Lifting of Regulated Areas and Surge of Gap Investors Drive 12 Consecutive Weeks of Price Increases

[Asia Economy Reporter Donghyun Choi] Despite the widespread rise in housing prices across Seoul and the metropolitan area last year, apartment prices in the Ilsan New Town area of Gyeonggi-do, which had been sluggish, have been on an upward trend for 12 consecutive weeks. This delayed recovery in housing prices is attributed to regulatory easing following the removal of the adjustment area designation and the balloon effect caused by the December 16 real estate measures last year.

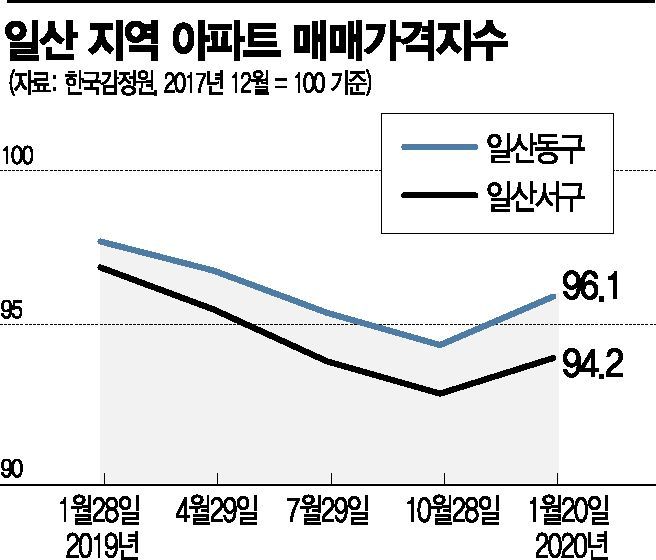

According to the weekly apartment price trends from the Korea Real Estate Board on the 29th, apartment prices in Ilsandong-gu, Goyang City, which includes Ilsan New Town, have risen for 12 consecutive weeks from November 4 last year to the 20th of this year. During this period, apartment prices in the area increased by an average of 1.27%. Ilsanseo-gu has also maintained an upward trend for 11 weeks (1.21%). Housing prices in Goyang City, which had been declining for 42 weeks (based on Ilsandong-gu) due to the influence of the 3rd New Town announced at the end of 2018, appear to have bottomed out and entered a full recovery phase after being removed from the adjustment area in November last year. With the removal of the adjustment area designation in Goyang City, it became possible to resell pre-sale rights six months after the sale, and the heavy capital gains tax (a flat 50%) on pre-sale right transactions was changed to general taxation based on the holding period, reducing the burden. Subscription eligibility was also expanded regardless of household head status or homeownership, and loan conditions were eased.

As a result, asking prices for apartment complexes with good locations such as transportation networks have risen by nearly 30 million to 50 million KRW within a month. An 84㎡ Hanla Apartment in Daehwa-dong (exclusive area) was traded at 330 million KRW (19th floor) in December last year. Compared to 297 million KRW (14th floor) two months earlier, this is a 33 million KRW increase. Currently, the asking price for this apartment has risen to around 350 million KRW. Similarly, a 134㎡ unit in Gangchon 3rd Complex Family Apartments in Madu-dong was actually traded at 605 million KRW on the 7th of last month. Currently, listings of the same size are registered on Naver Real Estate and other platforms at up to 650 million KRW. Compared to the 530 million KRW sale price in November last year, asking prices have risen by over 100 million KRW in two months. New apartments on the outskirts of the new town are also increasing in value. A 59㎡ unit in Ilsan Doosan We've the Zenith in Tanhyeon-dong was traded at 380 million KRW on the 20th. This is a 43.5 million KRW increase compared to a month ago, and currently, listings on Naver Real Estate and others show asking prices up to 420 million KRW. A representative of a brokerage in Tanhyeon-dong said, "With the removal of the adjustment area designation and the lifting of loan regulations, apartments that had not sold for a long time were quickly sold. During this process, several high-priced medium-to-large apartments were also traded."

Interest in the real estate market in this area has expanded further after the December 16 measures, according to local brokerage offices. This is the so-called balloon effect, where investors from Seoul, constrained by strict loan regulations and lacking funds, seek non-regulated areas. In particular, with news of the extension of the metropolitan area express railway (GTX) Line A (Ilsan~Suseo, Dongtan) and the 'Seohae Line (Daegok~Sosa Line) double-track railway' to Ilsan Station, many gap investors are flocking to station-area apartments around Daegok Station, Baengma Station, and Ilsan Station. Gap investment refers to investment aiming for capital gains by exploiting the difference between sale prices and jeonse (long-term deposit lease) prices. A brokerage official in Siksadong explained, "As sale prices rose sharply compared to jeonse prices, gap investment has become popular again. Popular complexes close to Seoul or with favorable metropolitan transportation networks have been swept up by Seoul investors or sellers have withdrawn their listings."

However, some argue that the recent housing price recovery may not be sustainable. The recent upward trend is seen as a delayed 'gap filling' phenomenon following the sharp rise in Seoul housing prices last year, and it is expected to decline once the supply of the 3rd New Town is in full swing. Professor Daejung Kwon of the Department of Real Estate at Myongji University predicted, "Ilsan has relatively few new apartments and has lower accessibility to Seoul compared to Goyang Changneung, designated as the 3rd New Town, so long-term price increases are difficult to expect."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)