KITA Releases Report on "Chinese Economic and Trade Laws Changing This Year"

Trade Sanctions on Unfair Practices and Discriminatory Measures Codified into Law

VAT Tax Base Clarified Under the "Destination Principle"

Prior Security Assessment Requ

Analysts say that as China moves to overhaul its economic and trade-related laws this year, trade risks for Korean companies doing business with China could increase. They point out that companies need to fully understand the changing Chinese business environment and establish appropriate trade strategies.

The Beijing office of the Korea International Trade Association announced on the 4th that it had jointly published a report titled "20 Major Chinese Economic and Trade Regulations Changing in 2026" with the Chinese law firm Duzheng.

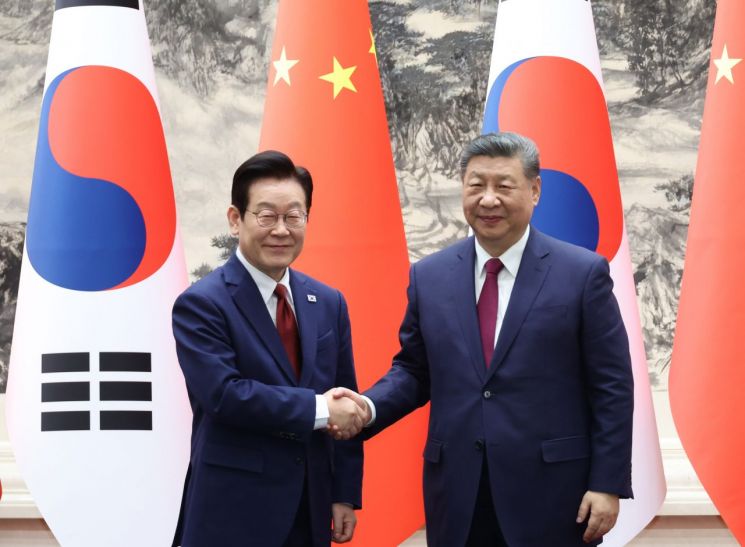

President Lee Jaemyung and Chinese President Xi Jinping are shaking hands at the Korea-China MOU signing ceremony held at the Great Hall of the People in Beijing on the 5th of last month. Yonhap News

President Lee Jaemyung and Chinese President Xi Jinping are shaking hands at the Korea-China MOU signing ceremony held at the Great Hall of the People in Beijing on the 5th of last month. Yonhap News

The report covers various legal changes, including the Foreign Trade Law and the Value-Added Tax Law of China. It also includes information on tariff adjustments and the new certification system for cross-border transfers of personal information that will be applied starting this year.

First, the Chinese authorities amended the Foreign Trade Law this year. If they determine that China’s sovereignty, security, or development is being undermined by unfair trade practices or discriminatory measures by foreign individuals or organizations, they can now restrict or prohibit the import and export of goods, technologies, and services to and from China.

They have also strengthened the supervision and administration of export and import licensing and declaration procedures, and clarified the standards for penalties in case of violations. The report stresses that trade risks related to China could increase, and emphasizes that companies must carefully examine, at the corporate level, whether they are in full compliance with the law.

The Provisional Regulations on Value-Added Tax, which had been in effect for 30 years, have been upgraded to a law. The taxation standard for services and intangible assets has been clearly defined according to the "destination-based principle," under which VAT is levied when they are consumed within China.

As a result, when software developed by a Korean headquarters is used by a Chinese subsidiary, or when designs created in Korea are applied to products in China, VAT is expected to be imposed consistently.

In addition, China has decided to apply provisional tariff rates lower than the Most-Favored-Nation (MFN) rates to 935 import items, focusing on high-tech industries, green transition, and the medical and livelihood sectors. In particular, the green transition list includes items such as recycled lithium-ion battery black mass and finely roasted pyrite.

Through the Cybersecurity Law, China has introduced new provisions on the abuse of artificial intelligence (AI), including false information and algorithmic discrimination, and has significantly tightened data-related regulations by implementing a certification system for cross-border transfers of personal information.

In particular, under the certification system for cross-border transfers of personal information, foreign companies that wish to transfer important data and personal information collected in China to overseas destinations must undergo a prior security assessment and obtain certification through a designated local representative in China.

Lee Bonggeol, head of the Beijing office of the Korea International Trade Association, said, "As China revises relevant regulations in various areas, including trade, taxation, and data, significant changes are expected in the business environment for our companies in China," adding, "We will continue to provide information and support so that companies can accurately understand the rapidly changing local regulations and apply them in practice."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.