About 45 Billion Dollars in Overseas Stock Investment by Individuals Last Year

Figure Includes 31.4 Billion Dollars in Direct Individual Investment Plus ETF Investments via Institutions

Overseas Equity Investment Surged Across All Investor Groups, N

Last year, the scale of overseas stock investments by so-called "Seohak Ants" (Korean retail investors investing abroad) reached 45 billion dollars (about 66.2310 trillion won), surpassing the National Pension Service's overseas stock investments over the same period. As not only individuals but also major players such as asset management companies, securities firms, and the National Pension Service engaged in broad-based overseas stock investments, domestic residents' overseas stock investments surged to 114.3 billion dollars last year. This surge significantly offset the effect of the record-high current account surplus of 123.05 billion dollars.

"Record-high current account surplus led by semiconductor exports"...Investment income balance tops 30 billion dollars

According to the "Preliminary Balance of Payments for December 2025" released by the Bank of Korea on the 6th, net assets in the financial account last year stood at 119.8 billion dollars, the largest figure on record. Overseas stock investments by domestic residents reached 114.3 billion dollars, up 72.2 billion dollars from a year earlier, rising to a level comparable to the record-high current account surplus of 123.05 billion dollars posted over the same period. By investor type, asset management companies, securities firms, and insurers accounted for 42.1 billion dollars; public institutions such as the National Pension Service for 40.7 billion dollars; and individual investors for 31.4 billion dollars. However, when stripping out and adding individual investments in exchange-traded funds (ETFs), which are classified under other financial institutions (about 13.6 billion dollars), the effective amount of individuals' overseas stock investments totals 45 billion dollars. This is about 4.3 billion dollars more than the National Pension Service's overseas stock investments over the same period. Kim Younghwan, Director of the Economic Statistics 1 Bureau at the Bank of Korea, noted, "When ETF investments are taken into account, last year the scale of individuals' overseas stock investments exceeded that of public institutions such as the National Pension Service," adding, "This rapid increase in residents' overseas stock investments significantly offset the positive effect of the current account surplus."

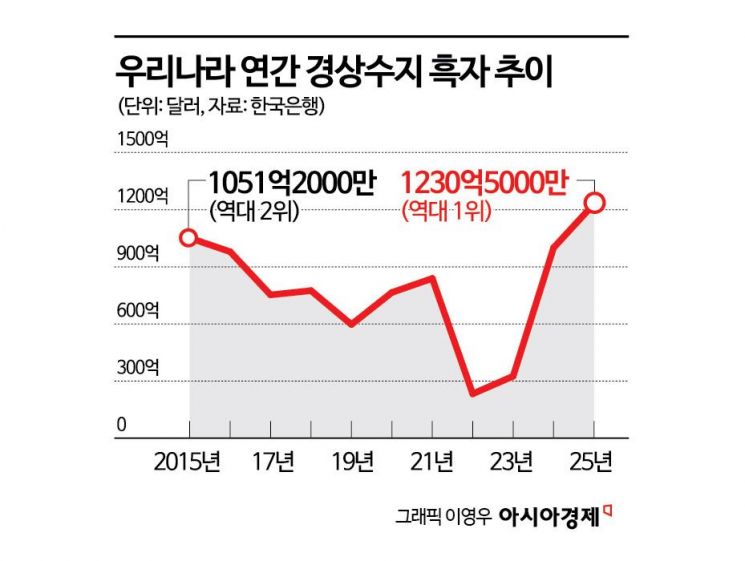

Last year, Korea's annual current account surplus reached 123.05 billion dollars, renewing the record high. This figure exceeded the previous peak of 105.12 billion dollars in 2015 by a wide margin of 17.93 billion dollars. It also surpassed the 115 billion dollar projection released by the Bank of Korea in November last year by 8.05 billion dollars.

The main reason the current account surplus exceeded expectations was the strong performance of semiconductor exports driven by expanded investment in artificial intelligence (AI). Last year's goods balance surplus was 138.07 billion dollars, up 25% from a year earlier, marking an all-time high. This was due to goods exports reaching a record 718.94 billion dollars. On a customs-cleared basis, semiconductor exports last year also renewed their record performance from the previous year. They came in at 173.4 billion dollars, up 22.2% from the year before, accounting for 24.4% of Korea's total exports. On the back of this, total exports last year rose 3.8% from a year earlier to 709.7 billion dollars, surpassing the previous record set in 2024. Goods imports amounted to 580.87 billion dollars, down from 593.06 billion dollars in the previous year, reflecting factors such as lower international oil prices.

With accumulated increases in overseas investments by domestic residents, the primary income balance surplus also remained strong at 27.92 billion dollars. The investment income balance, which is calculated by subtracting income from foreign investment in Korea from dividends and interest income generated by Koreans' overseas investments, posted a surplus of 30.17 billion dollars, the largest amount on record.

