Park Young-sun, Minister of SMEs and Startups, "Will Analyze and Announce Outcomes Such as Employment in Venture Investment Companies"

Angel Investment in 2018 Reaches 553.8 Billion KRW, Surpassing Records from the First Venture Boom in 18 Years

Minister Park Young-sun of the Ministry of SMEs and Startups announced the 2019 venture investment and 2018 angel investment performance, as well as the 2020 mother fund contribution plan at the Government Seoul Office Annex in Jongno-gu, Seoul on the 29th. Photo by Kim Hyun-min kimhyun81@

Minister Park Young-sun of the Ministry of SMEs and Startups announced the 2019 venture investment and 2018 angel investment performance, as well as the 2020 mother fund contribution plan at the Government Seoul Office Annex in Jongno-gu, Seoul on the 29th. Photo by Kim Hyun-min kimhyun81@

[Asia Economy Reporter Kim Cheol-hyun] Last year, venture investment in South Korea surpassed 4 trillion won for the first time in history. The number of invested companies, investment size per company, and investments in the Fourth Industrial Revolution sectors all showed an upward trend, placing the country among the top four globally in terms of venture investment relative to Gross Domestic Product (GDP). The Ministry of SMEs and Startups (Minister Park Young-sun, hereinafter referred to as the Ministry), the Korea Venture Capital Association (Chairman Jung Sung-in), and the Korea Angel Investment Association (Chairman Ko Young-ha) announced the '2019 Venture Investment and 2018 Angel Investment Performance' on the 29th, revealing these results.

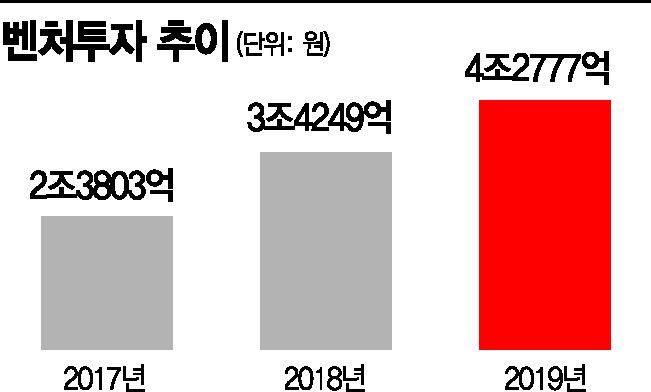

Last year, venture investment reached 4.2777 trillion won, a 25% increase from 3.4249 trillion won the previous year, marking the first time it exceeded 4 trillion won. Looking at the trend over the past three years, the figures have risen sharply enough to change by trillions each year, increasing 1.8 times in two years compared to 2017. Angel investment also recorded 553.8 billion won in 2018, surpassing the 549.3 billion won angel investment amount during the first venture boom in 2000, which had remained unbroken for 18 years.

◆The Era of 4 Trillion Won Venture Investment Begins = The increase in venture investment is analyzed to be due to the recent spread of the 'Second Venture Boom,' mainly driven by the private sector. Last year, 35% of the venture investment amount came from pure private funds, and this trend has steadily increased. This indicates that the private sector is actively participating in investments, driving the venture boom.

With the increase in venture investment last year, the ratio of venture investment to GDP, a comparative indicator by country, rose to 0.22%, entering the top four behind the United States, Israel, and China. The number of companies receiving venture investment increased by 15%, from 1,399 the previous year to 1,608. This is evaluated as an environment where more startups can attract venture investment. Not only the number of invested companies but also the average investment size per company increased by more than 200 million won, from 2.4481 billion won in 2018 to 2.66026 billion won last year, showing a trend toward larger investments. In particular, the number of companies attracting large investments of over 10 billion won increased by 33% from 51 to 68, and among them, companies attracting investments exceeding 20 billion won reached 22, doubling annually since 2017. DND Pharmatech, a bio company, attracted 83 billion won last year, becoming the first company to attract over 50 billion won in a single year.

Investments in Fourth Industrial Revolution sectors such as healthcare and artificial intelligence (AI) amounted to 1.706 trillion won, a 27% increase compared to 2018, accounting for about 40% of total investments. By sector, smart healthcare led with 617.2 billion won, followed by the sharing economy (276.1 billion won), AI (225.8 billion won), fintech (120.7 billion won), and big data (90.1 billion won). The amount individuals invested indirectly by contributing to venture funds, in addition to angel investments, nearly doubled to 571 billion won compared to the previous year. The proportion of individual participation in total funds increased from 6.2% to 13.9%, up by 7.7 percentage points, indicating growing individual involvement in venture funds. Although the total amount of venture fund formations slightly decreased to 4.1105 trillion won compared to last year, it still maintained the 4 trillion won level.

◆Venture Investment Growth Expected to Continue This Year = The upward trend in venture investment is expected to continue this year. According to a survey conducted by the Korea Venture Capital Association among 107 member companies, planned venture investments for this year are around 4.6 trillion won. Considering that the government’s mother fund budget has more than doubled to 1.1065 trillion won across all ministries compared to last year, the scale of fund formation is expected to increase, leading to even larger investment volumes this year.

On this day, the Ministry also announced this year’s mother fund contribution plan. This year, a total of 900 billion won will be contributed, combining the largest-ever budget of 800 billion won and recovered funds, aiming to form funds worth 1.9 trillion won based on this. Minister Park Young-sun stated, "The contribution areas will be balanced to cover not only the startup phase but also the subsequent leap phases, establishing a detailed growth support system that enables startups to grow into unicorns."

First, more than half of the contribution funds, 520 billion won (58%), will be used to create a 920 billion won fund focused on early-stage startups, supporting startup incubation in areas such as early-stage startups, youth entrepreneurship, regional development, and women entrepreneurs. Especially, investments in the 'scale-up' area will be concentrated to help growing startups leap into unicorn status. To this end, the remaining 380 billion won will be invested to form a 950 billion won 'Jump-Up Fund.'

To further accelerate the venture investment momentum, following the mother fund contributions, the 'K-Unicorn' project and angel investment activation measures will be announced consecutively. The K-Unicorn project, to be announced in February, will include plans to identify and nurture potential unicorn companies intensively, facilitating their rapid growth into unicorns. To further revitalize the recently revived angel investment market, angel investment activation measures will be announced in March. These are expected to include plans for professional angel development and accelerator advancement. Additionally, the Ministry plans to promptly analyze and announce the outcomes such as employment generated by companies receiving venture investments.

Minister Park said, "The Ministry plans to promptly enact subordinate laws of the Venture Investment Promotion Act, which passed the National Assembly on January 9, to solidify the institutional foundation of the venture investment ecosystem," adding, "We will also promptly analyze and announce outcomes such as employment generated by companies receiving venture investments."

Meanwhile, Minister Park commented on the sale of Woowa Brothers, a representative 'exit' case for domestic startups, to Germany’s Delivery Hero, saying, "From the perspective of startups and the unicorn market, it should be viewed positively, but regarding small business owners and delivery fee increases, the Ministry is playing a mediating role." She emphasized, "Since these issues may continue to arise, we are creating an innovation governance system to coordinate both sides’ positions and plan to continue this role going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)