Strong Q4 Outlook for Shinsegae, Hyundai, and Lotte

Luxury Spending Surges on Booming Asset Markets

Weak Won Drives Inbound Tourists to Department Stores

Despite the ongoing slump in the retail industry last year, the department store sector is expected to have enjoyed a "solo boom." This performance is believed to have been driven by increased luxury spending on the back of buoyant asset markets, as well as a rise in inbound foreign visitors due to the weak won. The shift in foreign tourist patterns from group tours to individual travel also helped disperse consumption demand from duty-free shops to department stores and other channels. The rebound in purchasing power at department stores that began in the third quarter of last year is expected to continue throughout this year.

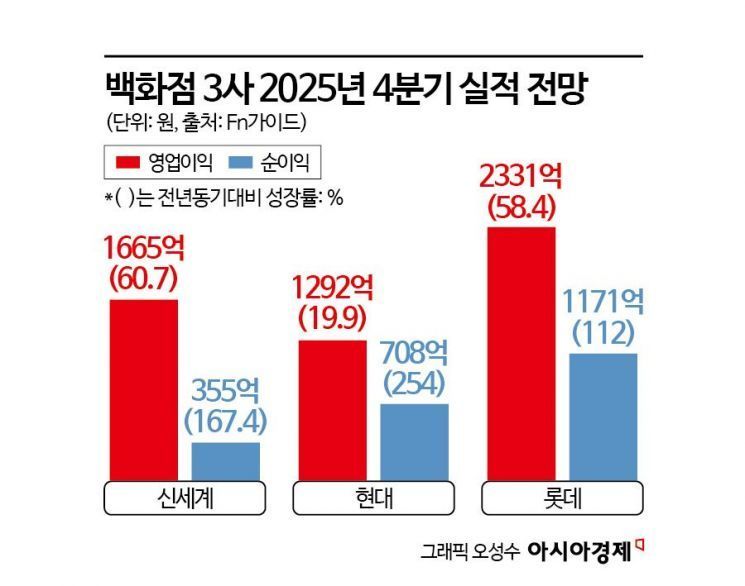

According to financial information provider FnGuide on the 4th, Lotte Shopping’s consensus sales for the fourth quarter of last year are estimated at 3.5854 trillion won, up 3.1% year-on-year. Operating profit and net profit are projected at 233.1 billion won and 117.1 billion won, respectively, representing growth rates of 58.4% and 112%.

Shinsegae Department Store is expected to post sales of 1.9376 trillion won, operating profit of 166.5 billion won, and net profit of 35.5 billion won for the same period, up 6.4%, 60.7%, and 167.4%, respectively. Hyundai Department Store is projected to record sales of 1.1347 trillion won, operating profit of 129.2 billion won, and net profit of 70.8 billion won. While sales are expected to decline 3.4%, operating profit and net profit grew 19.9% and 254%, respectively. Hyundai Department Store saw a slight drop in sales due to the closure of its downtown duty-free store in Dongdaemun in July last year, but its department store division continues to show solid growth.

The total sales growth rate of the department store industry recorded double-digit gains for two consecutive months, at 12.2% in October and 12.3% in November last year. Sales per store also grew 16.2% and 16.3%, respectively.

"Luxury goods" and "foreigners" are cited as the main drivers behind the strong earnings of the three major department store operators. Since last year, the domestic stock market has been on a steady rise and, entering this year, has even broken through the 5,000-point level, extending the trickle-down effect of buoyant asset markets. In fact, while all product categories including fashion have performed well, luxury goods in particular have driven top-line growth, with double-digit gains of 19.5% in October and 23.3% in November.

The increase in inbound foreign visitors due to the weak won is also assessed to have contributed to department store performance. The number of foreign tourists visiting Korea in 2025 reached 18.94 million, up 15.7% from 16.37 million in 2024, marking the highest annual figure in the past 10 years. Interest in K-culture has boosted demand for travel to Korea, and the government’s temporary visa-free entry policy for Chinese group tourists of three or more people implemented in September last year is expected to keep foreign tourist demand on a steady upward trajectory.

Backed by the rise in inbound visitors, the share of foreign customer sales at department stores is also increasing. Orin A, analyst at LS Securities, said, "At Lotte Department Store’s main branch, which sees particularly high foreign visitor traffic, the proportion of foreign sales reached 17.6% in November last year and 22.4% in December, showing a rapid absorption of foreign tourist demand."

The proportion of foreign sales at the three major department store operators rose from 4.4% in the first quarter of last year to 5.1% in the second quarter, and is expected to climb into the 6% range this year. A representative from the department store industry said, "Although there are differences by store, foreign sales have increased by at least 30% and up to 80% compared with a year earlier," adding, "Because of the weak won, prices of luxury goods can differ by close to 1 million won compared with overseas, so demand has risen sharply among both domestic and foreign customers."

Cho Sanghoon, analyst at Shinhan Investment & Securities, said, "Thanks to the government’s expansionary fiscal policy and domestic demand stimulus measures, rising asset markets, and a surge in foreign sales, the rebound in department store purchasing power that began in the third quarter of last year is expected to continue throughout this year."

Meanwhile, earnings announcements by the three major department store operators are scheduled to begin with Lotte Shopping on the 6th, followed by Shinsegae on February 9 and Hyundai Department Store on February 11.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.