(From left) Kim Junyoung, Manager of the Balance of Payments Team; Kim Younghwan, Director of Economic Statistics Division 1; and Park Seonggon, Head of the Balance of Payments Team, are speaking at a press briefing on "December 2025 Balance of Payments (Provisional)" held at the Bank of Korea in Jung-gu, Seoul on the 6th. Photo by Bank of Korea

(From left) Kim Junyoung, Manager of the Balance of Payments Team; Kim Younghwan, Director of Economic Statistics Division 1; and Park Seonggon, Head of the Balance of Payments Team, are speaking at a press briefing on "December 2025 Balance of Payments (Provisional)" held at the Bank of Korea in Jung-gu, Seoul on the 6th. Photo by Bank of Korea

December current account surplus at 18.7 billion dollars...Renews all-time monthly record

In December last year, the current account recorded a surplus of 18.7 billion dollars. This is the largest monthly surplus on record, far exceeding the figures for the previous month (12.9 billion dollars) and the same month a year earlier (12.74 billion dollars). The current account also remained in surplus for the 32nd consecutive month, marking the second-longest such streak since 2000. The key drivers were robust export performance centered on semiconductors and a sharp expansion in the primary income balance surplus due to increased dividend income.

The goods balance, which accounts for the largest share of the current account, was the main contributor to the surplus. In December last year, the goods balance surplus reached 18.85 billion dollars, setting a new monthly record. This was the result of exports hitting an all-time high on a monthly basis. Exports totaled 71.65 billion dollars, up 13.1% from the same month a year earlier. Information technology (IT) exports remained strong, led by semiconductors and information and communications equipment, while non-IT exports also increased, mainly in machinery and precision instruments and pharmaceuticals. On a customs-cleared basis, semiconductor exports in December last year came to 20.92 billion dollars, a sharp increase of 43.1% from a year earlier. Computer peripherals (33.1%) and wireless communication devices (24.0%) also performed strongly, pushing IT exports up by 32.4%. Non-IT exports likewise rose 2.1%, driven mainly by pharmaceuticals (27.3%) and machinery and precision instruments (2.9%). In contrast, exports of passenger cars (-4.2%) and steel products (-1.7%) declined from a year earlier.

Imports increased 1.7% to 52.8 billion dollars. Although raw materials (-1.0%) continued to decline due to falling energy prices, with petroleum products (-35.2%), coal (-20.9%), gas (-7.6%), and crude oil (-3.5%) all decreasing, imports of consumer goods surged 17.9%, led by passenger cars and gold, resulting in a second consecutive month of import growth.

The services account recorded a deficit of 3.69 billion dollars. The deficit widened compared with both a year earlier (-2.38 billion dollars) and the previous month (-2.85 billion dollars. The travel balance posted a deficit of 1.4 billion dollars. As the number of outbound travelers increased during the winter vacation peak season for overseas travel, the travel deficit widened from the previous month's 970 million dollars. The primary income balance surplus jumped to 4.73 billion dollars from 1.53 billion dollars in the previous month. This was because the impact of quarterly dividend payments on portfolio investment in the previous month dissipated, causing the dividend income balance surplus to surge from 930 million dollars to 3.71 billion dollars.

Net assets in the financial account (assets minus liabilities) increased by 23.77 billion dollars in December last year. In direct investment, overseas investment by domestic residents increased by 6.49 billion dollars, while foreign direct investment in Korea rose by 5.17 billion dollars. In portfolio investment, overseas investment by domestic residents increased by 14.37 billion dollars, mainly in equities, while foreign investment in Korea increased by 5.68 billion dollars, mainly in bonds.

2026 current account expected to surpass 2025 and top 130 billion dollars...Tariffs and geopolitical risks are key variables

The Bank of Korea expects this year's current account surplus to once again exceed last year's record level. The Bank of Korea's forecast for this year is 130 billion dollars.

The outlook is that, again this year, strong exports driven by the continuation of the semiconductor supercycle will underpin the current account surplus. However, as the export structure becomes more dependent on semiconductors, it is expected to be heavily influenced by whether the global trend of expanding AI investment continues and by changes in semiconductor market conditions. Last year, exports excluding semiconductors, on a customs-cleared basis, fell 1.1% from a year earlier. Director Kim said, "It is true that there are differences in performance by product category, but the semiconductor supercycle and the increasing export trends of ships and pharmaceuticals will have a positive impact," adding, "If, in addition, international oil prices remain stable and the primary income balance continues its solid upward trend, the current account is likely to maintain a favorable trajectory this year as well."

However, renewed uncertainty over tariffs and geopolitical risks were cited as key variables. A major concern is the reemergence of trade uncertainty, including the 25% tariff that U.S. President Donald Trump raised last month as he pressed for the passage of the Special Act on Strategic Investment in the United States. Director Kim added, "We view the overall trend positively," and "The figures that reflect the various variables that have emerged since the Research Department's November forecast (an annual surplus of 130 billion dollars this year) will be confirmed in the revised outlook to be released this month."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.