executive Vice President Kang Seong-su, Head of Business Division

[Asia Economy Reporter Oh Hyung-gil] Hanwha General Insurance, which has returned to a deficit after six years and is facing a management crisis, has chosen a 'financial expert savior.' Attention is focused on whether it can lay the groundwork for business normalization amid sluggish industry conditions.

According to the insurance industry on the 18th, Hanwha General Insurance decided on Kang Sung-soo, Executive Vice President in charge of business, as the final CEO candidate at the executive candidate recommendation committee held at the end of last month. Kang is expected to be appointed president at the board of directors and shareholders' meeting next month.

With Park Yoon-sik, who led Hanwha General Insurance through three consecutive terms since 2013, stepping down, it is expected that the generational shift within Hanwha Financial affiliates will continue following Cha Nam-kyu, Vice Chairman of Hanwha Life Insurance.

Born in 1964, Kang is considered a 'young blood' even in the non-life insurance industry. Except for Choi Won-jin, President of Lotte Insurance (born 1973), appointed last October, he is the youngest. The industry evaluates that he will demonstrate management capabilities aligned with the rapidly changing insurance market trends brought by the emergence of InsurTech (a combination of insurance and technology).

Kang graduated from Seoul National University with a degree in economics. After joining Hanwha Securities in 1988, he worked at Hanwha Construction and served as an executive in charge of management planning in the trade and explosives divisions. From 2016 to 2018, he was the executive director in charge of finance at Hanwha General Insurance and served as Vice President in charge of finance at Hanwha Holdings' management division until last year. He is a financial expert who returned to Hanwha General Insurance as Vice President earlier this year, signaling a change in the presidency.

The recommendation committee stated, "Kang is a financial strategy expert with abundant experience and insight. Considering his knowledge and experience in the financial industry accumulated while working at Hanwha Securities and Hanwha General Insurance, he has sufficient experience and capability to perform the CEO role."

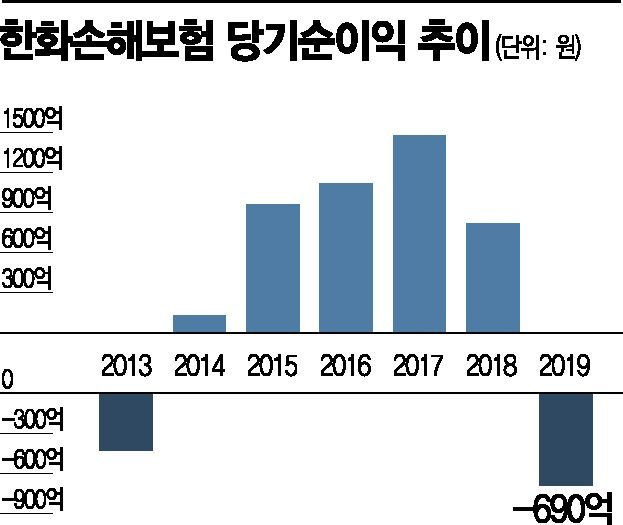

The most urgent task Kang must address is improving the financial structure. Last year, Hanwha General Insurance posted its worst performance. Net income turned to a deficit, decreasing by a staggering 150 billion KRW compared to the previous year. Losses in the insurance sector increased significantly due to rising loss ratios in automobile insurance and indemnity insurance. This is a sharp decline in performance even considering the structural downturn in the non-life insurance industry.

In 2018, although the insurance sales division recorded a loss of 367.4 billion KRW, it was offset by a profit of 489.6 billion KRW in the investment sales division, showing a significant difference from the current situation.

Especially, Hanwha General Insurance was included in the Financial Supervisory Service's management supervision list earlier this year and submitted a management improvement plan at the beginning of this month. The plan is to improve the insurance portfolio and reduce the loss ratio through precise underwriting.

Last month, it was excluded from the financial authorities' guideline to raise indemnity insurance premiums by single digits and instead implemented a double-digit increase. Internally, it has also started tight management by significantly reducing the number of executives in the recent regular personnel reshuffle.

Being included in the management supervision list requires regular reporting of management status to the Financial Supervisory Service and undergoing inspections to check whether improvement measures are properly implemented. If management improvement is not achieved, corrective actions may be taken promptly, including disciplinary actions against executives and employees and restrictions on new business entries.

A Hanwha General Insurance official said, "We are managing loss ratios and reducing business expenses according to the management improvement plan to secure a balance between sales and profits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)