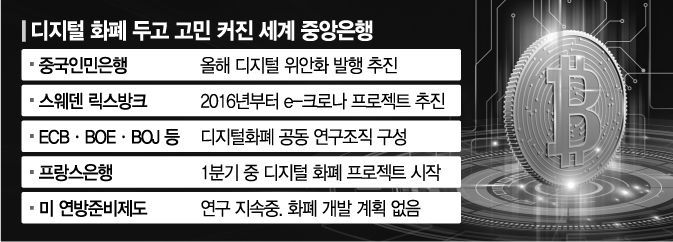

[Asia Economy Reporter Jeong Hyunjin] Digital currency has emerged as a 'hot issue' among central banks worldwide this year. Central banks around the world have begun to turn their attention to digital currencies based on blockchain technology. Following China and Sweden, which have already launched digital currency issuance projects, on the 21st (local time), the European Central Bank (ECB), Bank of England (BOE), Bank of Japan (BOJ), Bank of Canada, Sveriges Riksbank, and Swiss National Bank agreed to form a joint research group on 'Central Bank Digital Currency (CBDC).' According to the Bank for International Settlements (BIS), 70% of the world's 60 or so central banks are researching digital currencies.

◆ Shaken Central Banks... Grasping with CBDC? = Central banks began to focus on digital currencies after the 'private company' Facebook announced its virtual currency (cryptocurrency) project 'Libra' last year. Until then, many companies issued cryptocurrencies such as Bitcoin, but Libra clearly demonstrated the characteristics of currency as a means of transaction and store of value by linking to fiat currencies that exist physically.

From the perspective of central banks that oversee currency issuance and circulation, there was growing concern that the leadership of the financial market could be taken away by the private sector through digital currencies emerging from new technology development. The blockchain technology, the fundamental technology of digital currency, is characterized by distributing the bank's credit function to individuals. Along with the development of payment settlements and blockchain technology, cash usage is rapidly decreasing. Looking at China's Alipay, the influence of the private financial market has expanded.

Christine Lagarde, President of the ECB, said at the first monetary policy meeting after her inauguration last month regarding digital currency, "We must stand at the 'turning point'." She urged that as the sole institution issuing currency and leading monetary policy, central banks must make changes suitable for new technology.

The issuance and operation methods of CBDC are being discussed in various ways. China, preparing to issue digital currency this year, has announced that it will introduce a kind of substitute where physical yuan and digital currency are exchanged one-to-one through commercial banks. Also, methods such as the central bank directly creating and managing accounts for individuals and companies, excluding commercial banks, or charging small amounts to mobile devices are being considered.

Gita Gopinath, Chief Economist of the International Monetary Fund (IMF) and an expert in international monetary system analysis, recently said in an interview with Nihon Keizai Shimbun, "Digital currency has advantages such as reducing payment costs, but it enables households and companies to have deposit accounts directly with central banks," adding, "While central banks can easily adjust interest rates, the deposit and loan structure of commercial banks will be damaged, making a financial system upheaval inevitable."

◆ Fierce Hegemony Competition for Digital Reserve Currency Instead of Dollar = Another reason central banks are entering the digital currency market is to secure currency hegemony represented by the 'reserve currency.' The recent alliance of central banks such as the ECB, Japan, and Canada also signifies a challenge to the hegemony of the US dollar, which plays the role of the reserve currency.

Mark Carney, Governor of the BOE, proposed in August last year, "To absorb dollar exchange rate shocks, the global economy needs multiple reserve currencies," and suggested creating a "virtual reserve currency" through digital currency. The US Federal Reserve (Fed) and the House of Representatives blocked Libra's issuance to prevent a "challenge to the dollar." While the Fed is conducting research on digital currency, it maintains a cautious stance. Fed Chair Jerome Powell expressed a cautious response in November last year, stating there are currently no plans to issue a CBDC.

China, aiming for reserve currency status, has already begun final preparations for launching the digital yuan. It will release digital currency for the first time this year. Experts expect China to build a yuan network by leveraging the Belt and Road Initiative (一帶一路, land and maritime Silk Road) promoted in Asia and Africa.

European countries are also actively engaging in research and development (R&D) of digital currencies for hegemony competition. Fran?ois Villeroy de Galhau, Governor of the Bank of France, said, "We want to start digital currency experiments promptly. The project will begin before the end of the first quarter."

The Fed, which oversees the dollar, remains conservative about digital currency. Paul Sheard, Senior Research Fellow at Harvard Kennedy School, analyzed, "When setting the rules, they can always take a leading position," adding, "For now, they probably judged it advantageous to stand behind and observe the trend."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.