131 Securities Firms' Upgrade Reports... 12% Increase from Last Year

Mass Upgrades for Semiconductor Stocks Including Samsung Electronics and SK Hynix

Duty-Free, Cosmetics, and Entertainment Stocks Also Raised

[Asia Economy Reporter Song Hwajeong] As the stock market has continued to show strength this year and corporate earnings are expected to improve, securities firms have been raising their target prices for listed companies one after another.

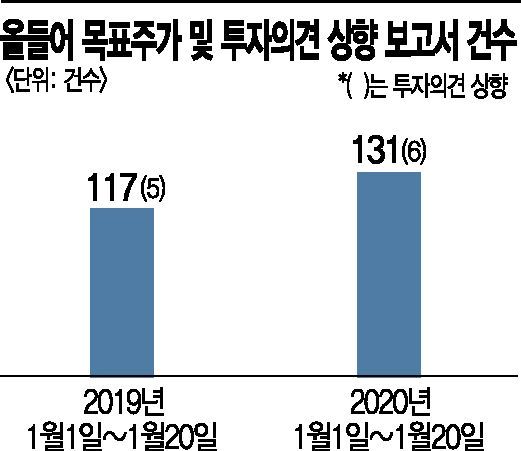

According to financial information provider FnGuide on the 21st, there have been 131 reports raising target prices released up to the 20th of this year. This is about a 12% increase compared to 117 reports during the same period last year. Upgrades in investment ratings also increased by one, from 5 last year to 6 this year.

By stock, semiconductor-related stocks such as Samsung Electronics and SK Hynix, which have been continuously hitting new highs this year, have seen their target prices significantly revised upward. For Samsung Electronics, 14 securities firms have raised their target prices this year. There have been 15 reports raising target prices. Samsung Electronics’ target price, which was previously in the high 50,000 KRW range to the low-to-mid 60,000 KRW range, has jumped to the high 60,000 KRW to the low 70,000 KRW range. NH Investment & Securities raised its target price from 63,000 KRW to 74,000 KRW, KB Securities from 63,000 KRW to 70,000 KRW, and Shinhan Financial Investment from 64,000 KRW to 73,000 KRW. Kiwoom Securities raised the target price from 65,000 KRW to 69,000 KRW on the 9th and then again to 73,000 KRW on the 14th.

SK Hynix saw 9 securities firms raise their target prices this year. The target price, which was previously in the high 90,000 KRW range to the low 100,000 KRW range, soared up to 140,000 KRW. Yuanta Securities raised SK Hynix’s target price from 100,000 KRW to 140,000 KRW, Shinhan Financial Investment from 110,000 KRW to 135,000 KRW, and Kiwoom Securities from 110,000 KRW to 130,000 KRW. Samsung Electro-Mechanics, which has also been hitting new highs this year, saw its target price raised by 6 securities firms, with the highest target price reaching 166,000 KRW.

In addition, stocks that underperformed last year such as duty-free shops, cosmetics, and entertainment stocks have recently seen their target prices raised one after another. With expectations for the lifting of China’s Hanhanryeong (restrictions on Korean Wave), stocks related to Chinese consumption have been strong this year. Hotel Shilla’s target price was raised by 9 securities firms this year. The target price for Hotel Shilla, which was previously in the 90,000 KRW range to the low 100,000 KRW range, rose to around 130,000 KRW. Amorepacific, which struggled due to poor earnings last year, has also seen a series of target price upgrades. So far, 7 securities firms have raised Amorepacific’s target price, which was previously in the low 200,000 KRW range, to as high as 270,000 KRW. Shinsegae also saw 7 securities firms raise its target price this year, with the target price rising from around 350,000 KRW to 400,000 KRW. YG Entertainment, which underperformed due to various negative factors last year, has had its target price raised by 3 securities firms this year, with the highest target price reaching 40,000 KRW.

Park Eunjeong, a researcher at Yuanta Securities, said, "We are upgrading the investment rating for the cosmetics sector to 'Overweight,'" adding, "Although most domestic companies failed to capitalize on the digitalization trend at home and abroad and the upward purchasing trend of Chinese consumers despite the industry’s favorable conditions over the past three years, this year the sector’s momentum is expected to recover due to improved earnings from companies that have implemented structural reforms."

The series of target price upgrades by companies is due to expectations of improved corporate earnings this year. The consensus operating profit for the KOSPI this year is expected to increase by 29.24% compared to the same period last year, reaching 171.3606 trillion KRW. Most KOSPI sectors are expected to see an increase in operating profit this year compared to last year, with the electrical and electronics sector, which underperformed last year, expected to grow by more than 60%. Samsung Electronics is expected to see a 47.93% increase in operating profit compared to last year, and SK Hynix is expected to increase by 150.32%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)