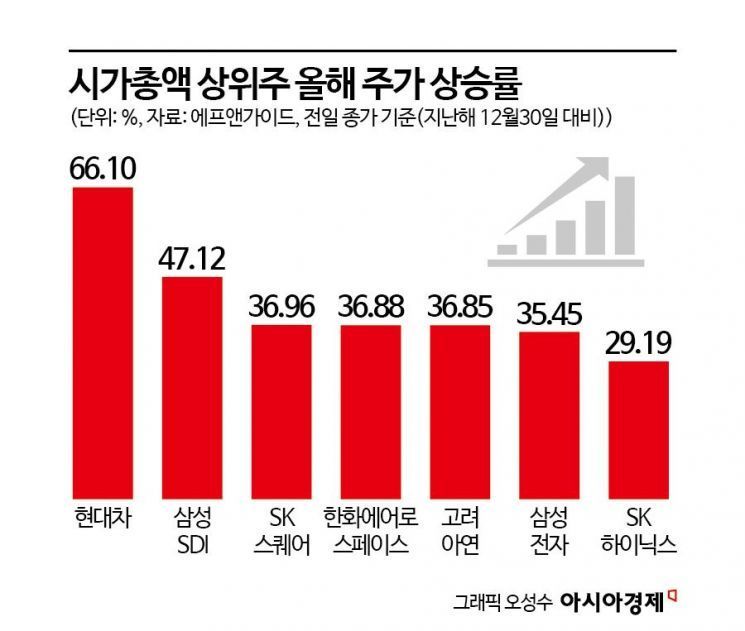

66% Share Price Surge This Year, No. 1 Among Top 30 by Market Cap

Soaring on Expectations for 'Atlas' Robotics

Samsung SDI Up 47%, SK Square 37%, Hanwha Aerospace 36%

Samsung Electronics and SK Hynix Poised for Further Gains with 'Single-St

Among the large-cap stocks with the highest market capitalization, Hyundai Motor Company, not Samsung Electronics or SK Hynix, recorded the largest share price increase this year. Hyundai Motor Company’s stock surged by 66% this year alone, driven by growing expectations for its robotics business.

Samsung Electronics and SK Hynix saw their share prices rise by 35% and 29%, respectively, this year, leading the KOSPI to surpass the 5,200-point mark. As both companies reported results that exceeded market expectations, some analysts predict that Samsung Electronics and SK Hynix may catch up to Hyundai Motor Company’s rate of share price increase.

Hyundai Motor Company Tops 30 Largest-Cap Stocks with 66% Share Price Increase This Year

According to FnGuide on January 29, among the 30 largest-cap companies in the Korean stock market, Hyundai Motor Company’s share price had soared 66.1% as of the previous day, ranking first in terms of increase. The stock, which hovered around 300,000 won at the start of the year, began to climb sharply after the company unveiled its humanoid robot “Atlas” at the CES 2026 tech exhibition in Las Vegas on January 7. On January 22, the share price briefly reached 595,000 won during trading, with the year-to-date increase approaching 100% at that point.

Experts believe that Hyundai Motor Group’s physical artificial intelligence (AI) technology is attracting attention, suggesting the share price could rise further. Kang Sungjin, a researcher at KB Securities, stated, “Hyundai Motor Company is being recognized as the only company capable of competing with Tesla after unveiling its humanoid robot,” and raised the target share price to 800,000 won. Haneul, a researcher at NH Investment & Securities, also explained, “The equity value of Boston Dynamics, the manufacturing subsidiary of Atlas, alone is enough to give the stock a premium.”

Samsung Electronics (35.4%) and SK Hynix (29.19%), both of which showed steady gains in the second half of last year, are also expected to continue their upward momentum. With both companies’ results surpassing market expectations and the AI market projected to expand further this year, there is potential for additional share price increases. Kim Dongwon, Head of Research at KB Securities, stated, “Reflecting the rise in memory prices, we are revising up Samsung Electronics’ operating profit forecasts for 2026 and 2027 to 16.2 trillion won and 18.3 trillion won, respectively, up by 12% and 11% from previous estimates, and raising the target share price to 240,000 won.”

On this day, as the share prices of Samsung Electronics and SK Hynix surged, the KOSPI opened at 5,243.42, up 72.61 points (1.40%) from the previous trading day. This was the first time in the history of the Korean stock market that the KOSPI surpassed the 5,200-point mark during trading. SK Hynix’s share price even climbed to 884,000 won in early trading.

The government’s announcement of plans to launch leveraged exchange-traded funds (ETFs) that track the returns of a single high-quality stock at twice the rate is also affecting the market. The liquidity effect of these ETFs could further increase liquidity related to blue-chip stocks such as Samsung Electronics and SK Hynix. Lee Eog-weon, Vice Chairman of the Financial Services Commission, stated at a press briefing the previous day, “While single-stock leveraged ETFs are available overseas, asymmetric regulations have prevented their launch in Korea, resulting in unmet demand for diverse ETF investment options. We will swiftly improve regulations to enhance the attractiveness of the domestic capital market.”

On the 22nd, when the KOSPI surpassed the dream index of 5000, employees at the Hana Bank dealing room in Jung-gu, Seoul, are joyfully clapping. January 22, 2026. Photo by Jo Yongjun

On the 22nd, when the KOSPI surpassed the dream index of 5000, employees at the Hana Bank dealing room in Jung-gu, Seoul, are joyfully clapping. January 22, 2026. Photo by Jo Yongjun

Samsung SDI (47%), SK Square (37%), Hanwha Aerospace (36%) Also See Significant Gains

Amid rising expectations for robotics, battery supplier Samsung SDI’s share price also jumped 47.1% this year. The market anticipates that Samsung SDI may supply batteries for Atlas.

Ahn Hoesoo, a researcher at DB Financial Investment, commented, “The battery collaboration between Samsung SDI and Hyundai Motor Company for Atlas is drawing attention,” and analyzed, “Samsung SDI’s all-solid-state batteries could provide meaningful early application cases in robotics.” Park Jinsu, a researcher at Shin Young Securities, added, “With expectations for the physical AI and humanoid markets opening up, interest in Samsung SDI’s next-generation all-solid-state batteries is likely to intensify,” and noted, “Samsung SDI is maintaining its schedule to commercialize all-solid-state batteries in the second half of next year.”

SK Square, the intermediate holding company of SK Group, also saw its share price soar 36.9% this year. The company’s 20.07% stake in SK Hynix has drawn attention, boosting its share price. Kim Hoejae, a researcher at Daishin Securities, stated, “With SK Hynix’s share price surging, the value of SK Square’s stake has come into focus, driving up its share price. SK Square will remain attractive as an alternative investment vehicle for SK Hynix.”

Hanwha Aerospace also saw its share price rise 36.8% this year, reaching an all-time high. The stock responded to expectations of continued weapons order rallies from various regions, including Europe, the United States, and the Middle East. Paek Jongmin, a researcher at Yuanta Securities, noted, “New orders have been secured from Poland, Estonia, Norway, and Sweden, and expectations for orders from Saudi Arabia, Spain, and the United States are also increasing.”

Korea Zinc also recorded a 36.8% share price increase this year. The prices of metals such as zinc and copper, which are Korea Zinc’s main products, surged due to international geopolitical instability, as well as the company’s entry into the U.S. market. In particular, the company has recently drawn attention as a beneficiary of the surge in silver prices. This is because silver is extracted as a byproduct during the refining of zinc and lead, so while costs remain unchanged, increased sales are expected to improve the company’s overall profitability.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)