Exclusion Announced Two Days Before Trade Agreement

Ultimately No Evidence Found of China's Manipulation

Explicit Achievement in Currency Manipulation Ban Talks

Ceasefire Status Can Be Designated Anytime

[Asia Economy New York=Correspondent Baek Jong-min, Beijing=Correspondent Park Sun-mi] The U.S. government's decision to withdraw the designation of China as a currency manipulator can be seen as a sign of temporarily easing pressure on China. Last August, when the yuan exchange rate surpassed 7 yuan per dollar and continued to weaken, the U.S. abruptly played the currency manipulator card. However, just two days before the scheduled signing ceremony of the Phase One trade agreement between the two countries on the 15th, the U.S. decided to withdraw the designation. This suggests that the U.S. had been using the currency manipulator designation as a pressure tactic against China.

Scott Kennedy, a China economy expert at the Center for Strategic and International Studies (CSIS), told the Washington Post (WP) on the 13th (local time), "Designating China as a currency manipulator last year was a political step created to pressure Beijing in trade negotiations."

The U.S. had imposed large-scale tariffs on Chinese goods but was concerned that China might respond by devaluing the yuan. Just before the U.S. designated China as a currency manipulator last August, the yuan exchange rate exceeded 7 yuan per dollar and continued to weaken, raising concerns that the effect of the tariffs imposed by the U.S. would be offset.

Afterwards, the yuan exchange rate fell back below 7 yuan per dollar, but it was not confirmed whether China manipulated the exchange rate. The International Monetary Fund (IMF), which was tasked with monitoring China's currency manipulation, has not found any significant evidence so far. David Dollar, a senior fellow at the Brookings Institution, told WP, "Because China did not manipulate the exchange rate, the U.S. recognized the reality."

There is also a view that the designation was not entirely ineffective. The New York Times (NYT) recalled, "The U.S. Trade Representative last month indicated that the U.S.-China trade agreement would include a clause denying currency manipulation," and mentioned, "Through the Phase One trade agreement, China will be prevented from using monetary policy to manipulate exchange rates and cause unfair outcomes for U.S. export companies." Securing a promise to prohibit currency manipulation through an official document agreed upon by both countries, rather than a unilateral designation, is considered a sufficient achievement.

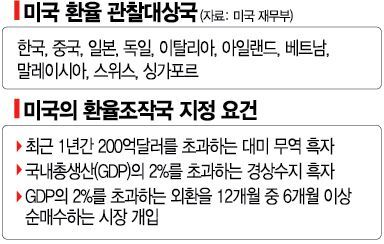

There is also an opinion that the U.S.-China currency war is more like a truce, as the U.S. can use the currency manipulator designation card at any time. In the report, when withdrawing the designation of China as a manipulator, the U.S. used the phrase "at this time," implying that it can be used again whenever necessary.

Meanwhile, Hong Kong's South China Morning Post (SCMP) reported on the 14th that the details of the U.S.-China Phase One trade agreement will include China purchasing a large volume of U.S. goods. Citing sources, SCMP stated that China will purchase $200 billion worth of U.S. goods over the next two years, including $75 billion in manufactured goods, $50 billion in energy, $40 billion in agriculture, and $35 to $40 billion in services.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.