10 Million KRW Business Owner, Income Tax 460,000 KRW · Health Insurance Fee 2.4 Million KRW... Effective Tax Rate 28.6%

28.6% Effective Tax Rate Similar to Income Tax Effective Rate of a 500 Million KRW Annual Salary Employee

[Asia Economy Reporter Kwangho Lee] In the first year of the full taxation implementation on housing rental income, business operators who newly registered as housing rental businesses are expected to bear additional health insurance premiums amounting to several times the income tax on monthly rent income.

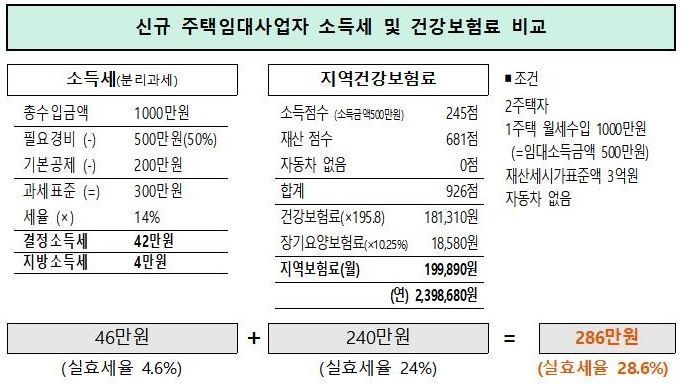

Statistics show that a housing rental business operator with an income of 10 million KRW pays an additional 2.4 million KRW in health insurance premiums on top of 460,000 KRW in income tax, resulting in an effective tax rate of 28.6%.

The Korea Taxpayers Federation stated on the 18th, "Housing rental income earners who were previously dependents under workplace health insurance lose their dependent status once they register as business operators and have business income of even 1 KRW or more," adding, "The government strongly encouraged registration as housing rental business operators but did not provide information about additional health insurance premium payments beyond income tax, which is expected to cause significant backlash."

Earlier, the National Tax Service sent a unified notice to owners of two or more houses, stating, "If you have continuously rented out houses since before December 31, 2019, apply for business registration by January 21." Rental income for the 2019 tax year must be reported in May, and regional health insurance premiums must be paid starting from November.

According to a simulation by the Taxpayers Federation assuming a new real estate rental business operator, Ms. A, who has a husband employed at a company, is a two-house owner as a couple and has registered as a housing rental business operator because she earns 10 million KRW annually in monthly rent from one house under her name. Accordingly, from the total income of 10 million KRW, after deducting 50% necessary expenses (5 million KRW) and a basic deduction of 2 million KRW, the taxable income is 3 million KRW. Applying a 14% tax rate results in a separate taxation rental income tax of 460,000 KRW (including local income tax).

However, since Ms. A has a business registration certificate, she has business income of 5 million KRW (total income 10 million KRW minus necessary expenses 5 million KRW) and was converted to a regional health insurance subscriber. Regional health insurance premiums are calculated by multiplying points assigned based on owned assets and vehicles in addition to rental income.

Assuming Ms. A has housing rental income of 10 million KRW (income amount 5 million KRW), a property tax standard market value of 300 million KRW, and no car, the estimated regional health insurance premium calculated using the simulation program on the National Health Insurance Service website is about 2.4 million KRW per year (200,000 KRW per month).

As a result of registering as a business operator due to full taxation on housing rental income, Ms. A must pay a total of 2.86 million KRW, including 460,000 KRW in income tax and 2.4 million KRW in health insurance premiums (5.2 times the income tax). This means she pays 29% of her rental income (10 million KRW) in income tax and health insurance premiums.

The Taxpayers Federation pointed out, "An effective tax rate of 29% on income is similar to the effective income tax rate of a salaried worker earning 500 million KRW annually," and criticized, "Applying such an effective tax rate to rental business operators whose monthly rent income is relatively small is unfair."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)