Korea Economic Research Institute Calculates Decline Rate of Total Money Velocity in 2018

Money Velocity↓, Economic Vitality↓... "Need for Changes in Business Environment"

[Asia Economy Reporter Dongwoo Lee] A recent study revealed that South Korea has the fastest decline rate in the velocity of money circulation among major OECD countries. This indicates that money circulates slowly in the market, weakening economic vitality and leading to lower growth and inflation rates. Consequently, there are calls for the government to address the stagnation of money flow in the Korean economy through corporate-friendly policies such as easing corporate tax burdens and strengthening tax incentives for research and development (R&D).

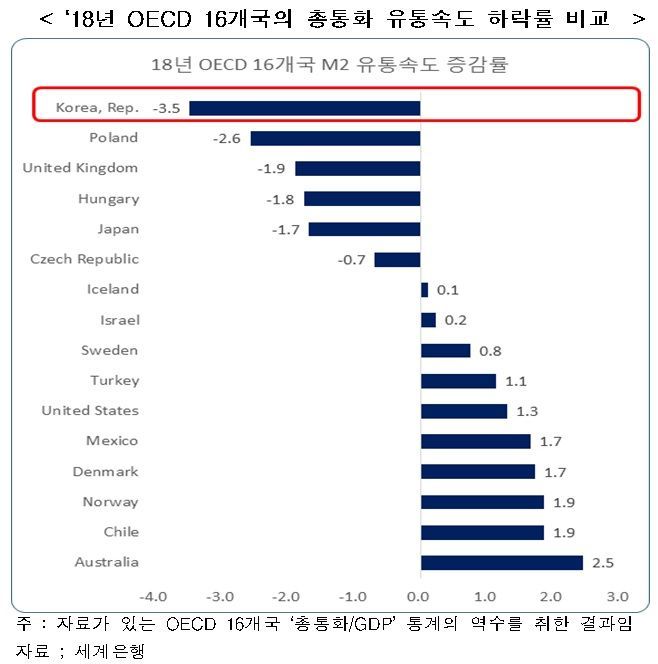

The Korea Economic Research Institute (KERI), under the Federation of Korean Industries, announced on the 9th that based on World Bank statistics, it calculated the decline rate of the total money velocity in 16 OECD countries with available data for 2018, finding that South Korea’s decline rate was the fastest among these countries.

KERI measured the velocity of money circulation by dividing nominal GDP by the money supply, and found that the velocity of total money (M2) showed a continuous downward trend from 0.98 in 2004 to 0.72 in 2018. As of 2018, South Korea exhibited the most pronounced symptoms of so-called money flow stagnation.

KERI emphasized that low growth rates and consumer price inflation are the causes of the decline in money velocity. Through time-series and cross-sectional analyses of the relationship between total money velocity, growth rates, and consumer price inflation, KERI explained that growth rates and consumer price inflation move in tandem with the speed at which money circulates in the market. Higher growth and inflation rates accelerate money turnover, whereas low growth and low inflation slow it down.

In fact, KERI’s analysis of monthly data from January 2001 to November 2019 on the effects of GDP, consumer prices, market interest rates, and total money on velocity showed that total money velocity increased by 1.3% when GDP rose by 1%, and by 0.8% when consumer price inflation rose by 1 percentage point. Conversely, when the CD interest rate increased by 1 percentage point compared to the previous year, velocity slowed by 2.2%, and when total money (M2) increased by 1%, velocity declined by 0.96%.

The analysis suggested that higher income levels lead to faster velocity because as income rises, people prefer credit payments over cash, reducing the demand for holding money and increasing circulation speed. The positive impact of inflation on money velocity is explained by the fact that in economies with higher inflation, the demand for holding money decreases, speeding up money circulation, according to KERI. Meanwhile, rising bank deposit interest rates increase deposit holdings and total money supply, which acts as a factor lowering velocity.

KERI stressed that although the downward trend in total money velocity is observed in several countries, it is important to note that South Korea’s decline rate in 2018 was the steepest among the 16 OECD countries. For example, Iceland, which showed an upward trend in growth rates, also exhibited an increase in total money velocity.

KERI argued that if low growth and low inflation persist due to declining economic vitality, the fundamental strength of the economy could be depleted. To escape the stagnation phase of low growth and low inflation, KERI emphasized the need for corporate-focused policies such as easing corporate tax burdens, strengthening tax incentives for investment and R&D, establishing a flexible labor market, and reforming various regulations.

Choo Kwang-ho, Director of the Job Strategy Office at KERI, stated, "The fact that the speed at which money circulates in the market ranks last among 16 OECD countries means that the strength of our economy has significantly weakened," adding, "We must revive economic vitality by improving tax systems, labor markets, and various regulations in a corporate-friendly manner."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.