Selective Buying Focused on Semiconductors and Cho Bangwon

Celltrion Stands Out Among Biotech Firms with Strong Foreign Investor Demand

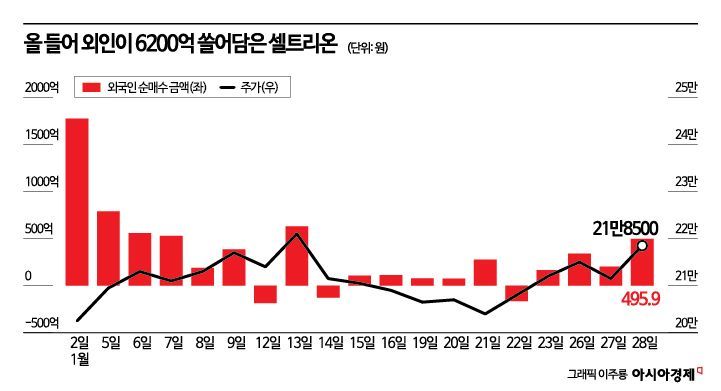

There is a surge of interest in Celltrion, the leading pharmaceutical and biotech stock. As the Korean stock market has recently soared, foreign investors have shifted their capital flows toward 'selective buying.' So far this year alone, over 600 billion won in foreign funds have flowed into Celltrion, driving an improvement in supply and demand. Market analysts attribute this turnaround to Celltrion's record-breaking performance-its core competitiveness-and the effectiveness of its 'overseas investor relations (IR) strategy,' which has significantly expanded its engagement with global investors.

Foreign Investors Buy 622.5 Billion Won in a Month... Strong Performance Dispels Concerns

According to Korea Exchange data on January 29, the cumulative net purchases of Celltrion shares by foreign investors this year have reached approximately 622.5 billion won. In less than a month, foreigners have net-purchased over 620 billion won worth of shares. On the previous day alone, they net-purchased 230,083 shares (about 49.6 billion won), sweeping up available stock. Industry insiders believe this robust buying is not simply bargain hunting. The combination of a turnaround in performance and proactive IR activities signals that foreign investors are re-evaluating Celltrion from a 'short-term trading' target to a 'long-term holding' stock.

Following its merger, Celltrion had faced foreign selling pressure due to concerns about a slowdown in profitability and tariff uncertainties. The situation reversed with the year-end performance announcement. The company projected annual sales of 4.1163 trillion won and operating profit of 1.1655 trillion won for last year. This marks the highest performance in the company's history, exceeding market consensus. Notably, operating profit is expected to surge 136.9% year-on-year, putting an end to concerns about profitability.

An industry official commented, "With stable biosimilar profits, Celltrion has established a virtuous cycle that allows for top-tier research and development (R&D) investment in Korea. Vertical integration-from development to sales-and the recent acquisition of a U.S. production facility are also factors enhancing its global competitiveness."

"Segmented by Region and Met Investors"… The Power of IR Organizational Restructuring

The improvement in fundamentals translating directly into foreign capital inflows is credited to Celltrion's strategic IR activities. Since 2024, Celltrion has reorganized its overseas IR teams into two specialized units: one dedicated to North America, and another to Asia and Europe. It is rare for a listed company to subdivide its IR organization by region in this way.

The strategy of delivering 'tailored messages' based on a detailed analysis of investor characteristics in each region has paid off. Celltrion has conducted a series of non-deal roadshows (NDR) at major global financial hubs-including Hong Kong, Singapore, London, and New York-as well as participating in key events such as the JP Morgan Healthcare Conference and the Jefferies Global Healthcare Conference.

Recently, Celltrion has further strengthened engagement by inviting global investors to its Songdo campus in Incheon, where it opened up production facilities and had executives provide direct explanations.

Using AI to Find Major Investors… Announcing Advanced IR Initiatives

Celltrion is not content with the current improvement in supply and demand and plans to further broaden its investor base using artificial intelligence (AI). The company aims to discover hidden major investors not only in traditional financial hubs like Hong Kong and New York, but also in Northern Europe, the Middle East, and Oceania.

To this end, Celltrion will introduce AI-based analysis to classify the nature and management strategies of funds by region and newly define a pool of potential investors that align with Celltrion's growth roadmap.

A Celltrion official stated, "The recent buying by foreign investors is the result of strong performance and synergistic, tailored communication. Moving forward, we will proactively identify potential investors through AI analysis and further advance our overseas IR strategy to enhance corporate value."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.