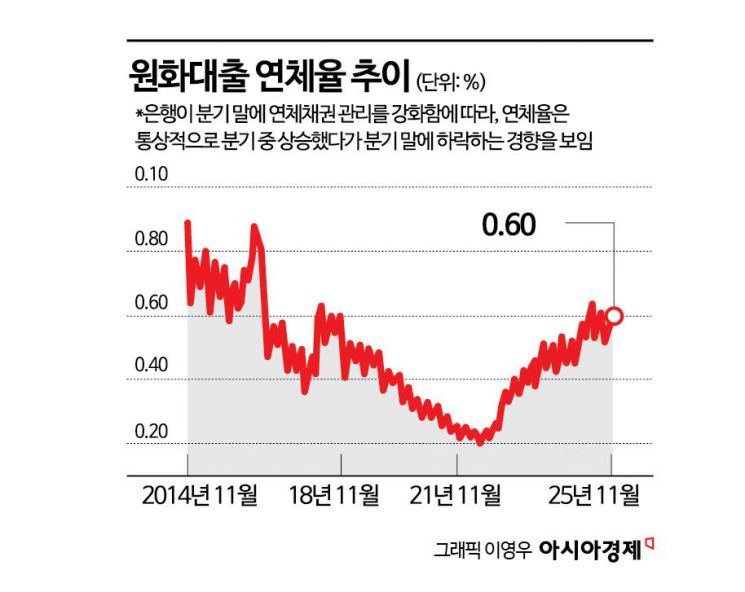

Delinquency Rate Hits 0.60% in November... Highest for November in Seven Years Since 2018

Warning Signs for Large Corporations Join Households and SMEs... Repayment Capacity Declines Amid High Interest Rates and Sluggish Domestic Demand

In November of last year, the delinquency rate in the banking sector surged to its highest level in six months. Delinquency rates rose not only for household loans and small and medium-sized enterprises (SMEs), but also for large corporations. This trend is attributed to the combined effects of sluggish domestic demand, which has led to declining sales, and the burden of high interest rates, which have increased debt repayment costs, thereby reducing the repayment capacity of both businesses and households. There are growing concerns that insolvencies may expand, particularly among vulnerable sectors such as small corporations and individual business owners, as well as in regional areas where business conditions remain weak.

Banking Sector Delinquency Rate Rises in November... Highest Since May

According to the "Status of Delinquency Rates on Korean Won Loans at Domestic Banks (Provisional)" released by the Financial Supervisory Service on January 28, the delinquency rate on Korean won loans (based on principal and interest overdue for more than one month) at domestic banks stood at 0.60% as of the end of November last year. This represents a 0.02 percentage point increase from 0.58% at the end of the previous month. Compared to the same month last year, the rate is 0.08 percentage points higher, marking the highest level for the month of November since 2018 (0.60%)-a seven-year high. It is also the highest since May 2025, when the rate reached 0.64%.

The amount of newly delinquent loans in November was 2.6 trillion won, a decrease of 300 billion won from the previous month (2.9 trillion won). Meanwhile, the amount of resolved delinquent loans increased by 600 billion won to 1.9 trillion won, compared to 1.3 trillion won in the previous month. Despite these changes, the overall delinquency rate still rose slightly. The Financial Supervisory Service explained that the slight increase in the delinquency rate was due to the accumulated burden of non-performing loans. However, the agency also noted that, since delinquency rates tend to decline at the end of each quarter as banks resolve more delinquent loans, the upward trend in the delinquency rate may slow or even decrease in December.

Delinquency Rate for Large Corporations Also Rises Sharply... Greater Pain for SMEs and Self-Employed

By sector, both corporate and household loan delinquency rates increased. As of the end of November last year, the corporate loan delinquency rate was 0.73%, up 0.04 percentage points from the previous month and 0.13 percentage points higher than in November 2024.

The debt repayment ability of large corporations also deteriorated. The delinquency rate for large corporations rose by 0.02 percentage points from the end of October to 0.16%, the highest level since February 2024 (0.18%). This was due to worsening internal and external conditions, such as tariff pressures from President Donald Trump and high exchange rates. In fact, a survey conducted by the Federation of Korean Industries (FKI) in November last year of 111 export manufacturing companies with annual sales of around 100 billion won found that 27.0% of respondents reported a deterioration in their financial situation compared to the previous year.

Yongmin Park, head of economic research at the FKI, said, "As of the cumulative third quarter of last year, except for a few companies that benefited from the boom in the semiconductor and shipbuilding industries, most companies faced worsening performance and tight financial conditions. More companies perceive that their financial environment has deteriorated further due to increased uncertainty from exchange rate volatility and tariff policies under the Trump administration."

The situation for SMEs has worsened even further. In the same month, the SME loan delinquency rate rose by 0.05 percentage points from the previous month to 0.89%, up 0.14 percentage points compared to November 2024. Breaking it down further, the delinquency rate for small corporations reached 0.98%, up 0.05 percentage points from 0.84% the previous month, approaching the 1% level. The delinquency rate for individual business owners, who are considered self-employed, also increased by 0.04 percentage points from the end of the previous month. This is because small corporations and self-employed individuals, who are the weak links in the domestic demand slump, have been hit hard by the prolonged downturn, reducing their ability to repay debts.

The household loan delinquency rate also continued to rise. As of the end of November last year, the household loan delinquency rate stood at 0.44%, up 0.02 percentage points from 0.42% at the end of the previous month. The mortgage loan delinquency rate was 0.30%, up 0.01 percentage points from the previous month. The delinquency rate for household loans excluding mortgages, such as credit loans, also rose to 0.90%, up 0.05 percentage points from 0.85% at the end of the previous month.

The Financial Supervisory Service announced that it plans to strengthen asset quality management at domestic banks through the sale and disposal of non-performing loans and to ensure sufficient loss-absorbing capacity by encouraging the accumulation of loan-loss provisions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.