Three-Year Renewal Season Starting This Year

Growth in Store Numbers Difficult Due to Store Opening Restrictions

Racing to Strengthen Win-Win Support Systems

[Asia Economy Reporter Lim Hye-seon] The war to 'protect franchise store owners' among convenience store companies has begun. Starting this year, a renewal season for more than 10,000 franchise stores will commence over the next three years. Due to regulations such as restrictions on new store openings, it is becoming difficult to expand in size through new stores, and fierce competition over store signs in the convenience store industry is expected to intensify.

According to the distribution and securities industries on the 14th, about 2,900 to 3,000 franchise stores will have contracts expiring this year. Next year, about 3,600, and in 2022, about 4,200 stores will come up for renewal, resulting in a large volume of approximately 10,800 stores entering the market over the next three years. The number of convenience stores in Korea surged between 2015 and 2017. While there were 23,888 convenience stores in 2012, the number increased to 35,000 by 2017. Considering that the typical contract period for convenience stores is five years, stores that opened during that period will sequentially enter the renewal season starting this year. A convenience store industry official explained, "In fact, less than 10% of store owners change their store signs, so it is more important to prepare to maintain the stores."

At the beginning of this year, convenience store headquarters rushed to strengthen their win-win support systems. GS Retail decided to lower the collateral amount for renewing franchise stores. In areas with poor sales, they support promotional costs for store owners, and established a system allowing store owners to request days off from headquarters on holidays and during personal events such as family occasions. They also expanded insurance coverage for parcel embezzlement to reduce operational risks for franchise stores. GS Retail prepared an additional budget of 20 billion KRW for win-win support funds on top of the 130 billion KRW provided last year for the newly established win-win system.

CU has decided to reduce or waive penalties for franchise owners who terminate contracts early starting this year. They also extended the initial stabilization period and, as part of franchise owner welfare, offer overseas distribution tours, operate a welfare mall, and support corporate condos. They newly introduced comprehensive consultation services covering labor, legal, and tax issues. Seven Eleven will fully cover the costs of about 30 equipment parts that were previously shared between franchise stores and headquarters. The support rate for discarded ready-to-eat meals has also increased from 20% to 40%. Additionally, if the sales rate of roasted sweet potatoes exceeds 50%, they provide up to 20% support for disposal costs.

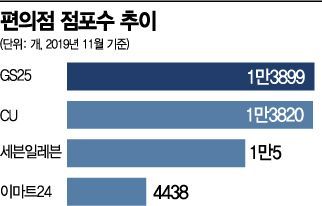

The industry expects GS Retail (GS25) and BGF Retail (CU) to maintain an advantage in the signboard competition starting this year. This is due not only to the benefits offered to franchise owners but also to their high sales per store. As of November last year, GS25 had 13,899 stores, and CU had 13,820 stores. The average sales per store were 507 million KRW and 449 million KRW, respectively. They also execute support funds amounting to about 40 billion KRW annually due to minimum wage increases. Park Jong-dae, a researcher at Hana Financial Investment, said, "Convenience store headquarters are now focusing on improving existing franchise store growth through product improvements and various new services rather than vague external expansion," adding, "They will fiercely compete by providing various benefits to franchise stores."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.