Worst Performance, Closing 200 Stores

Reborn as a Service Company, Launch of Lotte ON

"We will not tolerate 'mediocrity'." This was the resolute message delivered by Shin Dong-bin, Chairman of Lotte Group, at the first executive meeting (VCM) of the new year on the 15th of last month. He judged that failure to respond to change could threaten corporate survival. A month later, Kang Hee-tae, Vice Chairman of Lotte Shopping (Head of Distribution BU), announced a tough restructuring plan, stating, "I will take responsibility and make decisions." The role of calming employee unrest was entrusted to each division head. Moon Young-pyo, CEO of Lotte Mart, conveyed in a message to employees on the 14th that "we can no longer postpone structural reform" and urged, "Please do not waver, as we are making efforts with a desperate mindset that this is the last chance for the future."

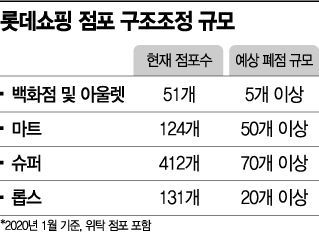

◆Worst Performance, Reducing Over 200 Stores=Lotte Group decided to first cut into its distribution sector. Since Lotte Shopping, the driving force that raised Lotte Group to the 5th largest conglomerate in Korea, is shaking, the crisis could spread to the entire group. Lotte Shopping will close more than 200 stores (30%) out of a total of 718 stores including department stores, marts, supermarkets, and LOHB's, which are underperforming in profitability. This is the largest scale restructuring since its founding in 1979. Vice Chairman Kang pointed out, "We failed to strategically respond to the rapidly changing offline environment."

Last year, Lotte Shopping recorded an operating profit of 427.9 billion KRW, a 28.3% decrease compared to 2018. Sales fell by 1.1% to 17.6328 trillion KRW. Looking at the fourth quarter alone, operating profit plunged 51.8% year-on-year to only 43.6 billion KRW.

The net loss was 853.6 billion KRW, more than doubling the deficit from the previous year. In the fourth quarter alone, a net loss of 1.0164 trillion KRW was recorded. Particularly, discount stores (marts) and supermarkets underperformed. Marts turned to an operating loss of 24.8 billion KRW last year. Supermarkets recorded an operating loss of 103.8 billion KRW, dragging performance down.

The restructuring criterion is 'profit and loss.' Chairman Kang explained during a conference call on the 13th, "More than 80% of unprofitable stores are leased stores," and "If they do not reach an appropriate EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), they will be subject to closure."

Supermarkets and marts will close stores first. Corporate supermarkets like Lotte Super have effectively stagnated growth due to strengthened regulations protecting neighborhood businesses. Out of 412 stores nationwide, more than 70 are expected to close. Unprofitable local stores will be prioritized for closure. Large marts like Lotte Mart will close at least 30% of their 124 stores. Health and beauty stores LOHB's will reduce 20 out of 131 stores first. Department stores have already closed about 10 stores deemed uncompetitive and plan to close 1-2 more unprofitable local stores.

Workforce restructuring is also inevitable. Voluntary and honorary retirement programs are expected to be implemented targeting mid-level managers. A Lotte Group official said, "Honorary Chairman Shin Kyuk-ho used to say that if management reached the point of firing employees, the top executives should resign first," adding, "Workforce restructuring is the last card, but we will choose the best method for survival."

◆What’s Next for Lotte Shopping=Lotte Shopping presented a future business blueprint to transform from a 'distribution company' to a 'service company' proposing lifestyle solutions. They plan to reorganize a total of 1 million pyeong (approx. 3.3 million sq ft) of offline space into stores that cross the boundaries of business types. Food sections in small and medium-sized department stores with low competitiveness will be replaced by supermarkets with fresh food competitiveness, and the fashion zones in marts will be planned by department store fashion buyers who have purchasing power for various brands.

Alongside this, they will focus on online business as a new growth engine. Lotte Shopping plans to launch an integrated online shopping mall, 'Lotte ON,' encompassing distribution affiliates as early as the end of next month. In the first phase, department stores, marts, supermarkets, and LOHB's will be integrated. Home shopping and Hi-Mart will also be operated together on Lotte ON. Utilizing Lotte’s 39 million customer data, all customer product behavior information will be integrated and analyzed, combining the strengths of offline and e-commerce to provide personalized services to each customer. It features AI-based analysis systems to suggest customized products for individuals.

Vice Chairman Kang said, "It was regrettable that Lotte failed to integrate and utilize its distribution resources according to the trends of the times," and added, "We will complement the strengths of department stores, marts, supermarkets, and LOHB's to establish efficient strategies."

◆Is Restructuring Starting in the Distribution Industry?=There are opinions that Lotte Shopping’s restructuring could be a signal for restructuring across the distribution industry. Emart, struggling with worsening profitability, is also downsizing. After recording its first deficit since its founding in the second quarter of last year and a second deficit in the fourth quarter, Emart is undertaking a major structural reform. Emart’s operating profit last year was 150.7 billion KRW, down 67.4% from the previous year. Sales increased by 11.8% to 19.0629 trillion KRW, but net profit decreased by 53.2% to 223.8 billion KRW.

Accordingly, Emart is making a large-scale investment of 845 billion KRW this year to lay the foundation for a rebound. First, 260 billion KRW will be invested in store renovations. They plan to renew 30% of their 140 existing stores this year to enhance store competitiveness and secure profitability.

Emart Wolgye store, which already started renovation last year, is transforming into a complex shopping mall by strengthening grocery and specialty restaurant areas. Future store renovations at Chuncheon and Gangneung stores will also be carried out in a way that departs from the traditional discount store image. An Emart official explained, "The renovation focuses on strengthening groceries by stocking small items not usually sold in general marts, diversifying product types, and improving freshness."

The remaining investment will be used for upgrading the online business SSG.com and opening new stores for the complex shopping mall Starfield and Emart Traders. Through these structural reforms, Emart plans to increase sales by more than 10% this year and surpass consolidated sales of 21 trillion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.