A Savings Bank's Loan Execution Rate Last Year 6%

Down 0.7 Percentage Points in One Year

Regulations Including Legal Maximum Interest Rate Reduction

Savings Banks Reduce Loans to Manage Costs

Borrowing from Loan Businesses Also Not Easy

[Asia Economy Reporter Kim Min-young] As the loan thresholds of savings banks and lending companies rise, it has become increasingly difficult for ordinary people to borrow money. Low-credit borrowers are being rejected even by lending companies, the last bastion of the formal financial sector, and are being pushed into the high-interest illegal private loan market. There are calls to improve the supply conditions of policy-based financial services for ordinary people to block the ‘balloon effect’ flowing into illegal private loans.

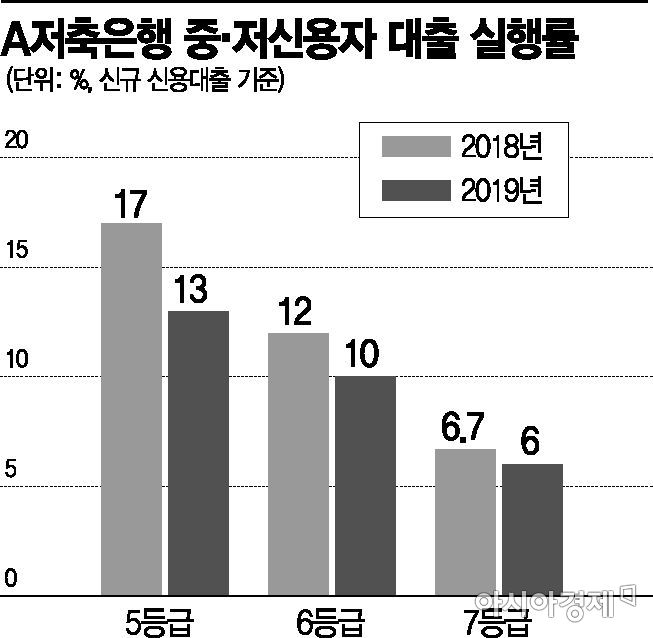

According to financial authorities and the savings bank industry on the 3rd, the loan execution rate for borrowers with a credit rating of 7 at a major savings bank last year was only 6%. This is a 0.7 percentage point drop from 6.7% in 2018, a year earlier. The loan execution rate refers to the percentage of new credit loan applications that actually result in loans being issued. In other words, out of 100 loan applicants, only 6 were able to borrow money.

During the same period, the execution rates for borrowers with credit ratings of 5 and 6 also fell from 17% to 13% and from 12% to 10%, respectively.

This is attributed to various regulations, including the reduction of the legal maximum interest rate. The government lowered the maximum interest rate to 24% per annum in February 2018. The maximum interest rate, which had reached 49% per annum in 2007, was reduced to less than half over about 10 years, and the rate of 27.9% in 2016 was adjusted downward by 3.9 percentage points again within two years.

Savings banks, which used to make money from the interest margin between loan rates and deposit rates, have reduced lending and taken cost management measures as the upper limit on loan interest rates decreased, causing hardship for ordinary people in urgent need of money.

Additionally, last year, the total debt service ratio (DSR) was applied to the industry, and this year, new loan-to-deposit ratio regulations (the ratio of loan balances to deposit balances in banks) were introduced, making household loans from savings banks even stricter.

A representative from the savings bank industry said, “The proportion of high-interest loans in the household credit loan sector sharply declined last year,” adding, “Loans are not given to low-credit borrowers at all.” In fact, among the 15 major savings banks, only three provided loans to borrowers with credit ratings of 9 to 10. Even then, loans were reportedly only issued when refinancing from high-interest loans with rates above 20% from lending companies.

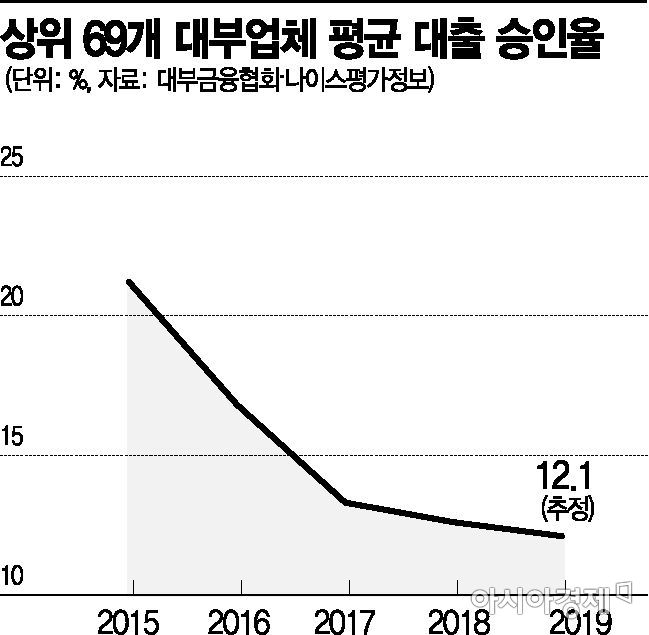

It is not easy to borrow money even in the ‘last bastion’ lending market. According to the Korea Financial Investment Association, the scale of new loans by the top 69 lending companies shrank from 7.1096 trillion won in 2015 to an estimated 4.1817 trillion won last year. The number of new borrowers also decreased from 1.15 million in 2015 to an estimated 555,000 last year, halving in four years.

The new loan approval rate also plummeted from 21.2% in 2015 to 12.1% last year, about half. The industry expects loan reductions to continue this year. The industry’s number one Sanwa Lending and number four Joicredit Lending have completely stopped issuing new loans.

Ultimately, ordinary people in urgent need of funds are being driven to illegal private loans. According to the Financial Supervisory Service, the scale of illegal private loan usage was about 7.1 trillion won at the end of 2018, with approximately 410,000 people using illegal private loans annually. Although the number of users decreased by about 108,000 compared to 2017, the proportion of vulnerable groups such as the elderly aged 60 and over surged from 26.8% to 41.1%. Housewives classified as low-credit borrowers also jumped from 12.7% to 22.9%.

To break the chain of illegal private loans, there is a view that the only way is to ease the constraints on savings banks and lending companies. Professor Kim Sang-bong of Hansung University’s Department of Economics said, “The maximum interest rate has been lowered too quickly to a level that financial companies cannot bear,” adding, “Allowing them to reduce funding costs and, in the case of lending companies, lifting the ban on public bond issuance or enabling them to borrow from banks to operate will increase approval rates.” For savings banks, restrictions on mergers and acquisitions (M&A), business rights regulations, and deposit insurance fees are representative regulatory items.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.