BloombergNEF Energy Transition Investment Trends Report

Record $2.3 Trillion Last Year, But Growth Rate Slows

Top Three Sectors: Electrified Transportation, Renewables, Power Grids

China's Impact: Renewable Energy Investment Down 9.5%

Supply C

Last year, global energy transition investment reached a record high of 2.3 trillion dollars. In the United States, energy transition investment increased despite President Donald Trump's policy of expanding fossil fuels.

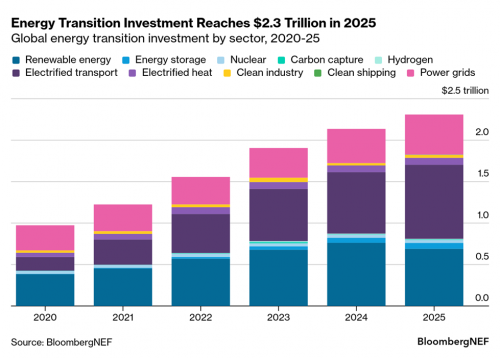

According to BloombergNEF's annual report, Energy Transition Investment Trends (ETIT), energy transition investment in 2025 increased by 8% from the previous year to 2.3 trillion dollars.

The largest share came from electrified transport (electric vehicles and charging infrastructure), which rose 21% year-on-year to 893 billion dollars. Renewable energy (690 billion dollars) and power grid investment (483 billion dollars) also accounted for a significant share.

However, renewable energy investment fell 9.5% from the previous year, mainly because regulatory changes in the power market in China, the world's largest market, increased uncertainty. Investment in hydrogen (7.3 billion dollars) and nuclear power (36 billion dollars) also declined.

The report stated that in 2025, clean energy supply investment exceeded fossil fuel supply investment for the second consecutive year, and the gap widened from 85 billion dollars in 2024 to 102 billion dollars in 2025.

While clean energy investment (including renewable energy, nuclear power, carbon capture, hydrogen, energy storage systems, and power grids) continued to increase, fossil fuel supply investment fell for the first time since 2020, declining by 9 billion dollars from the previous year. This decrease was mainly attributed to reduced spending in the upstream oil and gas sector (down 9 billion dollars) and lower investment in fossil fuel power generation (down 14 billion dollars).

However, even though energy transition investment hit an all-time high, its growth rate has steadily slowed, from 27% in 2021 to 8% in 2025.

The Asia-Pacific region maintained its position as the largest investment region in 2025, accounting for 47% of total global investment. China, the largest single market, still led overall investment, but for the first time since 2013, funding for renewable energy investment declined. India's investment increased by 15% to reach 68 billion dollars.

The European Union (EU) recorded 455 billion dollars, up 18%, making the largest contribution to the global increase. Investment in the United States also rose 3.5% to 378 billion dollars, despite moves by the Trump administration to slow the pace of the energy transition.

Clean energy supply chain investment, which includes spending on new solar, battery, electrolyzer, and wind equipment factories, as well as on battery metals production assets, increased 6% in 2025 to 127 billion dollars. BloombergNEF explained that last year's growth was driven mainly by the expansion of battery manufacturing and investment in battery materials.

BloombergNEF forecast, "Excess supply across all clean energy supply chain segments will continue to act as a drag, so while total investment is increasing, downward pressure on clean technology product prices will also persist."

The report also noted that debt issuance (debt financing) for energy transition purposes reached 1.2 trillion dollars in 2025, up 17% from 2024. This increase was driven by a 20% rise in corporate finance flows and a 20% rise in project finance flows, respectively.

Based on its base case, the Economic Transition Scenario, BloombergNEF projected that global energy transition investment will average 2.9 trillion dollars annually over the next five years.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.