Former Vice Chairman Shin Dong-ju Holds 800 Billion KRW Cash Reserves

Lotte Holdings Common Stock Purchase Possibility Rises

Focus on Management Dispute and Hotel Lotte IPO

Clear Shin Dong-bin Supportive Shares...Dispute Seen as 'Limited'

Former Vice Chairman of Lotte Holdings Japan Shin Dong-joo and Lotte Chairman Shin Dong-bin are coming out to attend the encoffining ceremony at the funeral hall of the late honorary chairman and founder of Lotte Group, Shin Kyuk-ho, set up at Seoul Asan Medical Center in Songpa-gu, Seoul, on the afternoon of the 20th. Photo by Kang Jin-hyung aymsdream@

Former Vice Chairman of Lotte Holdings Japan Shin Dong-joo and Lotte Chairman Shin Dong-bin are coming out to attend the encoffining ceremony at the funeral hall of the late honorary chairman and founder of Lotte Group, Shin Kyuk-ho, set up at Seoul Asan Medical Center in Songpa-gu, Seoul, on the afternoon of the 20th. Photo by Kang Jin-hyung aymsdream@

[Asia Economy Reporter Cha Min-young] Amid widespread speculation that Shin Dong-bin, Chairman of Lotte Group, and Shin Dong-joo, former Vice Chairman of Japan Lotte Holdings (currently Chairman of SDJ Corporation), who engaged in a 'brotherly feud' over the management rights of Lotte Group, might reconcile following the passing of their father, Honorary Chairman Shin Kyuk-ho, there is also a possibility that Shin Dong-joo could launch a final counterattack using his cash assets as leverage.

According to business circles and the securities industry on the 21st, attention is focused on the whereabouts of the cash assets held by former Vice Chairman Shin Dong-joo. In 2017, opposing the split and merger of Lotte affiliates, Shin exercised his stock purchase rights (put options) on four companies?Lotte Confectionery, Lotte Shopping, Lotte Chilsung Beverage, and Lotte Foods?securing approximately 800 billion KRW in cash.

Market speculation suggests that Shin Dong-joo might use the cash he secured to purchase shares in Lotte Holdings and mount a final counterattack. In the so-called 'brotherly feud' of 2017, Shin Dong-joo contested the management rights of Lotte Group against Chairman Shin Dong-bin but was ultimately defeated when Japan Lotte Holdings sided with Chairman Shin. Subsequently, Shin Dong-joo proposed raising the exercise price of the stock purchase rights, but this proposal was also rejected.

If Shin Dong-joo uses all his cash, he could buy about 21.19 million shares of Lotte Holdings common stock based on the previous day's closing price of 37,750 KRW per share. This would secure him a stake of around 20%, surpassing the current largest individual shareholder, Chairman Shin Dong-bin, who holds 11.7%.

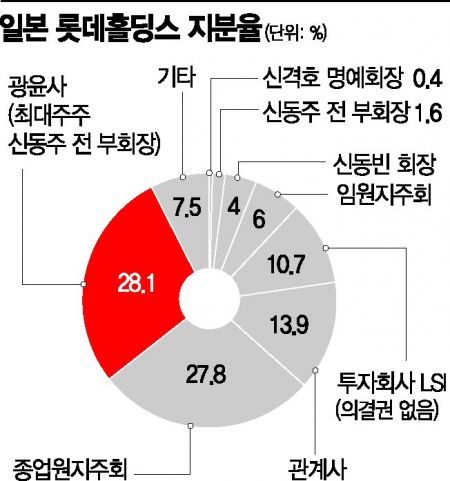

However, the prevailing analysis is that even if Shin Dong-joo deploys the entire 800 billion KRW to acquire shares in Lotte Holdings, it would not be beneficial. As of the end of September last year, the total number of issued shares of Lotte Holdings was 104,909,237. Major shareholders holding more than 5% include Lotte Holdings treasury stock (32.5%), Chairman Shin Dong-bin (11.7%), Hotel Lotte (11.7%), and Lotte Aluminum (5.1%). The combined stake of Chairman Shin and related parties amounts to 45.3%. Ultimately, unless Japan Lotte Holdings, which supported Chairman Shin, suddenly changes its stance, Shin Dong-joo's last-minute overturn is impossible. Major securities firms such as Mirae Asset Daewoo and KB Securities have also issued reports stating that the possibility of a management rights dispute is limited.

The reason for the focus on Lotte Holdings is that Hotel Lotte, which serves as the holding company for the Korean Lotte Group, remains unlisted. It is known that Honorary Chairman Shin Kyuk-ho opposed the initial public offering (IPO) of Hotel Lotte during his lifetime. Chairman Shin Dong-bin is highly likely to list Hotel Lotte in the future to increase his control over Lotte Group and align with the government's stance on establishing transparent governance. The Korea Corporate Governance Service stated in a report earlier last year that "Since the launch of Lotte Holdings, domestic governance has been rapidly improving, but the relationship between Lotte Holdings and Japan Lotte Holdings still needs to be clarified," adding, "It is necessary to monitor whether the governance of Lotte Group will be completed through the IPO of Hotel Lotte."

Meanwhile, the inheritance issue concerning approximately 1 trillion KRW left by the late Honorary Chairman Shin is also a matter of interest. Some in the business community have rumored that Honorary Chairman Shin expressed a wish to donate his wealth to society. Hwang Kak-gyu, Vice Chairman of Lotte Holdings and co-chairman of the joint funeral committee, avoided a direct answer when asked by reporters whether the late Honorary Chairman had expressed such intentions, saying, "Since the family has lived more off the assets, I think the family will discuss and decide among themselves."

It is known that Honorary Chairman Shin did not leave a separate will. In this case, the inheritance of about 1 trillion KRW will be divided equally among the four legal heirs: Shin Young-ja, former Chairwoman of the Lotte Welfare Foundation; Shin Dong-joo, former Vice Chairman of Lotte Holdings; Shin Dong-bin, Chairman of Lotte Group; and Shin Yu-mi, Advisor of Lotte Hotel, each receiving 25%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.