Impact of Front-Loaded Demand in China...Short-Term Adjustment Likely Early This Year

Key Markets Such as the U.S., Europe, and Japan See Negative Growth

Hyundai Motor Retains Top Sales Position...Up 78.9%

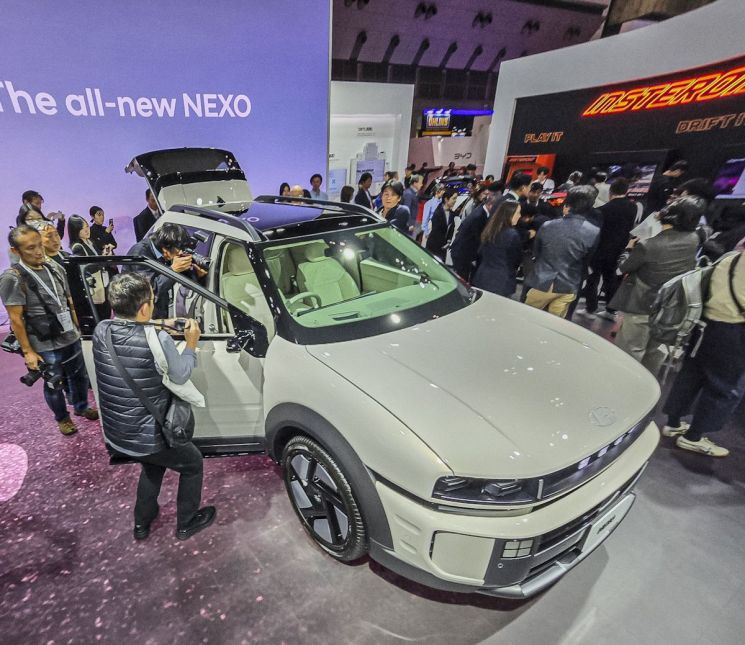

Visitors are inspecting the All-New Nexo displayed at the Hyundai Motor Company booth. Hyundai Motor Company

Visitors are inspecting the All-New Nexo displayed at the Hyundai Motor Company booth. Hyundai Motor Company

Helped by a brief rebound in the Chinese market in December, global fuel cell electric vehicle (FCEV·Fuel Cell Electric Vehicle) sales last year overcame weak performance in the first half and grew 24.4%. The sharp increase in sales in China at the end of last year was driven by demand being pulled forward, so a short-term adjustment is expected in early 2026.

According to market research firm SNE Research, global fuel cell electric vehicle sales from January to December 2025 reached 16,011 units, up 24.4% from the same period a year earlier.

SNE Research analyzed that this was largely due to the temporary surge in monthly sales in December, as the full exemption of purchase tax on new energy vehicles in China ended in December (to be converted to a 50% reduction starting in 2026), coinciding with the closing of performance evaluations for pilot city clusters.

By company, Hyundai Motor Company maintained its No. 1 position in the market by selling a total of 6,861 units, mainly of the Nexo (NEXO). With the launch of the second-generation Nexo in April, the company posted a high growth rate of 78.9%.

Toyota sold a combined 1,168 units of its Mirai and Crown models, down 39.1% from a year earlier. Sales in Japan also fell by 37.3%.

Chinese manufacturers are focusing more on commercial vehicles than passenger cars, thereby maintaining a relatively stable sales trend.

Honda launched the 2025 CR-V e:FCEV, a fuel cell passenger vehicle model, in the United States and Japan, but sales remained at 185 units. The CR-V e:FCEV is the first SUV to combine a hydrogen fuel cell with plug-in hybrid functionality. With a 4.3 kg hydrogen tank and a 17.7 kWh battery, it can travel 435 km under U.S. Environmental Protection Agency (EPA) standards.

By country, China ranked first with a market share of 48.7%. Korea followed with a 42.5% share, supported by strong Nexo sales. Major advanced markets such as Europe, the United States, and Japan are showing a clear contraction.

In Europe, combined sales of the Mirai and Nexo reached 566 units, representing a 23.1% year-on-year decline. In the United States, although the new Honda CR-V e:FCEV was launched, a sharp drop in Mirai sales led to a 37.7% decrease overall. The Japanese market also recorded a 37.3% decline due to sluggish sales of the Mirai and Crown.

SNE Research predicted that a short-term adjustment could emerge in the fuel cell vehicle market in early 2026. The fact that Toyota’s 2026 Mirai model has undergone only minor changes is also expected to limit demand for fuel cell passenger cars.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.