Pooling multiple subscribers' funds under professional management

The larger the fund grows, the stronger the accountability... Fiduciary duty codified

The background to labor, management, and government agreeing on a joint declaration to strengthen the function of the retirement pension system is a shared recognition that, more than 20 years after its introduction, the system has not sufficiently functioned as a mechanism to guarantee income in old age. Although it was designed as a core system for old-age income security, the limitations on subscribers' freedom of choice and on operational efficiency have shifted the risks and responsibilities associated with rate-of-return volatility onto workers.

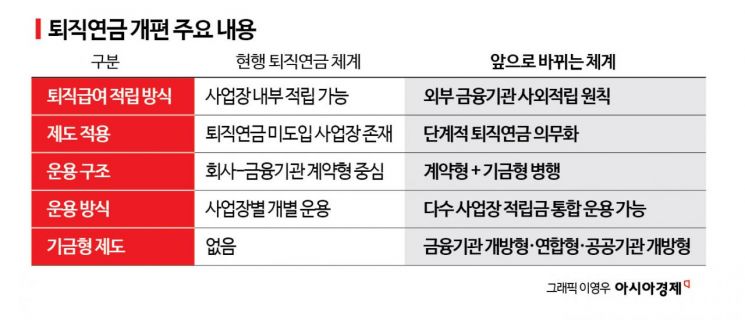

The key point of this agreement is that, going forward, the default principle will be to place retirement benefits with financial institutions outside the company, through what is called "external funding." Under the current retirement pension system, in many workplaces retirement benefits are accumulated inside the company. This method, in which the company directly holds the retirement benefits, is called "internal funding." Put simply, it is as if the retirement money is being kept in the company safe. The problem is that if the company's situation deteriorates, there is a high risk that workers will not receive their retirement benefits on time. This is why the task force (TF) has made external funding of retirement benefits the starting point for institutional reform.

External funding means keeping retirement benefits separately in a bank or pension account. Because the funds are accumulated with external financial institutions, such as banks or pension accounts, they are protected regardless of the company's circumstances. In this way, even if a company faces difficulties, workers' retirement benefits remain safe. In addition, even after external funding becomes mandatory, existing rights will not be reduced; existing options such as interim withdrawals and lump-sum payments will be maintained so that workers' current choices are preserved.

Pooling multiple subscribers' money for professional management

Another major change is the way retirement pensions are managed. Until now, subscribers have enrolled in "contract-type retirement pensions," under which they choose one of the financial products designated by their company. In a contract-type scheme, the company and a financial institution enter into a one-on-one contract, and workers select the financial products or investment portfolios to be used within that framework. Going forward, in addition to this, there will be a new option called a "fund-type retirement pension." In a fund-type scheme, the money of multiple companies and workers is pooled together and managed and operated by professionals as if it were one large fund.

The tripartite TF has identified as a problem the fact that retirement pensions have remained a "system for managing payouts at the time of retirement" rather than serving as a means of guaranteeing income in old age. In a contract-type structure at the level of individual workplaces, it is difficult to fully leverage professional expertise in asset management, and repeated criticism has pointed out that the cost-saving effects of economies of scale are also limited. The introduction of the fund-type scheme is interpreted as a structural shift intended to address these limitations.

The TF noted that, because a fund-type retirement pension operates by integrating and managing the accumulated funds of many subscribers, it enables long-term diversified investment and stable asset allocation. It believes this can both improve returns and reduce operational costs. At the same time, the fact that the fund-type scheme is designed to run in parallel with, rather than replace, the contract-type scheme is seen as a choice aimed at minimizing the disruption associated with institutional change.

If fund-type retirement pensions are introduced, the biggest change will be that the center of gravity in retirement pension management will shift from individual workplaces to professional asset management institutions. As the management of accumulated funds moves beyond the unit of individual workplaces and becomes concentrated at the fund level, asset allocation strategies and risk management frameworks are expected to become more systematic. This is expected to serve as a turning point in shifting retirement pension management away from a focus on short-term performance and toward a perspective centered on long-term old-age income.

The larger the fund grows, the greater the responsibility... Fiduciary duty to be codified

On the other hand, as the authority of the managing entities grows, calls to strengthen their responsibilities are also expected to increase. The TF's inclusion in the joint declaration of principles on fiduciary duty, prevention of conflicts of interest, and stronger internal controls reflects these concerns. "Fiduciary duty" essentially means a promise that those entrusted with other people's money must use it solely in the interests of its owners. If fund management is used to pursue specific policy goals or particular interests, the credibility of the system could be undermined, and in that sense the government's role in oversight and supervision is expected to become even more important.

Retirement pension subscribers will have two options in the future. If they prioritize stability, they can keep the existing contract-type scheme; if they wish to seek somewhat higher returns, they can choose a fund-type retirement pension. At the time of retirement, they will still be able to receive a lump sum as before, or they can opt to receive payments monthly in the form of a pension. A core element of this agreement is that workers' rights to choose will be preserved even as the system changes. Lee Byoung-Hoon, emeritus professor in the Department of Sociology at Chung-Ang University, said, "Retirement benefits are, under the Labor Standards Act, part of wages and are converted into a pension, and the key is to manage them in a safe and profitable way," adding, "Depending on labor-management agreements, this can be seen as a progressive improvement in the retirement pension system."

Meanwhile, this joint declaration is the result of about three months of work by the tripartite TF, which was launched in October last year. A total of 19 participants, including representatives of labor, management, government, youth, and experts, took part in the discussions, which focused on the effectiveness of the system.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.