[Asia Economy Reporter Lee Chun-hee] Experts analyzed that while the tax burden could increase by up to 50% this year due to the rise in the official land price, concerns about gentrification (displacement of tenants) are expected to be low.

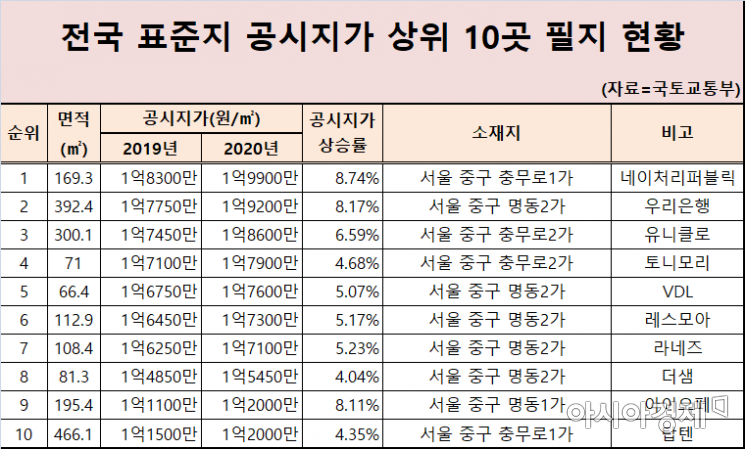

The Ministry of Land, Infrastructure and Transport announced on the 12th that it will disclose the prices of 500,000 standard land parcels as of the 1st of last month on the 13th. According to the ministry, the nationwide official land price change rate this year is 6.33%, which is 3.09 percentage points lower than last year's 9.42%. However, it is somewhat higher compared to the average change rate over the past 10 years (4.68%).

Park Won-gap, Senior Real Estate Specialist at KB Kookmin Bank, analyzed, "The increase rate was lower than last year, so the rise was localized mainly in areas with planned development or high investment demand." He added, "In Seoul, the Gangnam area and adjacent districts such as Seongdong and Dongjak showed relatively high increase rates. Especially, districts with active new town projects and redevelopment like Dongdaemun, Nowon, Seodaemun, and Geumcheon had higher increase rates than the previous year." The overall official land price increase rate in Seoul this year is 7.89%. Among them, only Seongdong-gu (11.16%) and Gangnam-gu (10.54%) showed an increase exceeding 10%.

Ham Young-jin, Head of the Big Data Lab at Zigbang, forecasted, "With the realization rate rising, the property tax burden (property tax and comprehensive real estate tax) on landowners in urban areas will increase compared to the past." He added, "Although the increase in property tax burden is limited to within 50% compared to the previous year and land tax rates have not been raised, so the shock may be less, the tax burden will not be insignificant in areas where the official land price increase or realization rate is high locally."

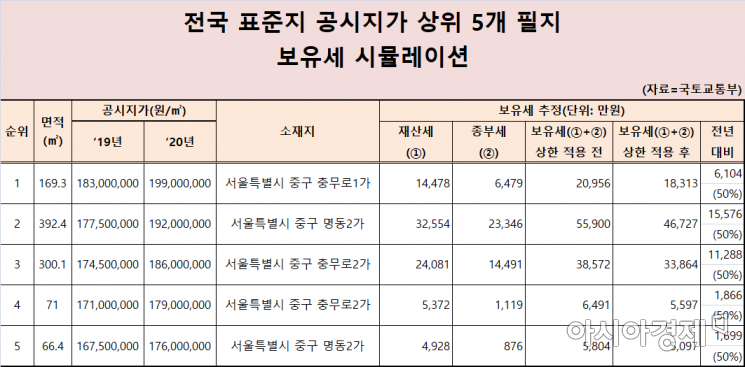

In fact, a simulation by the Ministry of Land, Infrastructure and Transport reflecting this year's official land price increase showed that the property tax burden for the top five land parcels nationwide all reached the upper limit.

The owner of the Nature Republic site in Chungmuro 1-ga, Jung-gu, Seoul, assuming ownership of only this land, must pay 183.13 million KRW in property tax this year. Considering the official land price increase, it should rise to 209.56 million KRW, but the 50% cap on property tax increase applies, resulting in an increase of only 61.04 million KRW compared to the previous year. The official land price per square meter of this site approaches 200 million KRW, making it the most expensive standard land nationwide. The total official land price of the entire site is 33.6907 billion KRW.

The same applies elsewhere. The owner of the 392.4㎡ site in Myeong-dong 2-ga, where Woori Bank Myeongdong Financial Center is located and ranked second nationwide, must pay 467.27 million KRW in taxes this year. Although the property tax should have been 559 million KRW, the 50% cap reduced the burden by about 100 million KRW. Nevertheless, the tax amount to be paid still increases by 155.76 million KRW.

Whether this increase in property tax burden will be passed on to tenants is a key issue. Ham said, "The increase rate for commercial land is 5.33%, which is half of last year's 12.38%," adding, "It is limited to say that concerns about the property tax burden on separately aggregated land leading to tenant gentrification or rent pass-through have been completely resolved." Separately aggregated land such as commercial and office accessory land is subject to comprehensive real estate tax if the total official land price exceeds 8 billion KRW.

Sun Jong-pil, CEO of Sangga News Radar, said, "If the domestic market and commercial district economy are good, there could be cases where the burden is passed on to tenants, but the current situation is not like that," predicting that the passing on of tax burden to tenants will not become widespread. He analyzed, "Due to the nature of commercial properties, continuous income is flowing in, and since the property tax increase is not at a comprehensive level, a fire sale phenomenon is unlikely."

However, Sun added, "Since the property tax burden due to the official land price increase is based on the land share, fire sales may occur in underground or second-floor commercial properties, which have lower profitability compared to the first floor."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.