[Asia Economy Reporter Eunmo Koo] Nike's (NIKE) flagship brand 'Jordan' has recorded quarterly sales of $1 billion for the first time ever, and its stock price continues to show strength. Analysts suggest that Nike's high Return on Equity (ROE) will positively influence future stock price increases.

According to KB Securities on the 4th, Nike's flagship brand 'Jordan' surpassed $1 billion in quarterly sales for the first time in the second quarter of fiscal year 2020 (September to November 2019). In the second quarter of fiscal year 2020, footwear sales within the Nike brand reached $6.21 billion, up 11.5% year-over-year, accounting for 63.0% of total sales. During the same period, apparel sales increased by 7.8% to $3.29 billion, and equipment sales rose by 5.6% to $340 million. KB Securities analyst Sehwan Kim explained in a report that "Nike is seeing increased sales not only due to new innovations in the Jordan brand but also because of growing interest in basketball among women and rising sales outside the United States."

The addition of Luka Don?i? of the NBA's Dallas Mavericks to the Jordan brand also raises expectations for future sales growth. Luka Don?i? joined Nike's Jordan brand on a five-year contract on the 30th of last month. Although he competed with Puma and Under Armour, Nike ultimately secured the contract.

Sales in the Chinese market are also showing growth through digitalization. China recorded the highest sales growth in the second quarter of fiscal year 2020, with sales reaching $1.85 billion, a 19.6% increase compared to the same period last year. Despite challenges such as the US-China trade dispute, Nike noted that digital sales growth in China has been strong since the launch of its mobile app. While momentum in China is strong, Nike has yet to fully realize its potential there, indicating room for further growth.

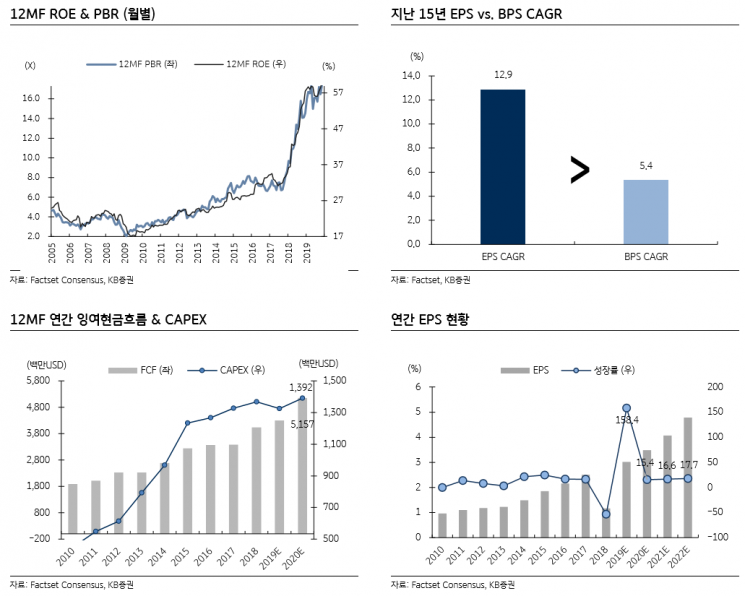

Nike's stock price over the past six months has outperformed Adidas. Over the past year, Adidas (ADDYY US) posted a stock return of 54.7%, surpassing Nike's 36.8%, but in the recent six months (second half of 2019), Nike's stock price rose 19.2%, exceeding Adidas's 5.0%. Nike's average expected earnings per share (EPS) growth rate over three years is 21.7%, similar to Adidas's 18.9%, and the price/earnings to growth ratio (PEG), calculated using the 12-month forward price-to-earnings ratio (PER), is 1.4 times, the same as Adidas. However, Nike's ROE is 56.0%, significantly higher than Adidas's 27.3%, and its operating margin is 12.1%, 1.6 percentage points above Adidas.

High ROE is expected to positively impact future stock price increases. Analyst Kim stated, "Nike's profit growth and appropriate shareholder return policies are strongly driving up ROE," and forecasted that "strengthening overseas business through digitalization and appropriate shareholder return policies will be positively reflected in Nike's future stock price."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.