Shinhan Leads with 5 Cases Including Facial Recognition Payment

Kookmin and BC Each Preparing 3 Cases

[Asia Economy Reporter Ki Ha-young] Credit card companies struggling with deteriorating profitability are seeking new opportunities through innovative financial services. These innovative financial services, designated under the Financial Regulation Sandbox according to the Financial Innovation Support Special Act last year, serve as a key foundation for new revenue streams. Starting from the first half of this year, credit card companies plan to pilot these services one after another as part of their business diversification efforts to transform for survival.

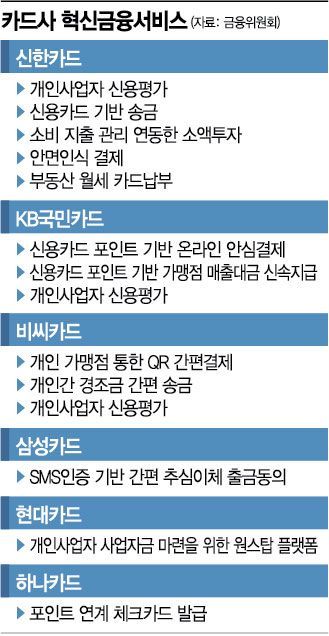

According to financial authorities and industry sources on the 17th, among the total 77 innovative financial services designated by the Financial Services Commission during the eight months following the implementation of the Financial Regulation Sandbox in April last year, 14 are credit card company services. Breaking it down by company, Shinhan Card has 5 services, KB Kookmin Card and BC Card have 3 each, and Samsung Card, Hyundai Card, and Hana Card have 1 each.

The most proactive is Shinhan Card. Shinhan Card plans to launch 'Shinhan Face Pay,' a payment service using only facial recognition, at Hanyang University as early as this month or by next month at the latest. The service is currently in the final stages of preparation for launch. Among the five innovative financial services, credit card-based remittance (My Remittance), credit evaluation for individual business owners, and overseas micro-investment services have been in operation since last year.

My Remittance, which started service on October 1 last year, surpassed a cumulative usage amount of 2.7 billion KRW by the end of last year. The 'Overseas Stock Micro-Investment Service,' conducted jointly with Shinhan Financial Investment, is also progressing smoothly. This service invests the spare change or a designated amount generated from card usage into overseas stocks. Domestic funds were applied from September 3 last year, and overseas stocks from November 25 last year. As of the 7th, the total number of subscribers is approximately 6,300 (over 2,300 for overseas stock investment), with an investment execution amount of about 540 million KRW.

A Shinhan Card official said, "Not only among credit card companies but across the entire financial sector, the most innovative financial services were selected last year," adding, "We plan to continuously discover new services in line with the financial authorities' intent to promote innovative financial services."

KB Kookmin Card, which had three innovative financial services selected last year, also plans to start operating services within this year. From July, it will provide 100% of sales proceeds as points to merchants with annual sales under 300 million KRW. This service aims to reduce fees for small business owners. Additionally, services such as safe payment for secondhand transactions and credit rating generation specialized for small business owners are being prepared.

BC Card has been designated for services including ▲small remittance between individuals using QR codes ▲credit rating generation specialized for small business owners ▲QR code payment services, and is currently reviewing these services. Hana Card introduced a system that allows payments within the point balance using a check card and plans to start the service around February to March.

An industry insider said, "Innovative financial services do not generate immediate profits," but added, "For credit card companies that need business diversification, this could be a new opportunity."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)