Preliminary Bidding for Prudential Life Starts This Month... Battle to Strengthen Non-Bank Sector

Improvement in BIS Ratio and Financial Management Also Highlighted

[Asia Economy Reporter Haeyoung Kwon] Last year, the five major domestic financial holding companies expanded their quasi-permanent capital available for mergers and acquisitions (M&A) by nearly 5 trillion won. This is analyzed as ammunition buildup in preparation for large-scale M&A, which CEOs of financial institutions such as Shinhan and KB Financial expressed determination for at the beginning of the year. Starting with the preliminary bidding for Prudential Life at the end of this month, the M&A battle among financial holding companies to strengthen the non-bank sector is expected to ignite from early this year.

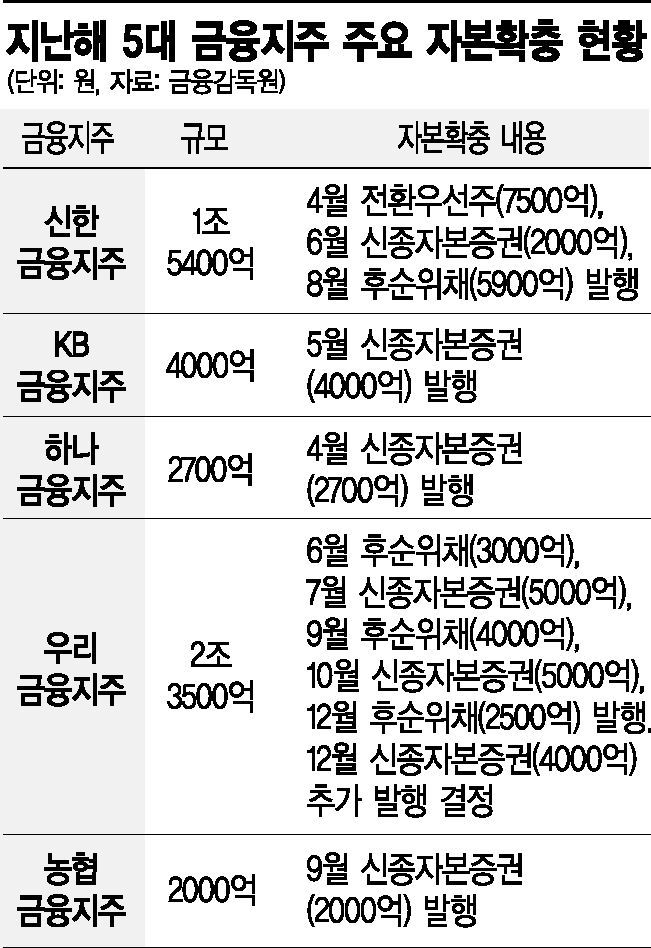

According to the financial sector on the 8th, the five financial holding companies?Shinhan, KB, Hana, Woori, and NH Nonghyup Financial?expanded their capital by approximately 4.76 trillion won last year through issuing hybrid capital securities and subordinated bonds, as well as third-party allotment rights offerings.

The most aggressive in capital expansion was Woori Financial. Woori Financial issued about 1.95 trillion won worth of hybrid capital securities and subordinated bonds in five rounds. Including the 400 billion won hybrid capital securities decided to be issued last month, it expanded its capital by 2.35 trillion won last year alone.

Other financial holding companies are also steadily accumulating ammunition. Shinhan Financial secured 1.54 trillion won in capital through issuing convertible preferred shares, hybrid capital securities, and subordinated bonds. KB Financial issued about 400 billion won of hybrid capital securities for the first time in 11 years since its establishment as a holding company in 2008. Hana Financial and Nonghyup Financial also issued hybrid capital securities worth 270 billion won and 200 billion won respectively to build up capital.

The reason financial holding companies are rushing to expand capital like this is not only to improve the Bank for International Settlements (BIS) ratio and secure financial soundness but also as a strategic move to prepare for domestic and overseas bank and non-bank M&A. The hybrid capital securities issued in large quantities by financial holding companies last year have characteristics of both stocks and bonds. They typically have a maturity of 30 years and can be extended, so they are considered quasi-permanent capital and are used as a means to increase the equity capital of financial holding companies. Hybrid capital securities and subordinated bonds with maturities of over five years are fully recognized as capital, which is advantageous for managing the BIS ratio.

The ammunition secured by financial holding companies is expected to be actively used in M&A starting early this year. While Woori Financial and Hana Financial competed over Lotte Card last year, KB Financial and Woori Financial are expected to compete in the preliminary bidding for Prudential Life on the 20th. Woori Financial Chairman Taeseung Sohn expressed interest in participating in the acquisition battle regarding Prudential Life, stating last month to reporters, "We are watching with interest." In particular, since banks account for more than 90% of the group's total assets and net profit for Woori Financial, it is urgent to establish the holding company’s profile through acquisitions of non-bank affiliates such as securities, insurance, savings banks, and capital. Woori Financial is focusing on M&A with the goal of becoming the top financial group in 2022. It also plans to complete the acquisition of Aju Capital and Aju Savings Bank in the first half of the year.

Shinhan Financial will also use the expanded capital for acquiring the remaining shares of Orange Life, expected to be about 350 billion won, which will be completed this month.

M&A is also a key variable in the 'leading bank' competition. The decisive factor behind KB Financial Chairman Jongkyu Yoon taking the leading financial title after nine years in 2017 was the acquisition of LIG Insurance and Hyundai Securities immediately after his inauguration. Shinhan Financial Chairman Yongbyung Cho reclaimed the leading financial title in 2018, just one year later, by strengthening the non-bank sector through acquiring Orange Life.

A financial sector official said, "With bank growth reaching its limits, financial holding companies are seeking breakthroughs for growth through non-bank and overseas M&A," adding, "Since financial holding company CEOs expressed their determination for M&A in their New Year's addresses, expansion through capital increases is expected to continue this year as well."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.