IF General Assembly Opens Today in Paris, France

Domestic Companies Including Samsung Show Interest Following Provisional Agreement on Digital Tax

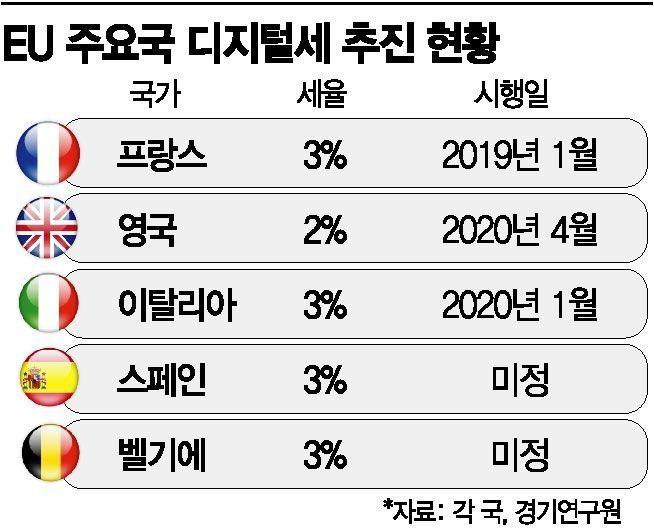

[Asia Economy Reporter Kim Min-young] The government and major domestic companies are closely monitoring the outcome of the digital tax agreement to be discussed at the Inclusive Framework (IF) General Assembly held in France on the 29th and 30th (local time). If a provisional conclusion is reached to impose digital tax not only on IT companies but also on multinational manufacturing companies such as smartphone makers, major Korean conglomerates like Samsung Electronics and Hyundai Motor Company will become subject to the digital tax. Although there are views that reaching an agreement will not be easy due to the conflict between the U.S. and Europe over the digital tax and the difficulty of 136 countries speaking with one voice, Korea plans to prepare measures such as preventing double taxation depending on the results of this meeting.

According to the Ministry of Economy and Finance on the 29th (Korean time), the Organisation for Economic Co-operation and Development (OECD) will seek an agreement to draft the digital tax at the IF General Assembly held in Paris, France, from today until the 30th. From Korea, Ko Gwang-hyo, Director-General of Income and Corporate Tax Policy at the Ministry of Economy and Finance’s Tax Policy Bureau (at the director level), along with two ministry officials, will attend to convey the government’s position.

At this General Assembly, the 136 countries, including OECD member and non-member countries, will discuss whether to limit the digital tax to IT companies such as Google and Facebook or to also impose it on multinational manufacturing companies targeting consumers, such as smartphone and automobile manufacturers. Attention is focused on what conclusion the OECD will reach amid the coexistence of an integrated approach that views not only IT companies but also multinational manufacturers as digital tax subjects and the strengthened consumer country taxation right logic that the country where the final product is consumed and sales occur should have the taxing rights.

Korea established a Digital Response Team within the Ministry of Economy and Finance’s Tax Policy Bureau last year in preparation for the possibility that the scope of digital tax subjects might expand to global manufacturing companies. In September, a public-private task force (TF) was also formed, including the National Tax Service, the Korea Institute of Public Finance, and related companies. Before attending OECD public hearings on the integrated approach and minimum tax held in November and December last year, the Ministry of Economy and Finance held two private meetings with related companies such as Samsung Electronics to listen to their opinions. Participating companies reportedly expressed concerns such as the "specificity of smartphone manufacturers" and "concerns about imposing digital tax on multinational manufacturers." The Ministry compiled the companies’ suggestions and the discussions of the public-private TF and conveyed them to the OECD. This month, ahead of the General Assembly, another private meeting was held with companies to explain the key issues regarding the digital tax and share trends from various countries.

Companies are also paying close attention to the results of the General Assembly, as their tax burdens could increase depending on the agreement reached. A Ministry of Economy and Finance official said, "The number of companies attending the meetings, recommended by the Korea Chamber of Commerce and Industry, the Digital Enterprise Association, and the Korea Game Industry Association, is steadily increasing," adding, "More than ten companies participated in the recent meeting."

The government expects that even if a provisional agreement on the digital tax is reached at this General Assembly, it will take 3 to 4 years to complete detailed implementation work such as drafting the report containing the agreement and to actually impose the digital tax. The government plans to focus on minimizing the total tax burden on Korean companies by responding to OECD movements regarding the definition of taxable companies, excess profit allocation, and the introduction of a global minimum tax, including signing treaties to prevent double taxation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)