Margin Loan Balances Also Exceed 30 Trillion Won

Experts Warn of Heightened Volatility for the Time Being

Although the KOSPI rebounded just one day after "Black Monday" and closed at an all-time high, the "fear index" that reflects market anxiety surged to its highest level in 5 years and 10 months.

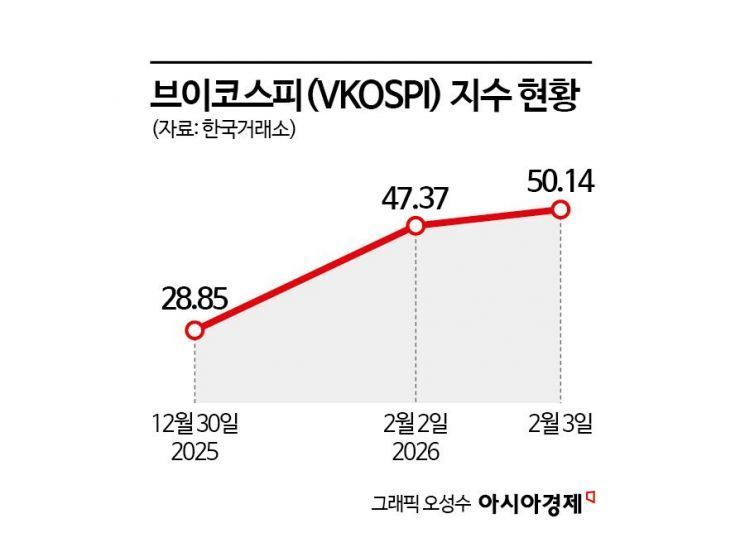

On the 4th, the KOSPI 200 Volatility Index (VKOSPI), known as the "Korean-style fear index," recorded 50.14 at the previous day's close. VKOSPI had been on an upward trend from 28.85 on December 30 last year and, on the 2nd when the index plunged, it broke above 40, entering the fear zone. A level in the 20s is considered an average range, 30 or higher is a high-volatility range, and 40 or higher is a fear zone.

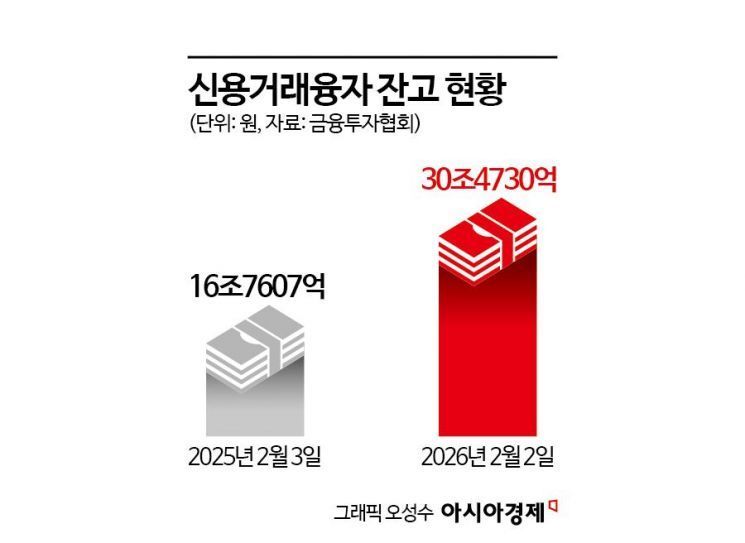

The sharp rise in VKOSPI is underpinned by an unprecedented volume of "bit-too" funds, meaning money borrowed to invest. According to the Korea Financial Investment Association, as of the 2nd, the balance of margin lending for stock trading stood at 30.473 trillion won, up 81.81% from 16.7607 trillion won a year earlier. Lee Sangyeon, a researcher at Shinyoung Securities, said, "There are concerns about an overheated stock market," but added, "Margin balances tend to increase as the market capitalization of the stock market grows."

Retail funds seeking to maximize short-term profits are even sweeping through the exchange-traded fund (ETF) market. "KODEX KOSDAQ 150 Leverage," which tracks twice the daily return of the KOSDAQ 150 Index, saw an inflow of 1.6056 trillion won over one week, showing a near-mania level of concentration. On January 26, an unprecedented incident occurred in which the Korea Financial Investment Association's pre-education website for leverage ETF investments was paralyzed due to a flood of individual investors. Individual investors must complete an online course at the Korea Financial Investment Association's Financial Investment Education Center before investing in leverage ETFs and similar products.

Investor deposits, which are idle funds waiting to enter the stock market, amounted to 111.2965 trillion won and have continued to increase since surpassing 100 trillion won on January 27. In addition, the number of active stock trading accounts was tallied at 100.20045 million on January 29. This represents a surge of about 1.73 million in roughly one month from 98.291148 million at the end of last year. Active stock trading accounts refer to entrusted trading and securities savings accounts that have deposits of at least 100,000 won and have executed at least one transaction in the past six months.

Experts urged investors to exercise particular caution, given that this is a period of heightened market volatility. Ahn Donghyun, an economics professor at Seoul National University, said, "The KOSPI 5000 level is a range where volatility is bound to increase," adding, "It can go down or up. This is a time when we need to watch the market very carefully." Kim Youngik, former professor at the Graduate School of Economics at Sogang University, said, "I believe the KOSPI is entering a correction phase," and advised, "Margin trading is increasing, and caution is needed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.